US Stocks Slip As Tariff Fears Weigh On Markets

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

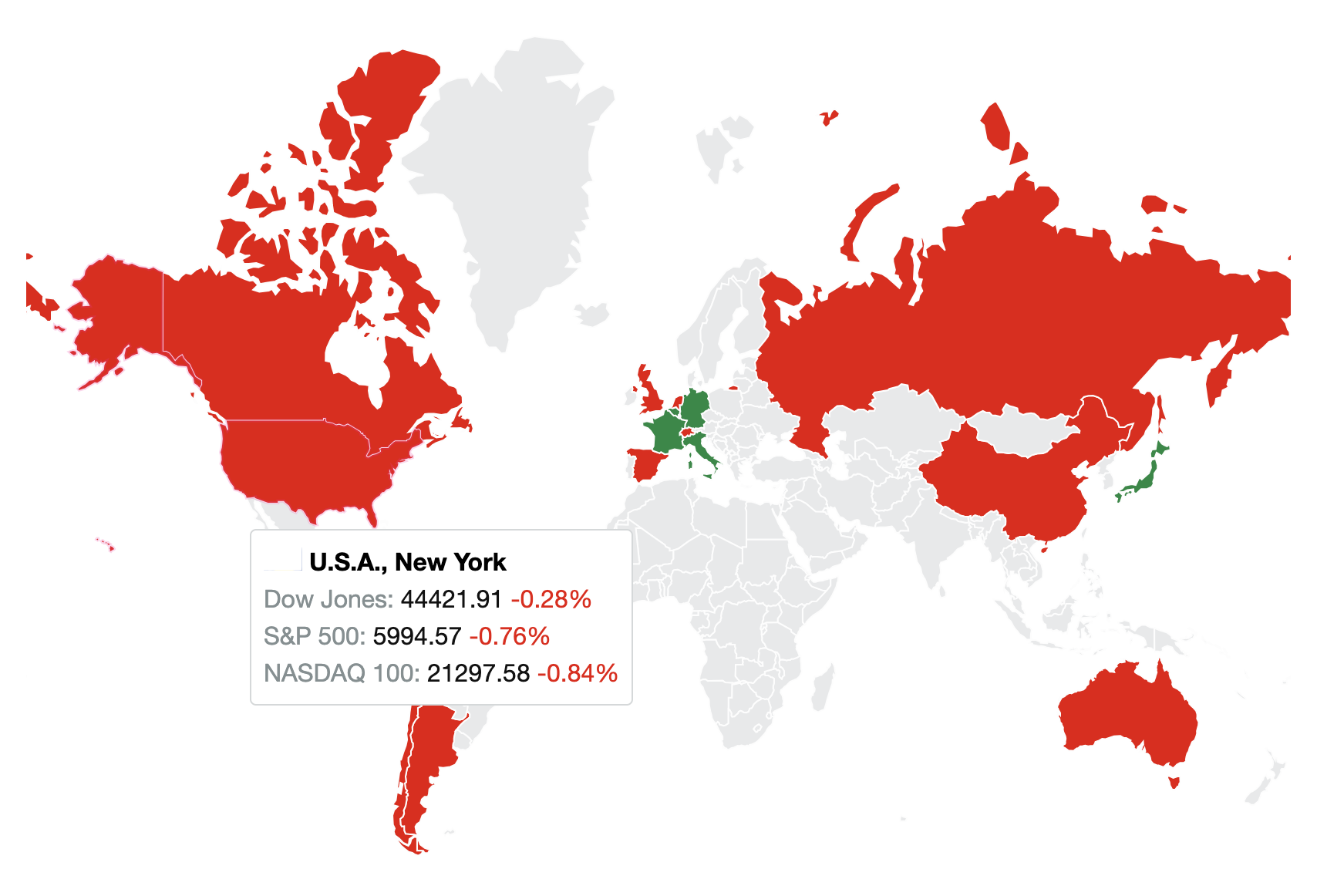

US stock markets ended Monday in the red, though they managed to recover some of their earlier steep losses following President Trump’s announcement of a one-month postponement on tariffs targeting Mexican imports.

This decision came after a phone conversation with Mexico’s President, Claudia Sheinbaum.

The S&P 500 declined by 0.76%, while the Nasdaq-100 dropped 0.84%. The Dow Jones Industrial Average also closed 122 points lower, rebounding from a sharp intraday decline of 665 points.

Investor anxiety over trade tensions weighed heavily on consumer discretionary stocks, with automakers particularly affected due to the looming tariff threats.

Major technology companies also faced significant pressure, with Apple shares sliding 3.4%, Nvidia falling 2.8%, and Tesla tumbling 5.2%.

In contrast, defensive sectors like healthcare, energy, and consumer staples performed better, as investors sought safer assets amid the uncertainty.

Market participants were also closely monitoring the upcoming talks between President Trump and Canadian Prime Minister Justin Trudeau for further developments on trade policy.

Over the weekend, Trump solidified plans for a 25% tariff on goods from both Mexico and Canada, alongside a 10% tariff on Chinese imports, set to take effect today.

In response, all three countries—Canada, Mexico, and China—have pledged to implement retaliatory measures, adding to the market’s cautious outlook.

Sources: Trading Economics, Business Insider