US Stocks Slide, Tariff Drama And CPI Keep Investors On Edge

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

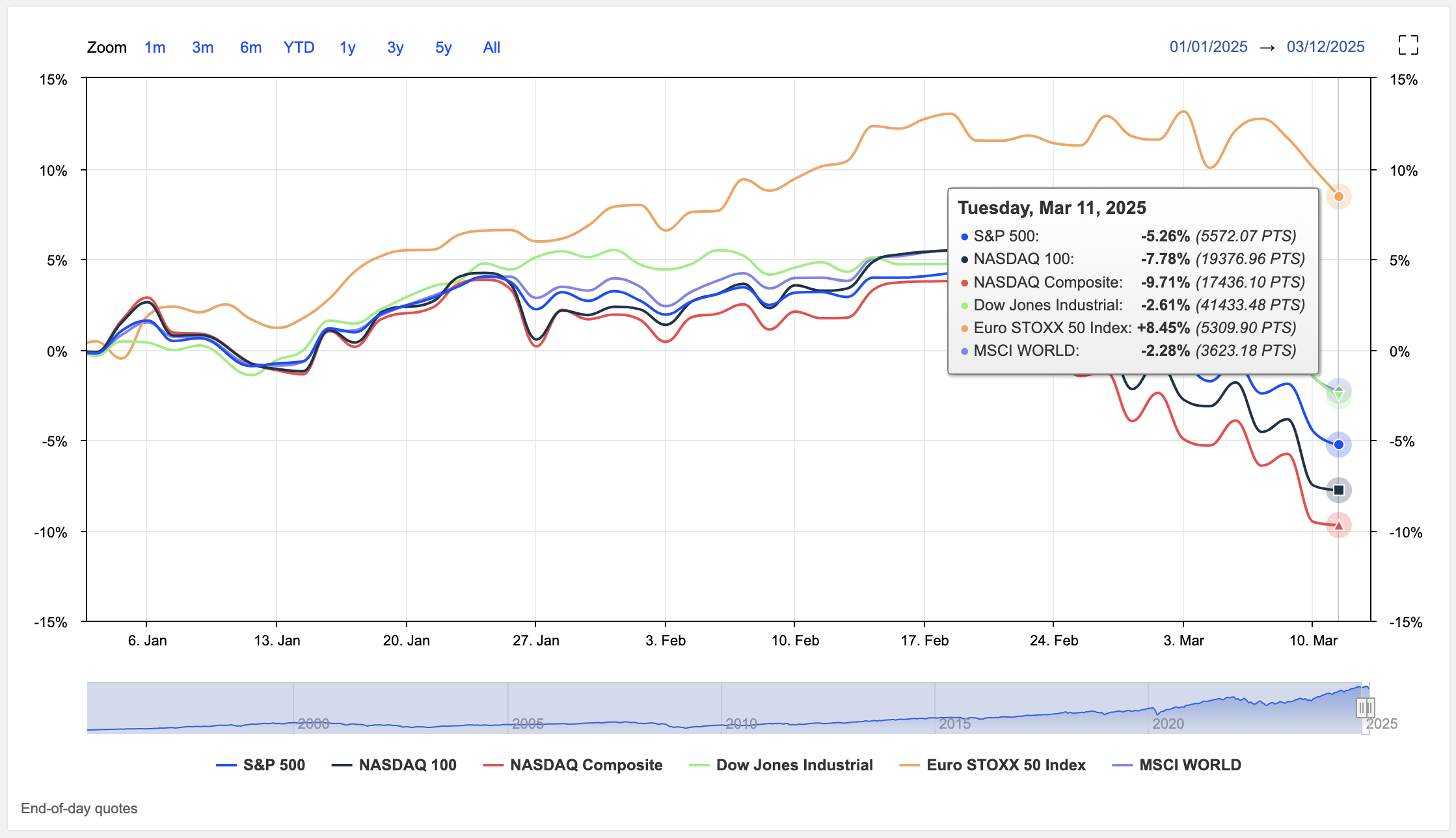

US stocks continued their downward slide on Tuesday, with the Dow Jones Industrial Average plunging 478 points and the S&P 500 dropping 0.76%, bringing it closer to correction territory.

Markets initially saw a brief rally, but the optimism quickly faded after President Donald Trump announced plans to impose higher tariffs on Canadian steel, only to reverse the decision later in the day.

This back-and-forth added to the already heightened volatility, leaving investors on edge.

The tariff drama has amplified concerns about the potential economic fallout, particularly as Trump’s trade policies continue to create uncertainty.

Investors are now bracing for today’s Consumer Price Index (CPI) report, which could play a pivotal role in shaping the Federal Reserve’s next move.

A softer inflation reading might fuel hopes for rate cuts, while a stronger-than-expected figure could delay any easing and further weigh on markets.

Adding to the unease, the S&P 500 has now erased nearly 10% of its gains since its February peak, marking its steepest decline in months.

The tech-heavy Nasdaq also remains under pressure, reflecting broader anxieties about growth and corporate earnings.

With trade tensions and inflation data in the spotlight, markets are likely to remain volatile in the near term.

What’s your take on how the CPI report will impact the Fed’s strategy? 📉💡