US Stocks Slip Ahead Of November Jobs Report

- This topic has 0 replies, 1 voice, and was last updated 4 months ago by .

-

Topic

-

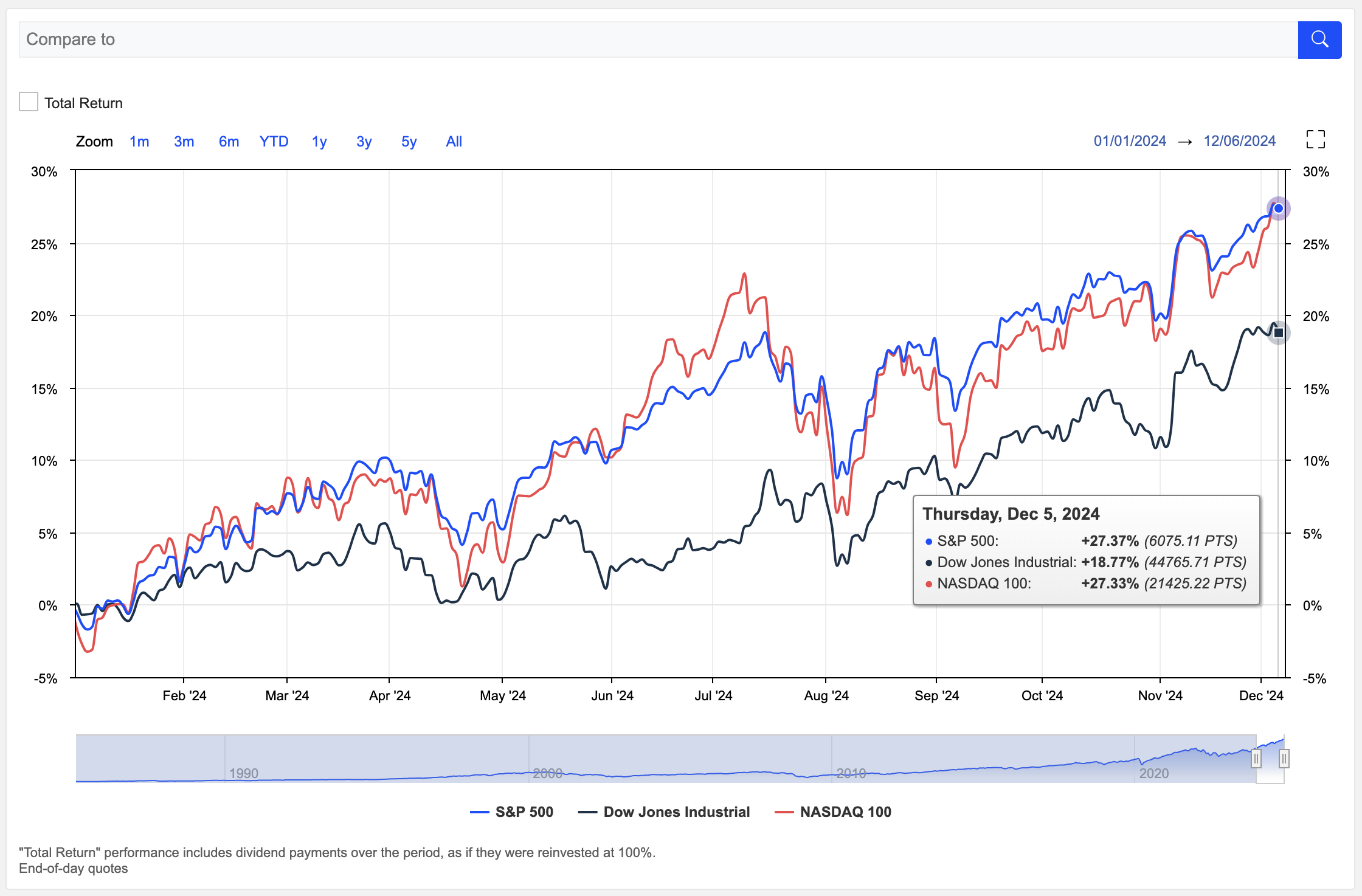

US equities cooled on Thursday as all major indexes posted losses, reflecting market caution ahead of today’s much-anticipated November jobs report.

The Dow Jones Industrial Average fell 0.6%, slipping below the 45,000 mark, while the S&P 500 and Nasdaq Composite registered modest declines as well, signalling a broadly risk-averse sentiment across Wall Street.

The pullback comes as investors remain on edge about the Federal Reserve’s next moves on interest rates.

With the labour market playing a crucial role in shaping monetary policy, market participants are closely watching the upcoming jobs data for signs of strength or weakness.

A stronger-than-expected report could reinforce expectations of tighter monetary policy, while weaker numbers might hint at a pause in rate hikes, potentially easing pressure on equities.

Sectors sensitive to interest rate changes, including technology and consumer discretionary, experienced some of the sharper declines during the session.

Meanwhile, bond yields edged higher, adding to concerns about the cost of capital and its impact on corporate earnings.

The jobs report is likely to provide clarity on the broader economic outlook, making it a pivotal moment for markets.

Until then, volatility may persist as traders weigh the implications of economic data on the Fed’s trajectory for 2024.

Data: eToro, MarketScreener