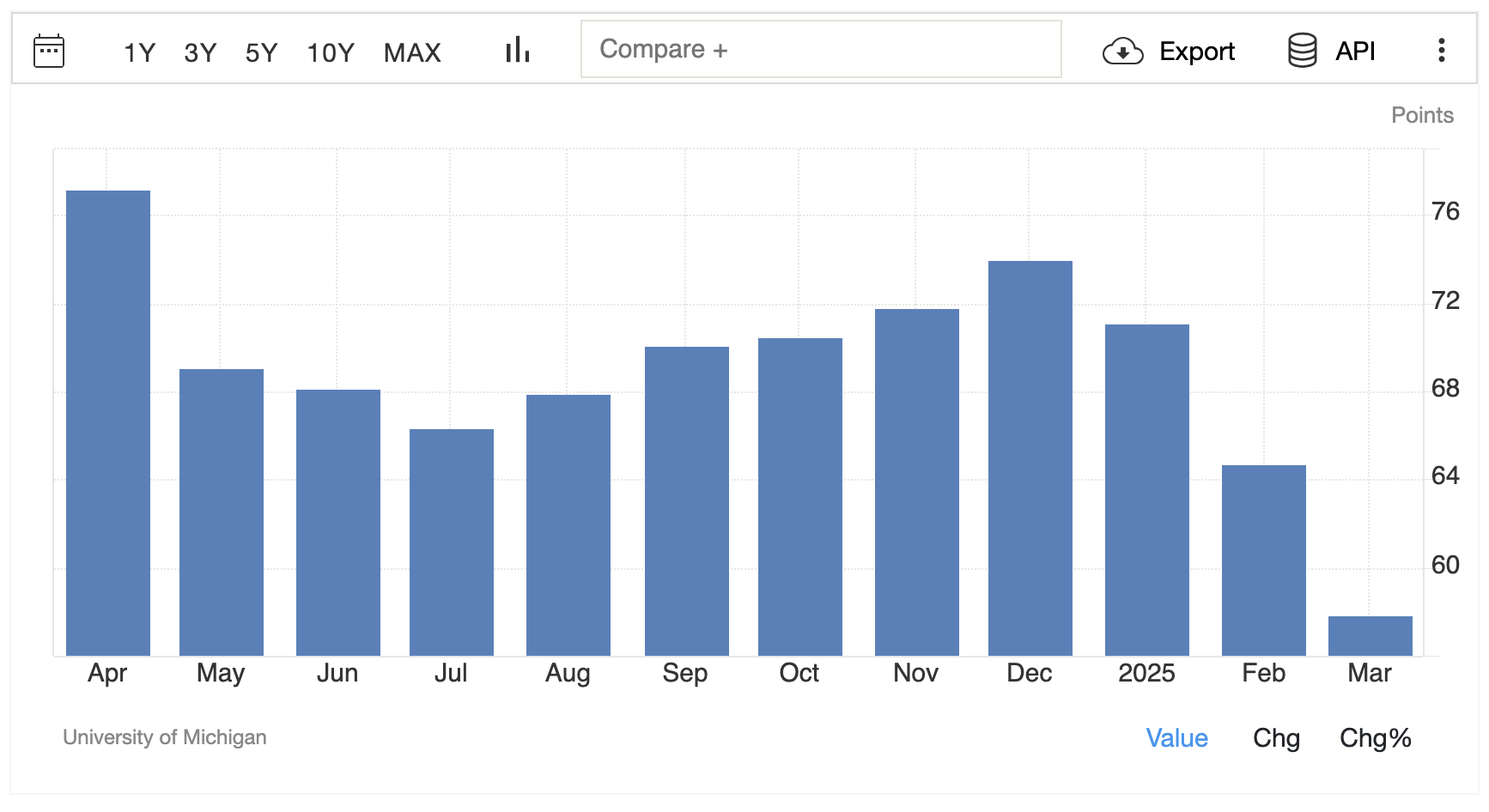

US Consumer Sentiment Plunges To 2-Year Low

- This topic has 2 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

The University of Michigan’s consumer sentiment index for the US dropped to 57.9 in March 2025, marking the lowest level since November 2022 and falling sharply from 64.7 in February.

This reading was well below the forecast of 63.1, signalling a significant deterioration in consumer confidence.

The decline represents the third consecutive monthly drop, with many consumers pointing to policy uncertainty and other economic factors as key reasons for their pessimism.

While perceptions of current economic conditions remained relatively stable at 53.5, compared to 65.7 in February, future expectations deteriorated sharply to 54.2 from 64.

This decline was broad-based, affecting outlooks on personal finances, labour markets, inflation, business conditions, and stock markets.

The growing unease reflects concerns about the trajectory of the economy, particularly amid escalating tariff tensions and volatile policy shifts.

Inflation expectations also surged, with the year-ahead gauge rising to 4.9%, the highest since November 2022, up from 4.3% in February.

Similarly, the five-year inflation outlook jumped to 3.9% from 3.5%, marking the largest month-over-month increase since 1993.

These rising inflation expectations are likely fuelled by President Trump’s recent tariff announcements, including 200% tariffs on EU spirits and 50% tariffs on Canadian steel, which have heightened fears of higher prices across the economy.

The decline in sentiment was notable across political affiliations, with Republicans, Democrats, and independents all reporting lower expectations for the future.

This bipartisan drop underscores the widespread anxiety about economic uncertainty and its potential impact on household finances and spending.

The data suggests that consumers are increasingly wary of the economic landscape, with policy volatility and tariff-induced inflation weighing heavily on their outlook.

If sentiment continues to decline, it could lead to reduced consumer spending, which accounts for approximately 68% of US GDP, potentially signalling broader economic challenges ahead.

What’s your take—do you think this sentiment slump is a temporary setback or a sign of deeper economic trouble? 🤔

Chart: Trading Economics