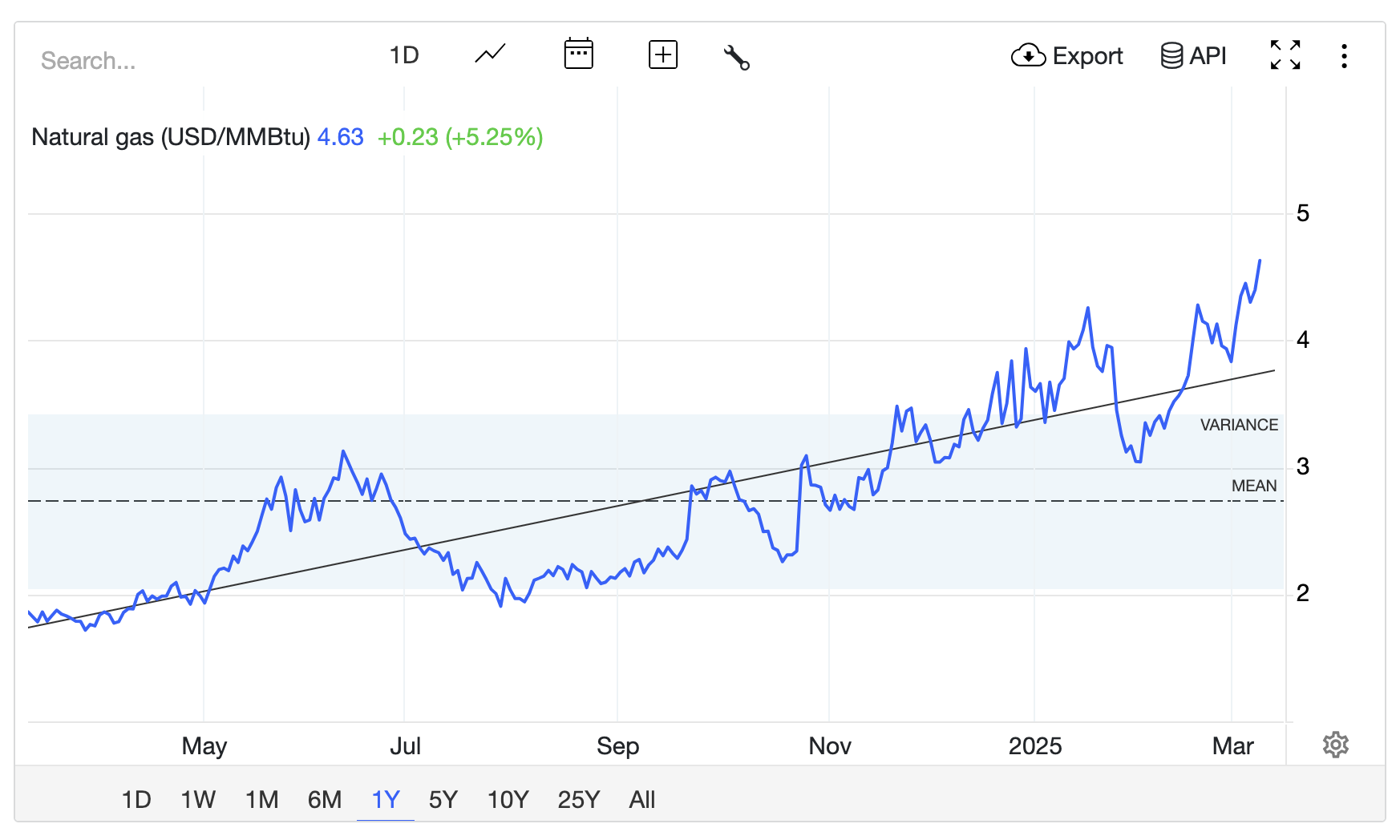

US Natural Gas Hits 2-Year High, Tightened Supply

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

US natural gas futures surged nearly 5% to $4.60 per million British thermal units (MMBtu), reaching their highest level since December 2022, driven by a combination of extreme weather, supply constraints, record LNG exports, and geopolitical tensions.

Arctic conditions across North America and Europe have significantly increased heating demand, while freezing temperatures have caused production disruptions, known as “freeze-offs,” temporarily halting gas extraction in key regions.

These disruptions have tightened supply, exacerbating price pressures.

Meteorologists predict a shift in weather patterns, with the Lower 48 states transitioning from predominantly warmer-than-normal conditions between March 6-15 to colder-than-normal temperatures from March 16-21.

This forecast suggests continued high demand for natural gas as heating needs persist, further straining supply.

LNG exports have also played a critical role in driving prices upward, reaching an all-time high of 15.6 billion cubic feet per day (bcfd) in February.

The strong global demand for LNG, particularly from Europe and Asia, has kept pressure on domestic gas supplies.

Geopolitical uncertainties, including potential reductions in Canadian gas exports to the US, have added to supply concerns, making it more challenging to replenish storage levels.

Despite these pressures, gas production in the Lower 48 states has increased to an average of 105.8 bcfd in March, up from a record 105.1 bcfd in February.

This growth in production is supported by expanded pipeline infrastructure and improved access to markets, but it has been insufficient to fully offset the impact of heightened demand and supply disruptions.

The interplay of these factors has created a volatile market environment, with natural gas prices reflecting the delicate balance between supply and demand.

Storage levels, which are critical for maintaining market stability, have been under pressure due to increased withdrawals driven by strong winter demand.

The Energy Information Administration (EIA) projects that natural gas inventories at the end of March 2025 will be 4% below the five-year average, indicating potential supply shortages.

The global gas market is also influencing US prices, with geopolitical tensions and the halt of Russian piped gas transit via Ukraine on January 1, 2025, increasing European LNG import requirements.

This has further tightened global market fundamentals, adding upward pressure on US natural gas prices.

As the market navigates these challenges, the focus remains on the ability of producers to meet rising demand while managing supply constraints.

The combination of extreme weather, record LNG exports, and geopolitical uncertainties suggests that natural gas prices may remain elevated in the near term, with significant implications for consumers, industries, and energy markets worldwide.

Chart: Trading Economics