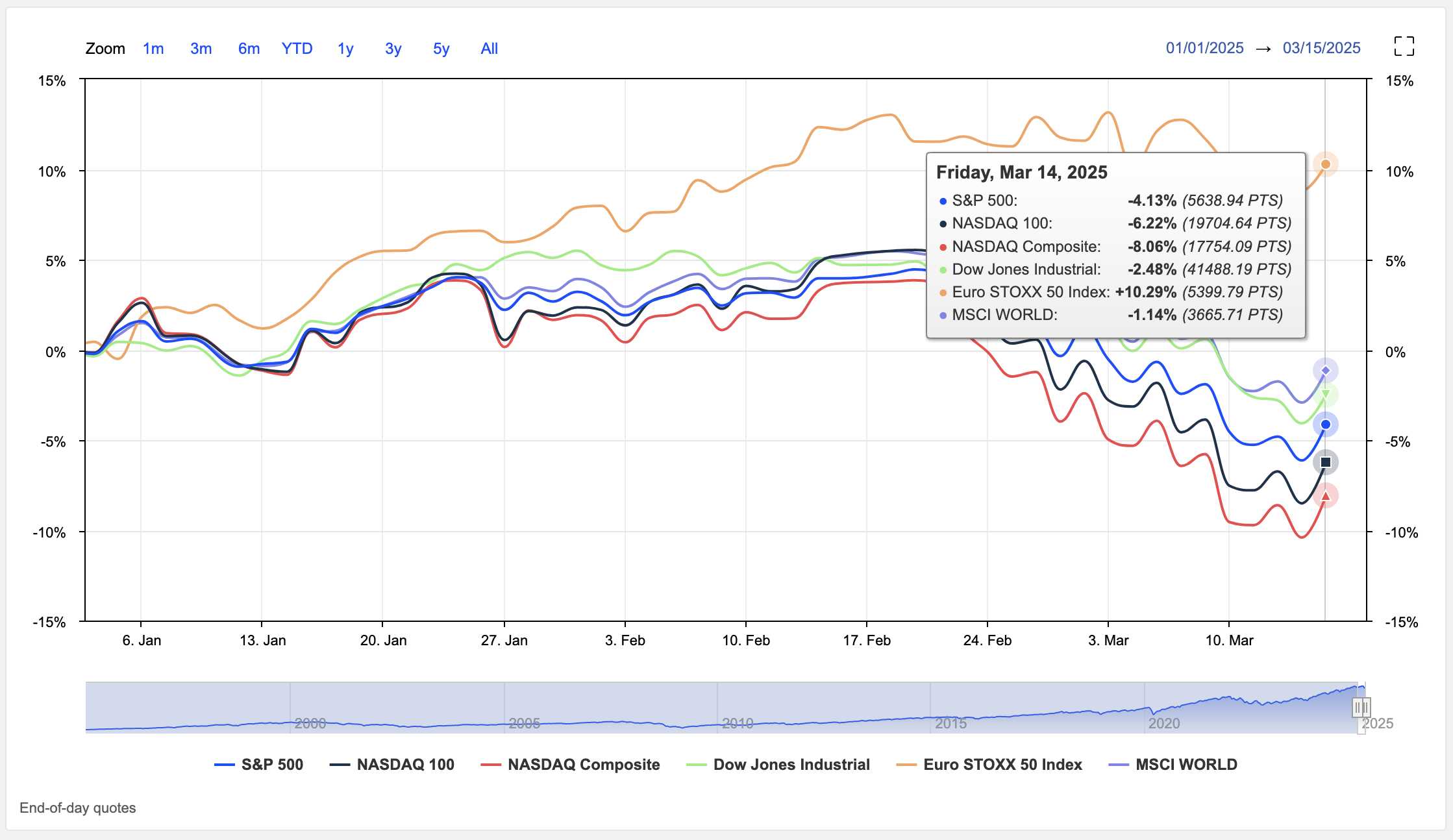

US Stocks Rally Friday, But Post Worst Weekly Losses In Over A Year

- This topic has 2 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

US stocks ended a turbulent week on a high note Friday, with the S&P 500 surging 2.1%, the Dow Jones Industrial Average gaining 674 points (1.7%), and the Nasdaq 100 climbing 2.5%.

The rally was fuelled by easing fears of a government shutdown and investor resilience in the face of weak consumer sentiment data.

Senate Minority Leader Chuck Schumer’s indication of support for a Republican-backed funding bill helped reduce political uncertainty, providing a temporary boost to market confidence.

However, the University of Michigan’s consumer sentiment index plunged to 57.9 in March, its lowest level since November 2022, reflecting growing concerns over inflation and the economic impact of tariffs.

One-year inflation expectations rose to 4.9%, the highest since 2022, signalling heightened anxiety among consumers.

Tech stocks led the rebound, with Nvidia soaring 5.3%, while Tesla, Meta, Amazon, and Apple all gained over 1%.

Palantir also jumped 8.3%, defying concerns over potential defence spending cuts, as investors focused on its expanding commercial AI initiatives.

Despite Friday’s gains, the broader market struggled for the week.

The S&P 500 and Nasdaq each fell over 2%, marking their fourth consecutive weekly decline, while the Dow posted a 3.1% drop—its worst weekly performance since March 2023.

Several factors contributed to the rally, including the avoidance of a government shutdown, a recovery in the tech sector, and investor resilience despite weak economic data.

Schumer’s support for the funding bill alleviated fears of a shutdown, reducing political uncertainty.

Meanwhile, oversold conditions and bargain-hunting drove gains in tech stocks, particularly in AI-related companies like Nvidia and Palantir. Investors also remained optimistic, betting on a potential Fed rate cut later this year.

However, broader market challenges persist.

Trump’s escalating trade policies and rising inflation expectations continue to weigh on consumer and investor confidence.

The combination of weak sentiment, tariff risks, and geopolitical tensions has created a volatile environment, with investors seeking clarity on the economic outlook.

While Friday’s rally provided a much-needed reprieve, the underlying issues—tariffs, inflation, and policy uncertainty—remain unresolved.

Analysts caution that sustained market recovery will depend on clearer economic signals and a resolution to the trade war.

What’s your take—will the markets stabilise, or is this just a temporary bounce in a broader downturn? 🤔📈

Chart: MarketScreener