US Stocks Surge On Friday, Despite Trump & Zelenskyy Tensions

- This topic has 1 reply, 1 voice, and was last updated 1 month ago by .

-

Topic

-

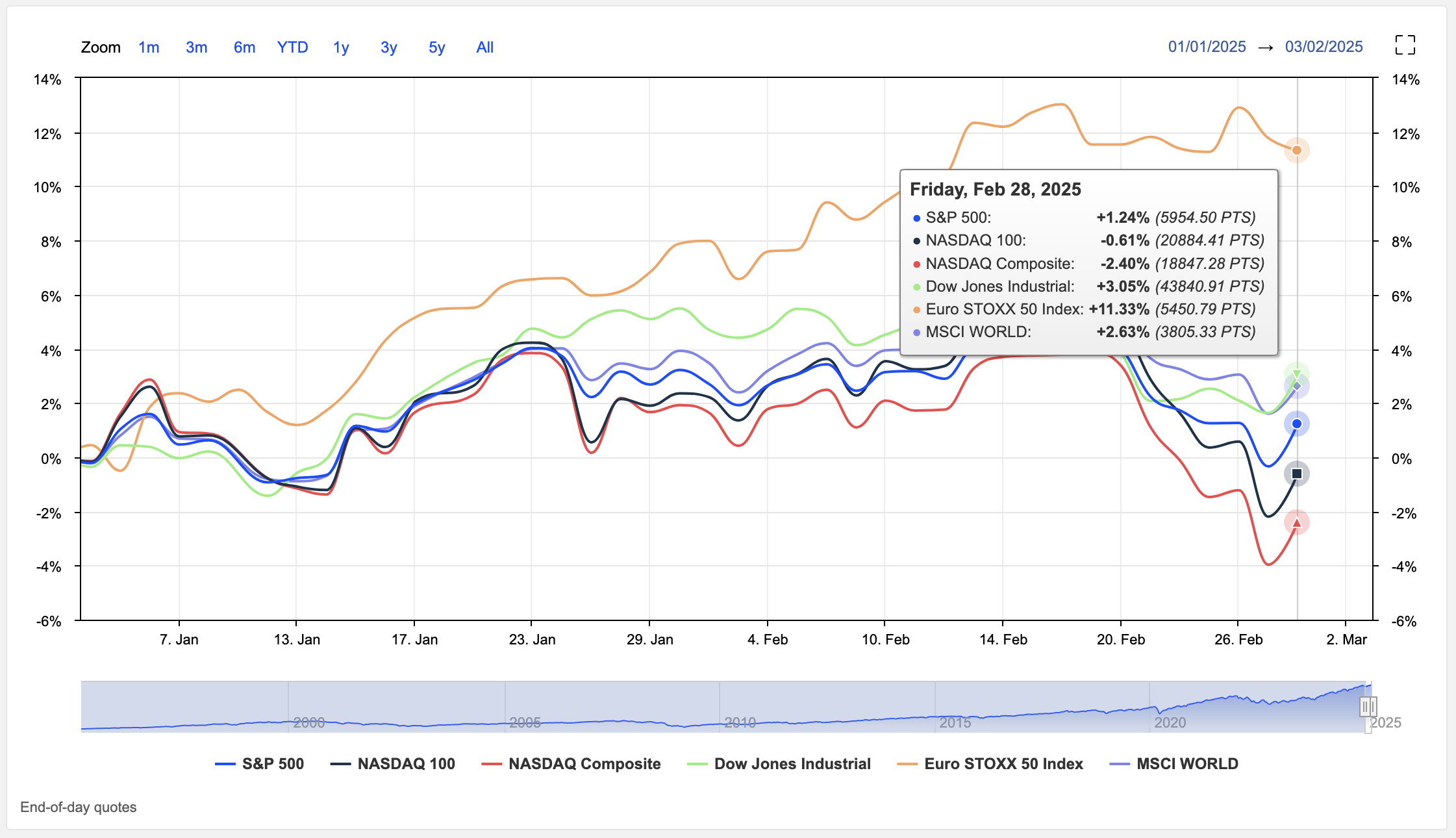

US equity markets concluded Friday’s session on a positive note, with the S&P 500 and Nasdaq Composite both advancing 1.6%, while the Dow Jones Industrial Average gained 601 points.

This upward momentum came despite a brief pullback triggered by an unprecedented and tense exchange between President Donald Trump and Ukrainian President Volodymyr Zelenskyy in the Oval Office.

The heated discussion, which unfolded live before the world’s media, raised concerns about escalating geopolitical risks and the stability of US-Ukraine relations.

Experts from King’s College London described the meeting as a “train wreck by design,” suggesting it could have far-reaching implications for Ukraine, Europe, and global geopolitics.

Adding to market uncertainty, President Trump’s renewed tariff threats prompted retaliation warnings from China, particularly affecting the technology sector.

This development reignited fears of a potential trade war, reminiscent of earlier tensions between the two economic giants.

Economic data released on Friday painted a mixed picture.

While core PCE inflation, the Federal Reserve’s preferred gauge, eased to 3.7% as anticipated, consumer spending unexpectedly declined by 0.2% in January.

This marked the first decrease in consumer spending since March 2023, potentially signaling a shift in consumer behaviour and economic momentum.

In the technology sector, Nvidia shares rose 0.6%, recovering slightly from Thursday’s 8.5% plunge. The company’s CEO, Jensen Huang, remained optimistic about Nvidia’s long-term prospects in AI and computing.

Tesla stock gained 3.9%, breaking a six-day losing streak. However, concerns persist about CEO Elon Musk’s increasing involvement in government efficiency campaigns and its potential impact on Tesla’s operations.

The volatile trading environment led to significant monthly declines for major indices.

The S&P 500 and Nasdaq Composite posted their worst monthly performances since April 2024 and September 2023, respectively, dropping 1.4% and 4%. The Dow Jones Industrial Average fell 2.2% for the month.

Looking ahead, market analysts anticipate more muted gains for stocks in 2025 compared to the strong performance of the past two years.

Morgan Stanley suggests that while the third year of a bull market typically produces mediocre returns, it is usually not negative.

Investors will likely continue to monitor geopolitical developments, economic indicators, and corporate earnings closely as they navigate the uncertain landscape of 2025.

Source: Trading Economics