US Stocks Rebound After Powell Comments

- This topic has 2 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

US stocks experienced a turbulent session on Friday, as markets rebounded from earlier declines amid ongoing uncertainty fuelled by President Donald Trump’s trade policies.

The S&P 500 rose 0.6%, the Nasdaq Composite gained 0.7%, and the Dow Jones Industrial Average added 222 points, or 0.5%.

The recovery came after Federal Reserve Chair Jerome Powell emphasised that the central bank is not in a hurry to cut interest rates, providing some reassurance to investors.

However, the broader economic outlook remains clouded by persistent trade tensions and policy unpredictability.

The latest economic data painted a mixed picture.

The February jobs report showed non-farm payrolls increasing by 151,000, falling short of the expected 170,000, while the unemployment rate edged up to 4.1%.

This weaker-than-anticipated jobs growth raised concerns about the labour market’s resilience, particularly in light of recent government spending cuts and layoffs in the public and private sectors.

Analysts noted that while softer job data could bolster arguments for additional Fed rate cuts, sustained job creation remains crucial for economic stability.

The market’s volatility was further exacerbated by uncertainty surrounding Trump’s trade policies.

Although the president announced temporary exemptions on tariffs for goods from Canada and Mexico, investors remain wary of the potential for escalating trade conflicts.

The exemptions, which suspend tariffs on products covered by the North American trade agreement until April 2, provided some relief but failed to fully alleviate concerns.

The unpredictability of Trump’s tariff strategies has created an environment of heightened anxiety, particularly as the US continues its trade dispute with China and prepares for potential reciprocal trade barriers.

Amid the broader market turbulence, individual stocks saw significant movements.

Broadcom surged 8.4% after posting upbeat results, driven by strong demand for its artificial intelligence infrastructure products.

In contrast, Costco plunged 7% following disappointing earnings, reflecting challenges in the retail sector.

These divergent performances highlight the uneven impact of economic and policy uncertainties on different industries.

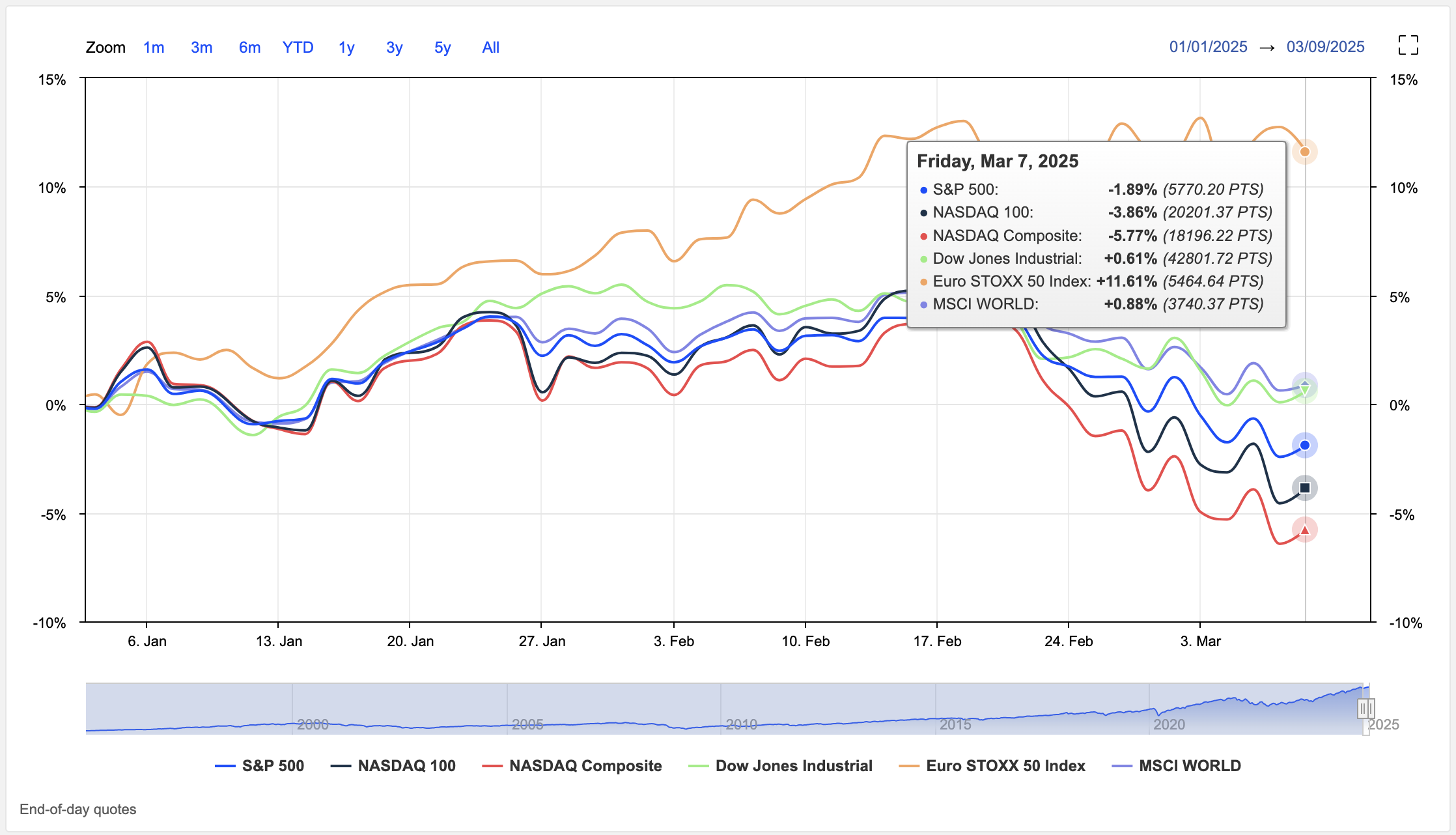

Despite Friday’s gains, the major indexes posted their worst weekly performance since September.

The Dow and S&P 500 each declined more than 2%, while the Nasdaq lost 3%.

This marked the third consecutive week of losses for the S&P 500 and Nasdaq, underscoring the ongoing challenges posed by trade tensions and economic data.

Powell’s comments reinforced the Fed’s cautious approach to monetary policy, signalling that the central bank is closely monitoring economic conditions but is not yet ready to commit to further rate cuts.

This stance reflects the Fed’s balancing act between supporting economic growth and addressing inflationary pressures, particularly in the context of Trump’s trade and fiscal policies.

Sources: Trading Economics, MarketScreener