Weaker Technical Forecast For SPY

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

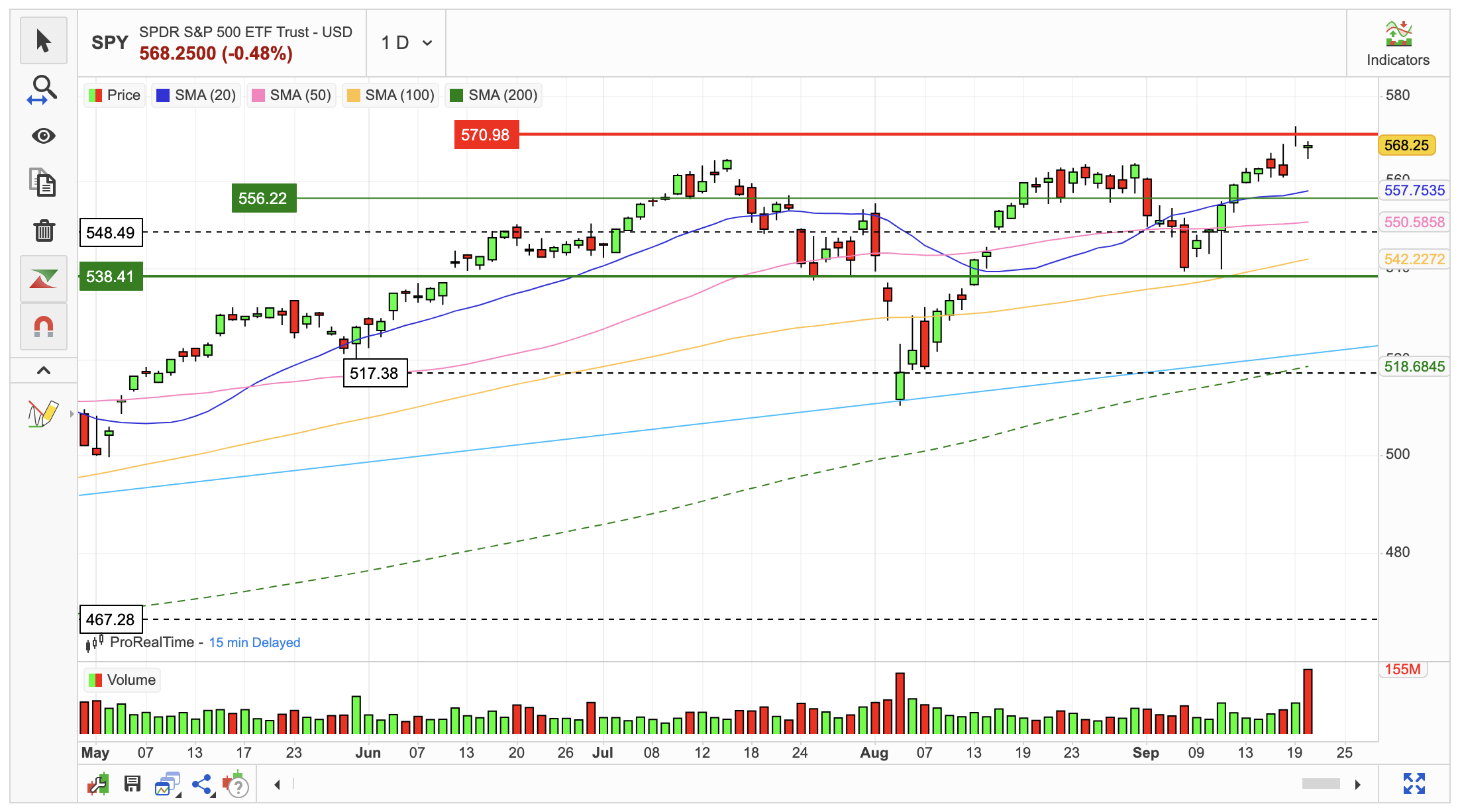

On September 20, 2024, the SPY ETF experienced a slight downturn, closing at $568.25, down from its previous day’s high of $570.98. This represented a 0.478% decrease.

Intraday trading was marked by volatility, with the ETF’s price fluctuating by 0.731%. It reached a low of $565.17 and a high of $569.30.

Despite this short-term decline, the SPY ETF has exhibited a broader upward trend, gaining 5.15% over the past two weeks. This positive momentum is supported by the fact that it has closed higher on 8 of the last 10 trading days.

Trading volume on September 20th surged by 3 million shares, reaching a total of 70 million. This increase in volume, coupled with the price decline, could suggest rising investor uncertainty or potential short-term selling pressure.

Currently, the SPY ETF is trading near the upper end of a horizontal price range. This level often acts as a resistance point, indicating potential selling opportunities. However, a breakout above the upper trend line, currently at $573.01, could signal a bullish reversal.

A successful breakout typically involves a significant increase in volume. It’s also worth noting that ETFs rarely move directly from the bottom to the top of a price range without experiencing some degree of retracement. ETFs that initiate a rise from the middle of a horizontal trend are often considered more likely to continue their upward momentum.