UK Manufacturing PMI Drops To 14-Month Low

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

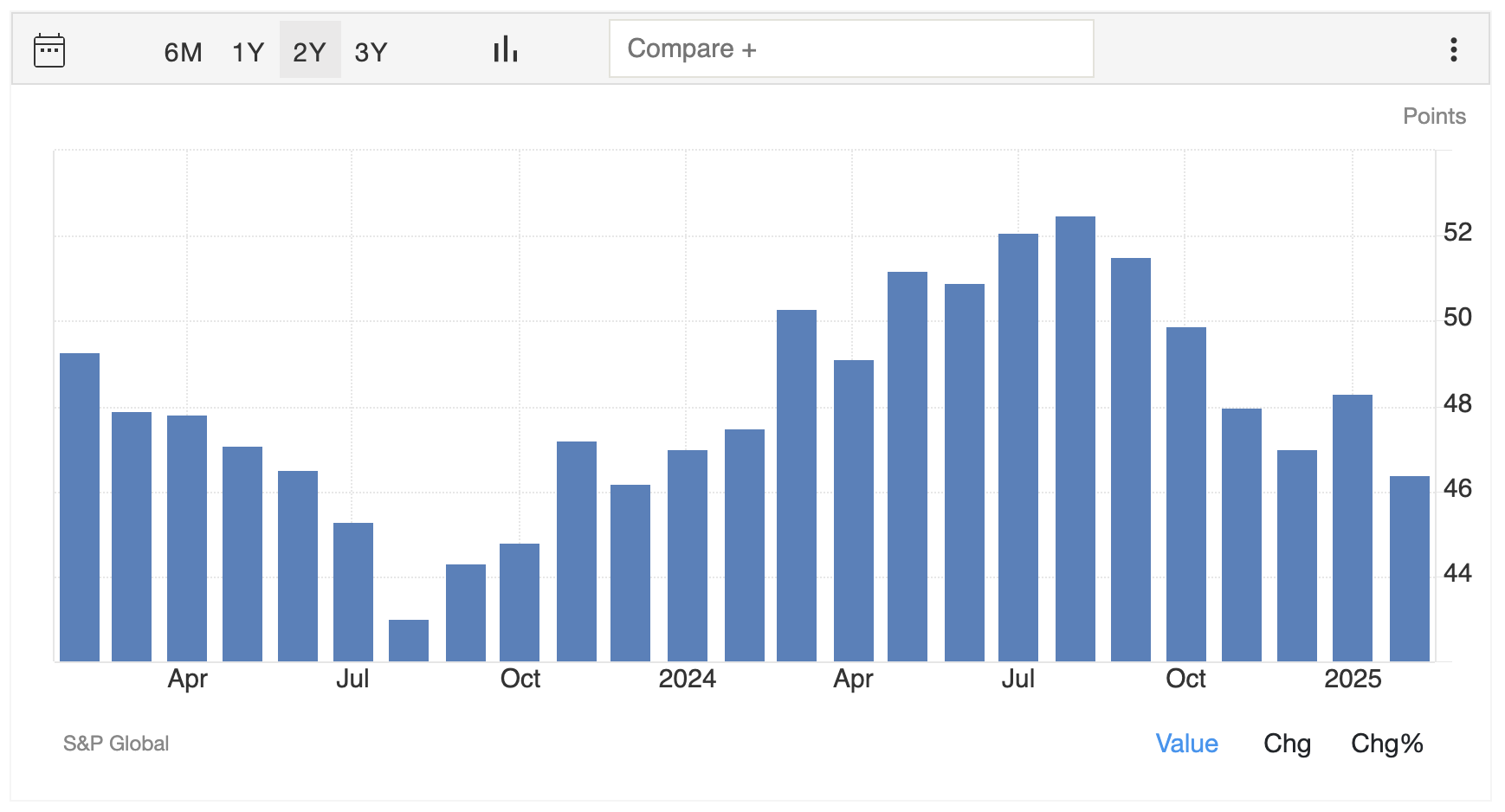

The UK manufacturing sector experienced a significant downturn in February 2025, as indicated by the S&P Global UK Manufacturing PMI.

The index dropped to 46.4, down from January’s 48.3, and fell short of the anticipated 48.4.

This marks the most severe contraction in the sector since December 2023, with the PMI reaching a 14-month low.

Manufacturing output declined for the fourth consecutive month, with the rate of decline accelerating in February.

This persistent contraction was attributed to weakening sales in both domestic and international markets, reflecting broader economic concerns and cautious spending among clients.

Employment in the manufacturing sector saw a notable decrease, accompanied by a significant reduction in unfinished business.

This trend suggests that companies are adjusting their workforce in response to reduced demand and economic uncertainties.

Input cost inflation intensified, driven by rising raw material and energy prices.

This uptick in costs marks the fourth consecutive month of increasing input price inflation, partly due to higher salary payments and suppliers raising prices in anticipation of increased employers’ national insurance contributions announced in the October 2024 UK government budget.

Factory gate prices experienced their steepest rise since April 2023, indicating that manufacturers are passing on some of the increased costs to consumers.

This trend could potentially contribute to broader inflationary pressures in the economy.

Despite the overall negative outlook, business activity expectations for the year ahead showed a slight improvement from January’s 25-month low.

Both manufacturers and service providers reported a modest increase in confidence regarding their business expansion plans and sales pipelines.

The manufacturing sector’s struggles are part of a broader economic picture where the UK private sector growth has slowed slightly.

Source: Trading Economics