Cheapest Brokers In 2026

When it comes to active trading, cost matters; whether you’re an experienced trader or a beginner, I know from my time as a full-time trader that fees, commissions, and spreads can make a big difference in your profitability.

Fortunately, we’ve compared and ranked the cheapest brokers in January 2026. Our experts have personally tested the top low-cost providers and listed the best discount brokers with low fees but terrific trading platforms.

Lowest Cost Brokers

These are the 6 best discount brokers, ranked by lowest total trading costs and overall rating:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

FOREX.com

FOREX.com -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

UnitedPips

UnitedPips

Why Are These The Best Brokers For Affordable Day Trading?

Here is a summary of why we think these are the top low-cost brokers:

- Interactive Brokers is our top-rated cheapest broker in 2026 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

Comparison Of Costs At Our Cheapest Brokers

Find the right discount brokerage for you with our comparison of key costs for active traders:

| Broker | Cost Rating | Fee on EUR/USD | Fee on FTSE | Fee on Stocks | Fee on Oil | Fee for Inactivity |

|---|---|---|---|---|---|---|

| Interactive Brokers | / 5 | 0.08-0.20 bps x trade value | 0.005% (£1 Min) | 0.003 | 0.25-0.85 | $0 |

| NinjaTrader | / 5 | 1.3 | - | - | - | $25 |

| FOREX.com | / 5 | 1.2 | 1.0 | 0.14 | 2.5 | $15 |

| Plus500US | / 5 | 0.75 | - | - | - | $0 |

| OANDA US | / 5 | 1.6 | - | - | - | $0 |

| UnitedPips | / 5 | 0.7 | NA | NA | NA | $0 |

How Safe Are These Cheap Brokers?

See how dependable the cheapest day trading brokers are and how they help safeguard your account:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✘ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✔ | ✘ | ✘ | |

| UnitedPips | ✘ | ✔ | ✔ |

Mobile Trading Comparison

See how good these brokers are for low-cost day trading on mobile:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| UnitedPips | Web Access Only | ✘ |

Are The Top Brokers With Low Fees Good For Beginners?

Beginners should use brokers with minimal fees that allow trading with virtual money and support new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| UnitedPips | ✔ | $10 | 0.01 Lots |

Are The Top Brokers With Low Fees Good For Advanced Traders?

See how good these cheap trading platforms are for advanced traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| UnitedPips | - | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare The Ratings Of The Cheapest Day Trading Brokers

Uncover how the top inexpensive brokers score in core areas according to our hands-on evaluations:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| FOREX.com | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| UnitedPips |

How Popular Are These Budget Brokers?

Many day traders prefer the most popular brokers with low fees (those with the largest user base):

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| NinjaTrader | |

| FOREX.com | |

| UnitedPips |

Why Choose Interactive Brokers For Low-Cost Trading?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

Why Choose NinjaTrader For Low-Cost Trading?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Why Choose FOREX.com For Low-Cost Trading?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Why Choose Plus500US For Low-Cost Trading?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Although support response times were fast during tests, there is no telephone assistance

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

Why Choose OANDA US For Low-Cost Trading?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- Day traders can enjoy fast and reliable order execution

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Why Choose UnitedPips For Low-Cost Trading?

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

Cons

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

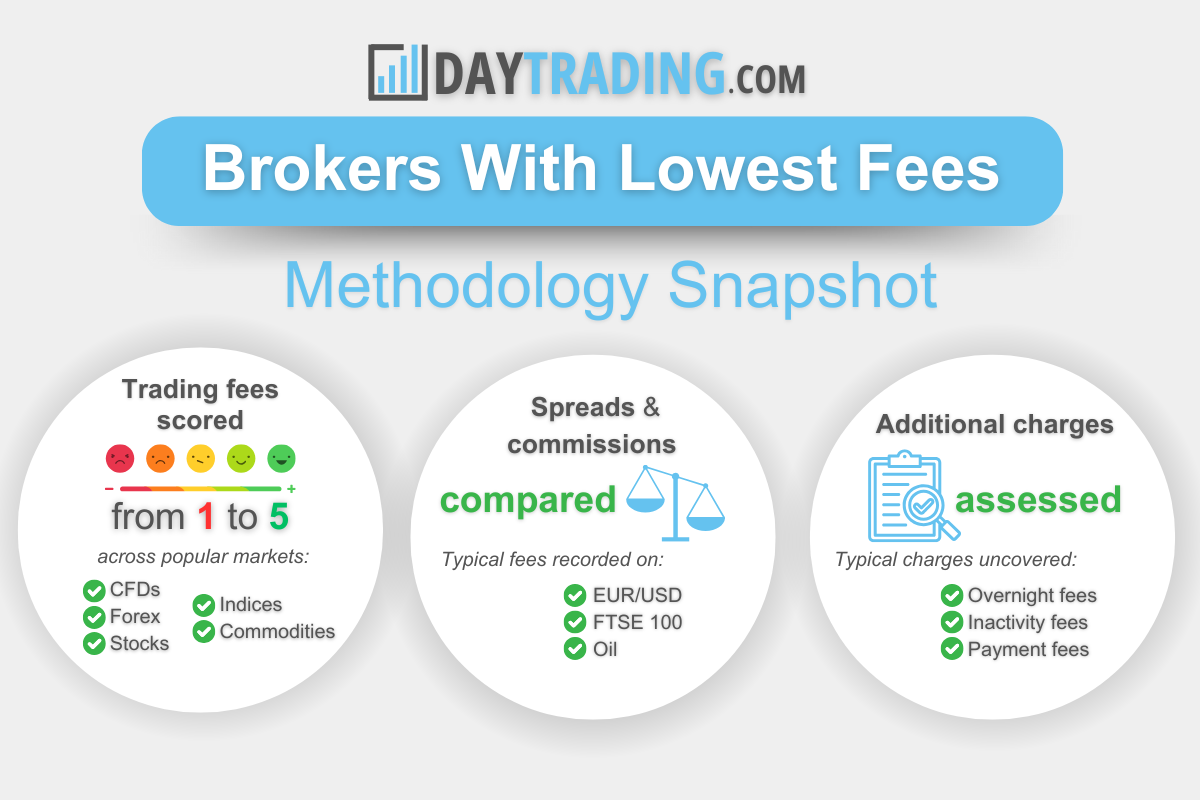

How We Chose The Cheapest Brokers

We ranked brokers with the lowest trading fees using two core metrics that draw on nearly 300 data points:

- Cost Rating: We scored each broker from 1 to 5 for their trading fees across popular markets, including forex, stocks, indices, commodities, and CFDs. We then compared everything against industry standards.

- Overall Rating: We gave each broker a 1 to 5 score after testing every inch of their offering. This reflects our belief that low costs must pair with an outstanding trading environment for the best overall experience.

Why Cost Matters In Trading

When it comes to popular instruments with short-term traders like CFDs and forex, every dollar counts.

The allure of trading lies in its potential to multiply small investments into significant profits, but excessive fees can erode your gains, leaving you with little to show for your efforts.

As a day trader making frequent trades, minimizing trading costs is crucial to achieving profitability.

For example:

- A trader executing 50 trades per month with a $10 commission per trade will spend $500 just on commissions.

- Similarly, wide spreads on popular currency pairs like EUR/USD can inflate costs for scalpers and high-frequency traders.

Understanding The Fees You’ll Pay To Trade

Let’s break down the primary costs like spreads and commissions, which are often the most visible costs of short-term trading:

Spreads

This is the difference between the bid (selling) and ask (buying) price of an asset.

- Tight spreads (eg 0.0-0.5 pips for EUR/USD) are ideal for traders, especially scalpers and day traders making frequent transactions.

- Brokers may offer variable or fixed spreads. Variable spreads tend to be lower during normal market conditions but widen during volatility. Fixed spread brokers offer the same price regardless of market conditions.

Commissions

These are charged per trade, usually alongside raw spreads.

Commissions are often preferred by professional traders who value transparency and consistent pricing.

Overnight/Swap Fees

While these can generally be avoided by day traders, if you hold positions overnight, you’ll incur swap fees reflecting the interest rate differential between two currencies.

- Positive swaps: You may earn interest if you hold higher-yielding currency.

- Negative swaps: Most positions result in a fee, which can be substantial for long-term trades.

A long position on EUR/USD may incur a daily fee of $1.50 per standard lot. Over a month, this could total $45, significantly affecting profitability.

Other Hidden Fees

These are less obvious but can still have a significant impact:

- Inactivity Fees: Some brokers charge monthly fees for dormant accounts. Look for brokers, such as Pepperstone, that explicitly avoid such charges.

- Withdrawal Fees: Fees for withdrawing funds vary; some brokers charge a percentage or a fixed amount per transaction. Look for brokers, such as Eightcap, that don’t charge internal withdrawal fees.

- Currency Conversion Fees: These apply when trading in a currency other than your account’s base currency. If you frequently trade in this currency, opt for brokers with multi-currency accounts, such as Swissquote, to minimize conversion losses.

- Leverage Considerations: Leverage lets you control larger positions with less capital, magnifying both profits and losses. Retail traders typically get up to 1:30 leverage in regulated markets (EU, UK, Australia) or up to and beyond 1:500 in less regulated areas. While it increases exposure, it also raises the risk of significant losses and may include extra risk management fees.

Higher spreads or commissions can eat into profits, particularly for short-term traders like us day traders.I’ve always compared brokers based on all the cost metrics to assess my overall trading fees, and I suggest you do too.

An Example Trade With The Costs Laid Bare

Let’s bring all the fees you could incur to life by taking a look at a short-term CFD trade on the SPX500 with a price movement from 6,000 to 6,050.

Trade Details:

- Index: SPX500 (S&P 500 Index)

- Account Type: Standard CFD Account

- Position: Buy (Long)

- Lot Size: 1 standard lot (representing $1 per point move in the SPX500 price)

- Opening Price: 6,000

- Closing Price: 6,050

- Duration of Trade: Held for three days (including two overnight periods)

- Leverage: 1:20 (5% margin requirement)

1. Spread Costs

Assume my broker charges a spread of 0.5 points on the SPX500.

Cost:

- Spread = 0.5 points x $1 per point = $0.50.

2. Commission Costs

Many brokers charge commissions in addition to spreads. For example:

- Commission = $4 per round turn per lot.

Cost:

- Commission = $4.00.

3. Overnight/Swap Fees

Holding a leveraged position overnight incurs financing costs (you can avoid this by day trading).

For a long position:

- Typical rate = 3% annualized interest on the borrowed amount.

Calculation:

- Borrowed amount = Position value – Margin = ($6,000 x 1 lot) – ($6,000 / 20 leverage) = $5,700.

- Daily interest = (3% / 365) x $5,700 ≈ $0.47 per day.

Cost For 2 nights:

- $0.47 x 2 = $0.94.

4. Currency Conversion Fees (If Applicable)

If your account currency isn’t USD (over 90% of brokers we’ve evaluated offer a USD trading account), conversion fees might apply. Assuming:

- Fee = 0.5% of profit or trade value.

For simplicity, if you make a $50 profit:

- Conversion fee = 0.5% x $50 = $0.25.

Total Charges

| Charge Type | Cost |

|---|---|

| Spread | $0.50 |

| Commission | $4.00 |

| Overnight Fees (two days) | $0.94 |

| Conversion Fee | $0.25 |

Total Trading Costs: $5.69

Net Profit/Loss Calculation

If the trade moves 50 points in my favor (from 6,000 to 6,050):

- Profit = 50 points x $1 per point = $50.

- After deducting total costs of $5.69:

Net Profit = $44.31.

Why “Cheap” Isn’t Always Better

While finding a low-cost broker is essential, cheaper isn’t always better. Here’s why:

- Hidden Costs: We’ve observed an increasing number of brokers with “zero commission” models, such as Robinhood and Freetrade, but they sometimes widen spreads or impose high overnight fees to compensate.

- Limited Features: Some low-cost brokers cut corners, offering fewer research tools, educational resources, or slower customer service.

- Lack Of Security: A broker advertising unrealistically low fees might skimp on regulatory compliance, putting your funds at risk.

The key is to balance cost and quality. Look for brokers offering competitive pricing without compromising reliability, features, or safety.

What To Look For In A Low-Cost Broker

A “cheap” trading platform must still meet high standards of transparency, flexibility, security, and usability to support a positive trading experience.

Based on my many years of trading, here’s what to prioritize:

- Transparency: Transparent brokers provide upfront details about their costs, allowing traders to make informed decisions. Key areas to check:

- Spreads and Commissions: Look for trading platforms offering clearly defined rates (eg spreads from 0.0 pips with commissions around $3.5 per lot).

- Additional Fees: Ensure clarity on potential charges like:

- Inactivity fees.

- Deposit/withdrawal fees and currency conversion rates.

- Regulatory documents and website FAQs should outline all possible fees.

- Account Flexibility: Options to suit different trading styles. Common options include:

- Standard Accounts: Ideal for beginner traders with zero or low commissions and slightly wider spreads.

- Raw Spread Accounts: Suitable for advanced day traders and professional traders, offering interbank spreads (eg starting at 0.0 pips) paired with a flat commission.

- Micro Accounts: Allow trading with smaller positions (eg 0.01 lots), perfect for those starting with limited capital.

I’ve always looked for brokers that allowed easy switching between account types as my trading strategy evolved.

Pros And Cons Of Low-Cost Brokers

Pros

- Reduced Trading Costs: Tight spreads and low or zero commissions allow traders to retain more profits, which is particularly beneficial for day traders who make frequent trades. For example, trading like IC Markets providing raw spreads starting at 0.0 pips with minimal commission fees are ideal for high-frequency trading.

- Suitability For Scalping And Frequent Trades: Scalpers, who rely on minute price movements, benefit significantly from brokers with low spreads and fees, such as Fusion Markets. Traders executing dozens of trades daily save considerably when commissions are low or non-existent.

- Accessibility For New Traders: Affordable options like micro or standard accounts let beginners enter the market with lower upfront costs. Lower minimum deposits (some brokers like XM allow as little as $5) encourage broader participation in trading.

- Transparency In Pricing: Many budget brokers like FBS pride themselves on clear, upfront fee structures, helping traders avoid surprises.

Cons

- Limited Features Or Research Tools: Some low-cost brokers like FXCC may sacrifice advanced features like market analysis tools, trading signals, or educational resources to maintain competitive pricing. Full-featured platforms like TradingView integrations may be absent or cost extra.

- Reduced Customer Support: I’ve seen that cost-cutting can extend to customer service. Traders may experience slower response times or limited support hours compared to premium brokers. For example, some brokers like RedMars only offer basic email or ticket-based support rather than 24/7 live chat.

- Hidden Costs: While spreads and commissions may appear low, hidden fees like inactivity charges, withdrawal costs, or currency conversion fees can add up over time. Carefully read the fee structure to avoid unpleasant surprises.

- Compromises In Regulation: Not all low-cost brokers are regulated by top-tier authorities, potentially exposing traders to greater risk. Always prioritize brokers regulated by ‘green tier’ entities in DayTrading.com’s Regulation & Trust Rating like ASIC (Australia) or FCA (UK), even if their costs are slightly higher.

Low-cost brokers offer significant advantages, particularly for traders who maximize profits by minimizing fees.However, early in my career, I discovered that trading with budget brokers may cause trade-offs that could impact your overall trading experience.

Bottom Line

When it comes to choosing the cheapest broker for short-term trading, it’s essential to look beyond the surface and evaluate the overall value they provide.

With trading firms increasingly aiming to position themselves as “discount brokers”, featuring attractive low fees and tight spreads, that’s just part of the equation.

A brokerage that aligns with your trading style, offers a user-friendly platform and ensures safety through proper regulation, is just as important. That’s why we blended cost with the overall quality of the trading environment to compile our rankings.

To find the right trading platform for your needs, see DayTrading.com’s choice of the best brokers with low fees.