Wall Street’s Downturn Extends Into Fourth Week

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

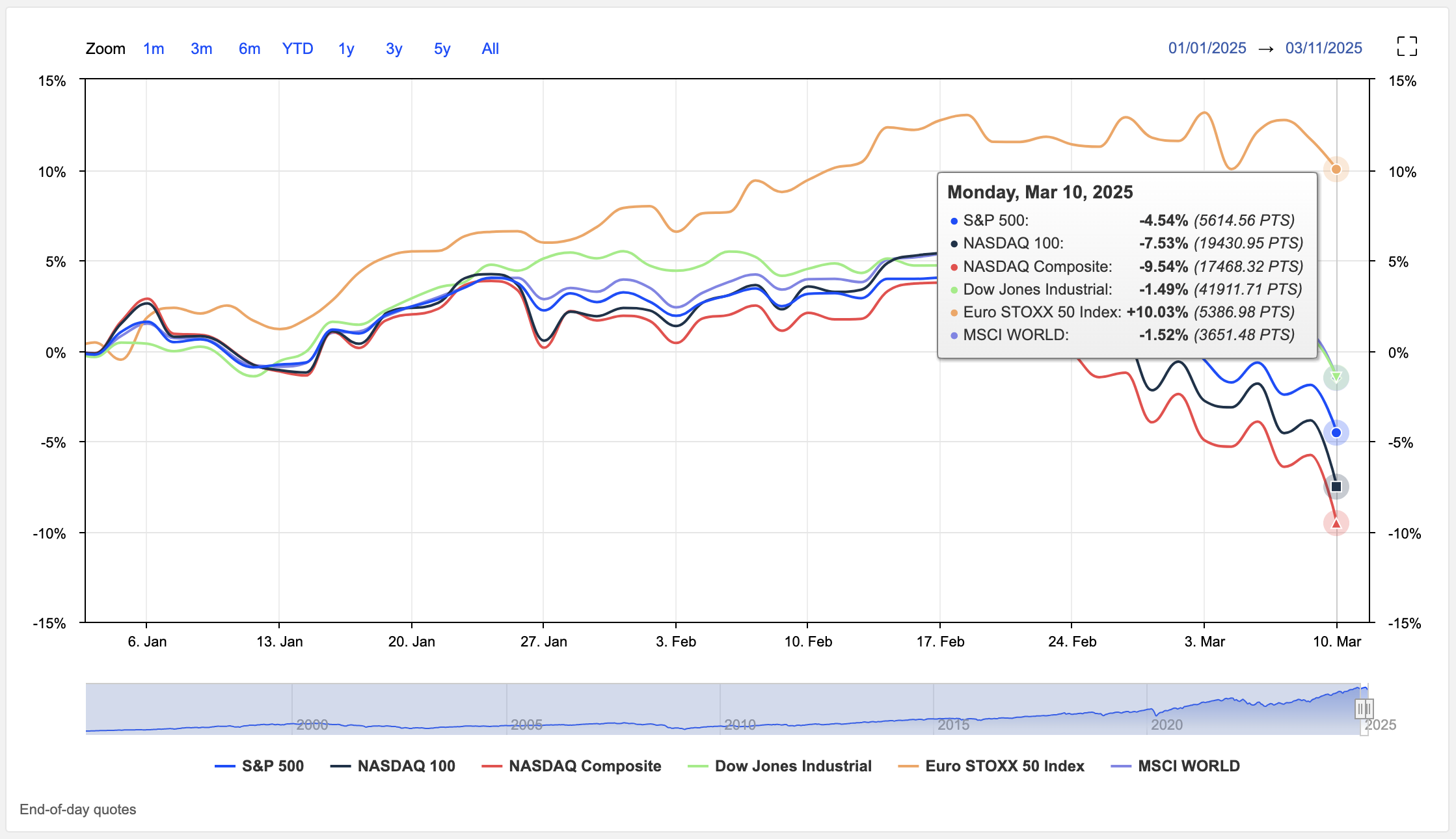

Wall Street’s three-week sell-off deepened on Monday as escalating fears over tariff uncertainty and its potential to spark a recession rattled investors.

The S&P 500 tumbled 2.7%, the Dow Jones Industrial Average plunged 890 points (2%), and the Nasdaq 100 slumped 3.9%, marking its steepest single-day decline since 2022.

Tech giants bore the brunt of the sell-off, with Tesla plummeting 15.4%, Nvidia dropping 5%, and Meta falling 4.4%, dragging the broader market lower.

The Trump administration’s tariff policies have amplified concerns that rising inflation could complicate the Federal Reserve’s ability to cut interest rates, further unsettling markets.

In a Sunday interview, President Trump described the economy as being in “a period of transition,” but his remarks did little to assuage investor anxiety.

Instead, they fuelled fears that the administration’s aggressive trade measures could backfire, stifling economic growth and potentially triggering a recession.

As markets braced for a potential slowdown, Treasury yields fell sharply, reflecting a flight to safer assets like bonds.

This shift underscored growing investor caution amid a volatile economic backdrop.

Adding to the uncertainty, key inflation data due later this week could further influence market sentiment, particularly if it signals persistent price pressures.

The sell-off also highlighted broader concerns about the administration’s policy direction, including recent government shake-ups and the unpredictable nature of trade negotiations.

With the S&P 500 now down 8% from its February peak and the Nasdaq officially in correction territory, investors are grappling with the possibility of prolonged market turbulence.

Analysts warn that the combination of trade tensions, geopolitical risks, and economic uncertainty could continue to weigh on equities in the near term.