UK Economy Beats Forecasts, But Uneven Growth Signals Caution For Investors

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

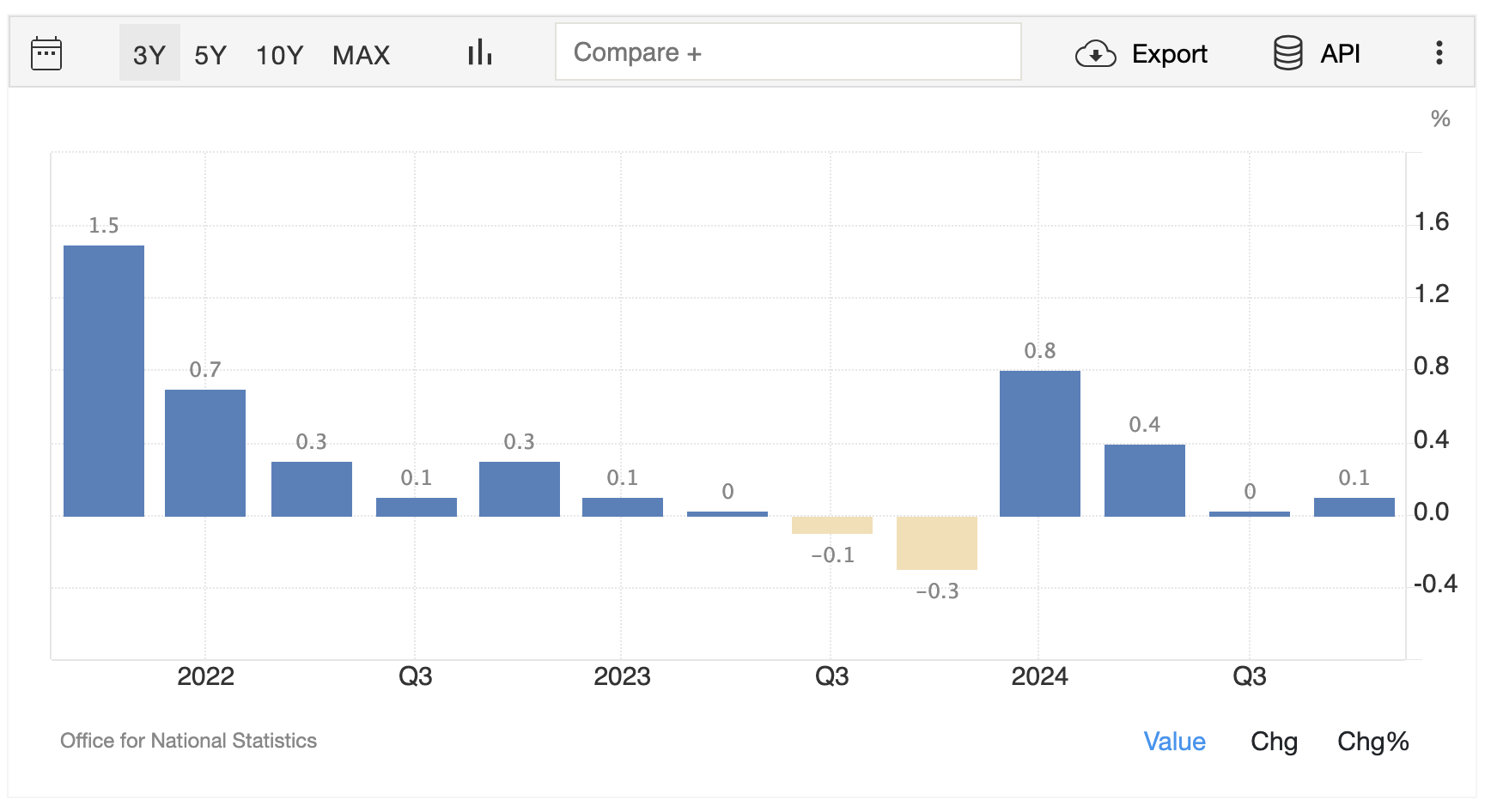

The UK economy demonstrated unexpected resilience in the fourth quarter of 2024, growing by 0.1% compared to the previous quarter, according to preliminary estimates from the Office for National Statistics (ONS).

This modest expansion surpassed economists’ expectations of a 0.1% contraction and followed a period of stagnation in Q3 2024.

The growth was primarily driven by the services sector, which increased by 0.2%, and the construction industry, which saw a 0.5% rise.

However, these gains were partially offset by a continued decline in the production sector, which contracted by 0.8% – marking its fifth consecutive quarter of negative growth.

The manufacturing subsector, in particular, experienced a 0.7% decline, with notable decreases in transport equipment (-2.3%) and pharmaceuticals (-4%).

The mining and quarrying industry also saw a significant 2.5% reduction in output.

On the expenditure side, the economy faced headwinds from declining exports, which fell by 2.5%, primarily due to reduced demand for fuels, machinery, and transport equipment.

Conversely, imports rose by 2.1%, largely influenced by movements in non-monetary gold.

Gross fixed capital formation declined by 0.9%, with a substantial 22.9% drop in transport investment.

These negative factors were counterbalanced by a significant increase in inventory levels and a 0.8% rise in government spending, particularly in public administration, defence, and healthcare sectors. Household expenditure remained flat during this period.

For investors, these figures present a mixed picture.

The unexpected growth may boost confidence in the UK’s economic resilience, potentially supporting the value of the pound and domestic-focused equities.

However, the continued weakness in manufacturing and exports could raise concerns about the country’s international competitiveness and trade balance.

The stagnant household expenditure suggests that consumer-focused sectors may face challenges in the near term, which could impact retail and hospitality stocks.

Conversely, the increase in government spending and construction activity might create opportunities in related industries and infrastructure projects.

Investors should also consider the implications for monetary policy.

The modest growth, combined with recent declines in inflation, may encourage the Bank of England to maintain its current stance on interest rates or even consider further cuts.

This could benefit interest-rate sensitive sectors such as real estate and utilities.

The increase in inventories, while contributing to GDP growth, may signal caution among businesses about future demand.

Investors might want to monitor inventory levels in various sectors for potential oversupply risks or opportunities for companies with strong inventory management.

While the UK economy has shown signs of resilience, the uneven nature of the growth across sectors suggests that a selective approach to investing may be prudent in the current economic climate.

Source: Trading Economics