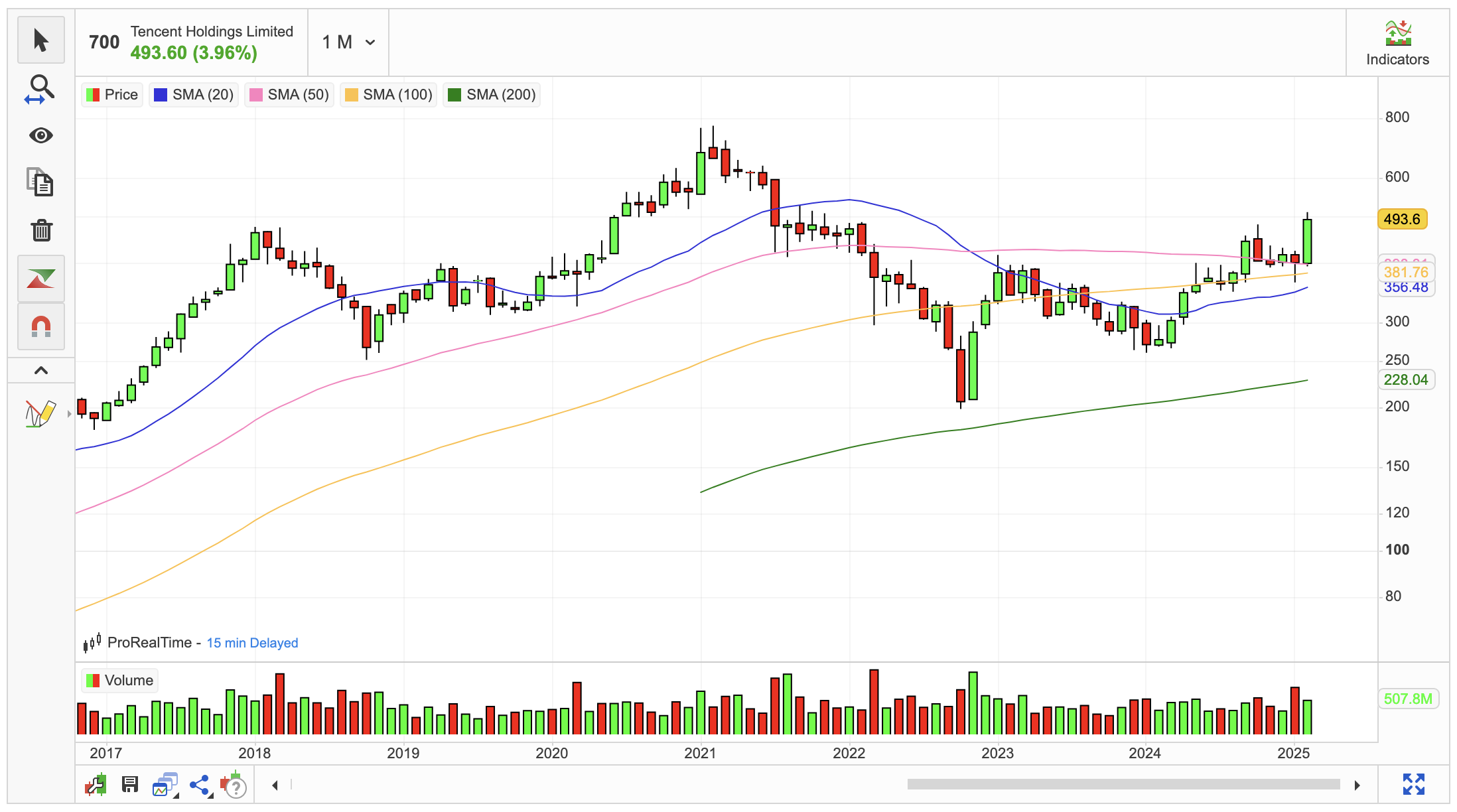

Tencent Hits 3-Year High: Is AI The Next Catalyst?

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

Tencent Holdings (HKG: 0700) experienced a significant stock price surge, reaching levels not seen since 2021, following the integration of DeepSeek’s AI technology into WeChat’s search functionality.

This strategic move has positioned Tencent at the forefront of China’s rapidly evolving AI landscape, as the country increasingly embraces DeepSeek’s innovative solutions.

The integration of DeepSeek’s AI model into WeChat, China’s dominant super-app, marks a pivotal moment for Tencent.

Users in the trial phase can now access an ‘AI Search’ button within the chat interface, offering a more intelligent and diverse search experience.

Importantly, Tencent has clarified that this AI-powered search only utilises data from public WeChat official accounts and other online content, addressing potential privacy concerns by explicitly stating that private user data, such as chat histories or Moments posts, are not accessed.

This development comes amid a broader trend of Chinese tech giants adopting DeepSeek’s technology since its launch in January 2025.

The AI model, which is seen as highly competitive with OpenAI’s offerings and is available under an MIT open-source license, has gained significant traction among industry leaders in China.

Tencent’s stock performance has been bolstered not only by this AI integration but also by a series of successful game releases over the past year.

The company’s gaming division, a cornerstone of its business model, has seen a 9% growth in revenue, driven by strong international sales and the launch of popular titles like ‘Dungeon and Fire’ in China.

This combination of AI advancement and gaming success has contributed to an impressive 70% stock surge for Tencent over the past 12 months.

The market’s positive reaction to Tencent’s AI integration reflects growing investor confidence in Chinese technology stocks, particularly in the AI sector.

Analysts at Goldman Sachs suggest that the widespread adoption of AI could enhance Chinese earnings per share by 2.5% annually over the next decade.

However, they also caution that significant policy interventions are necessary to address persistent macroeconomic issues and ensure sustained equity market improvements.

As Tencent continues to leverage DeepSeek’s AI capabilities, it faces both opportunities and challenges.

The integration could potentially open new revenue streams and enhance user engagement across Tencent’s ecosystem.

However, the company must navigate complex regulatory landscapes, data privacy concerns, and intense competition in the rapidly evolving AI space.

Sources: eToro, MarketScreener