Upstart Rips 25% After Hours On Strong Earnings, AI Lending Momentum

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

Upstart Holdings Inc. (NASDAQ: UPST) delivered a stunning fourth-quarter earnings report for 2024, triggering a significant after-hours rally in its stock price.

The AI-powered lending platform’s shares surged by approximately 25% following the release of its financial results, which substantially exceeded market expectations.

The company reported total revenue of $219 million for Q4 2024, marking a robust 56% year-over-year increase and a 35% quarter-over-quarter growth.

This impressive top-line performance was driven by a substantial rise in loan originations, with transaction volume reaching 245,663 loans, up 68% from the previous year.

Upstart’s financial metrics showed notable improvements across the board.

The company narrowed its GAAP net loss to $2.8 million, a significant reduction from the $42.4 million loss reported in Q4 2023.

Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) soared to $38.8 million, compared to a mere $0.6 million in the same quarter of the previous year, demonstrating the company’s progress towards profitability.

The market’s enthusiastic response to Upstart’s results reflects growing investor confidence in the company’s AI-driven lending model and its ability to navigate the challenging macroeconomic environment.

Upstart’s performance is particularly noteworthy given the recent history of interest rate hikes and lending market volatility.

Looking ahead, Upstart provided an optimistic outlook for 2025, projecting full-year revenue of approximately $1 billion and an adjusted EBITDA margin of around 18%.

This forward guidance further fuelled investor excitement, as it suggests continued strong growth and improved profitability.

The company’s success in expanding its product offerings, including growth in auto loans and home equity lines of credit (HELOCs), indicates Upstart’s potential to capture larger shares of the $677 billion auto loan market and the $1.4 trillion home lending market.

As Upstart continues to demonstrate the effectiveness of its AI-powered risk assessment platform, it appears well-positioned to capitalise on the gradual thawing of the lending freeze that has affected the financial sector.

The company’s ability to innovate and adapt to market conditions has clearly resonated with investors, setting the stage for what could be a transformative period in Upstart’s growth trajectory.

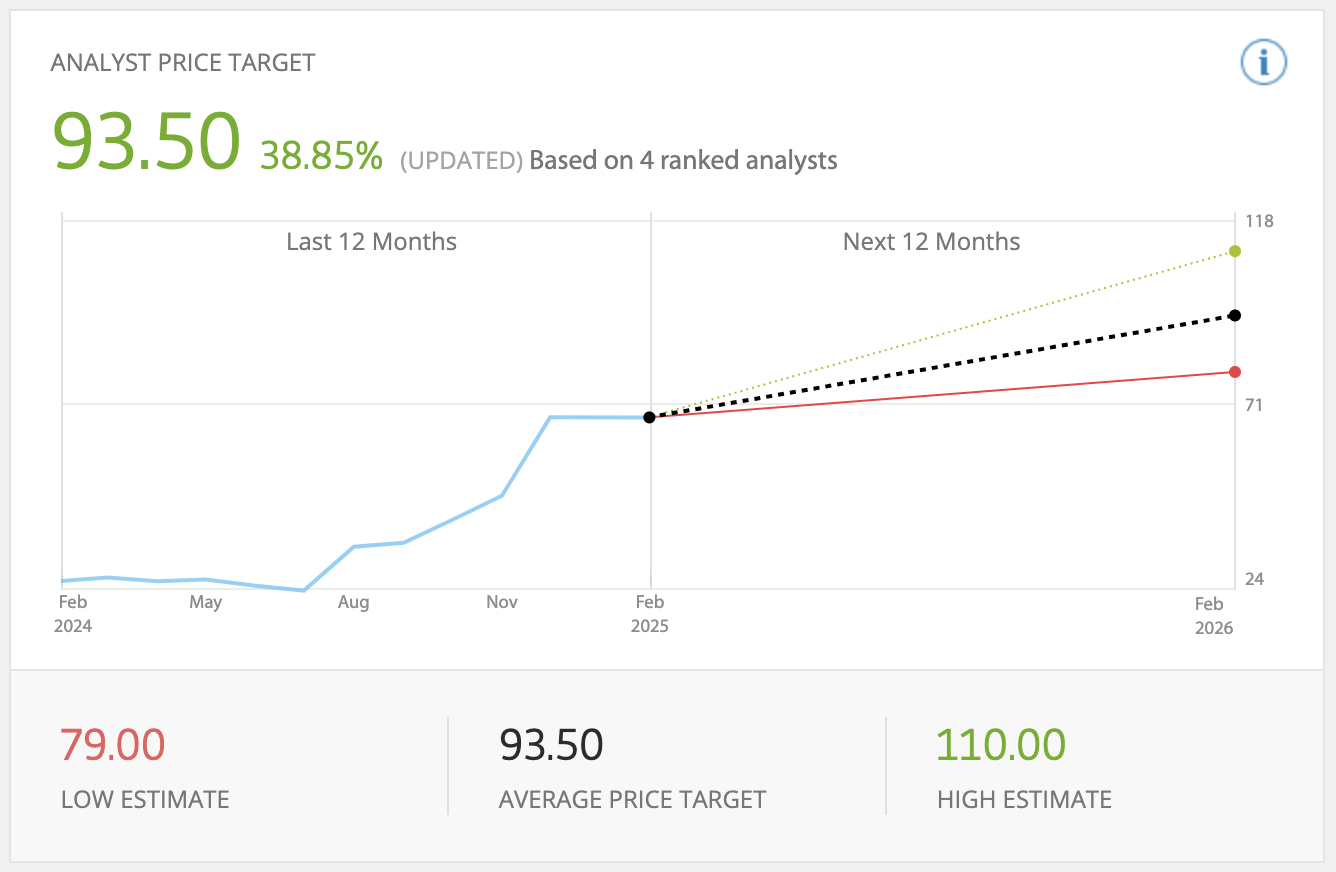

Sources: eToro, TipRanks