US Stock Market Recap (27th June, 2024)

- This topic has 0 replies, 1 voice, and was last updated 9 months ago by .

-

Topic

-

US equities saw modest gains on Thursday, mirroring a dip in Treasury yields. This followed the release of mixed economic data that hinted at a potential economic slowdown.

Investors are particularly attentive to this news, as it could potentially lead to an interest rate cut by the Federal Reserve in the coming months, a move that could significantly impact the market.

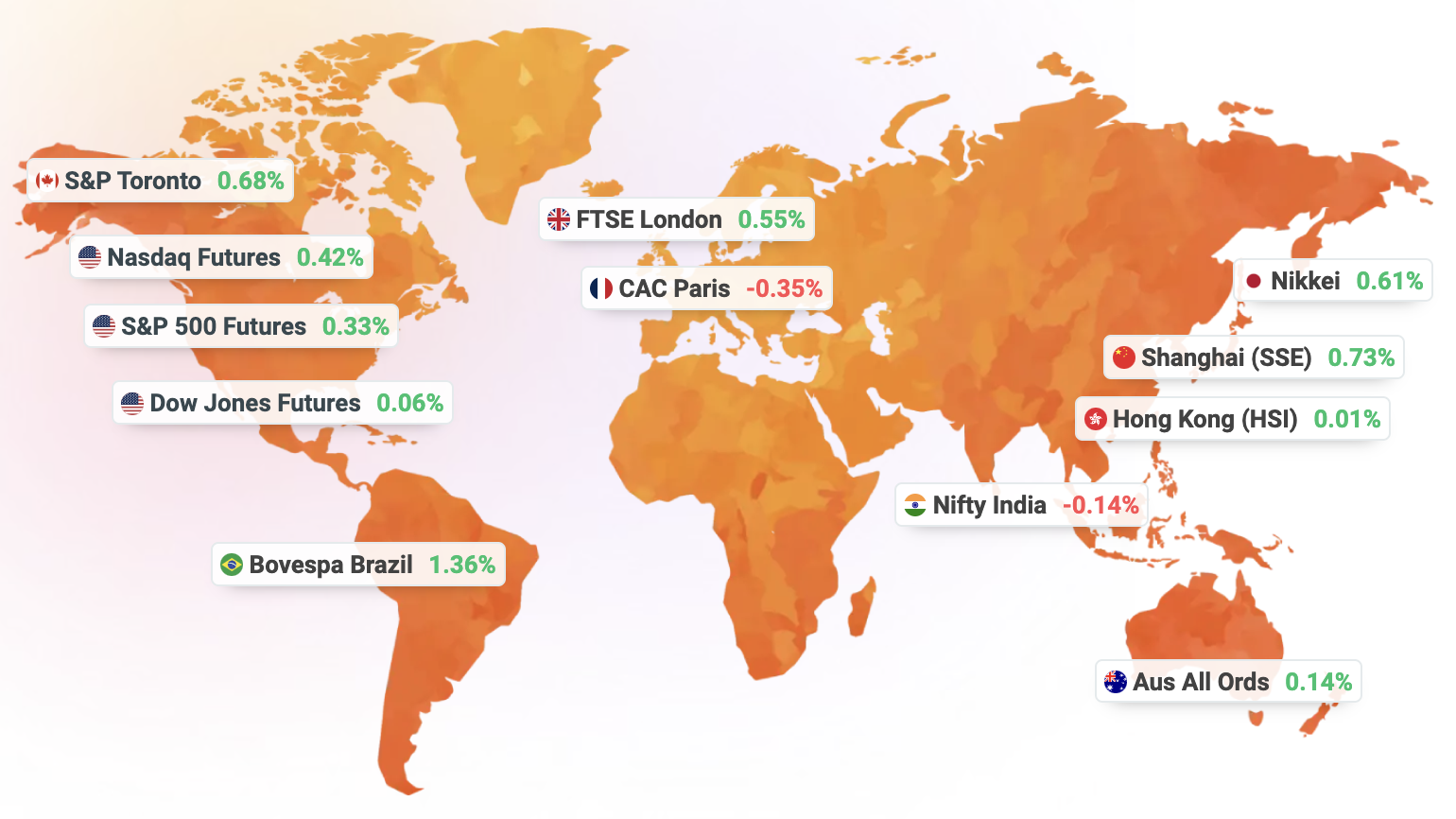

The major market indexes closed slightly higher. The S&P 500 and Dow Jones Industrial Average both saw an increase, while the tech-heavy Nasdaq Composite, known for its focus on technology stocks, rose by 0.42%.

Economic data released earlier painted a conflicting picture, adding an element of intrigue to the market analysis. Initial jobless claims, a measure of recent layoffs, declined for the second week.

However, continuing claims, which track those receiving unemployment benefits for an extended period, reached their highest level since 2021, suggesting a potential cooling of the labour market. On a brighter note, GDP growth was revised upwards to 1.4% from a previous estimate of 1.3%.

Consumer discretionary stocks led the gainers, driven by a 2.1% increase in Amazon’s share price. The communication services sector also performed well, with Alphabet, Meta, and Netflix rising by modest percentages.

Conversely, consumer staples and financials lagged, with Walmart and Visa’s shares experiencing slight declines. Among other notable movers, Nvidia’s stock dipped slightly, while Salesforce saw a significant surge.