Tech stocks lead market charge after Fed stands pat

- This topic has 2 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

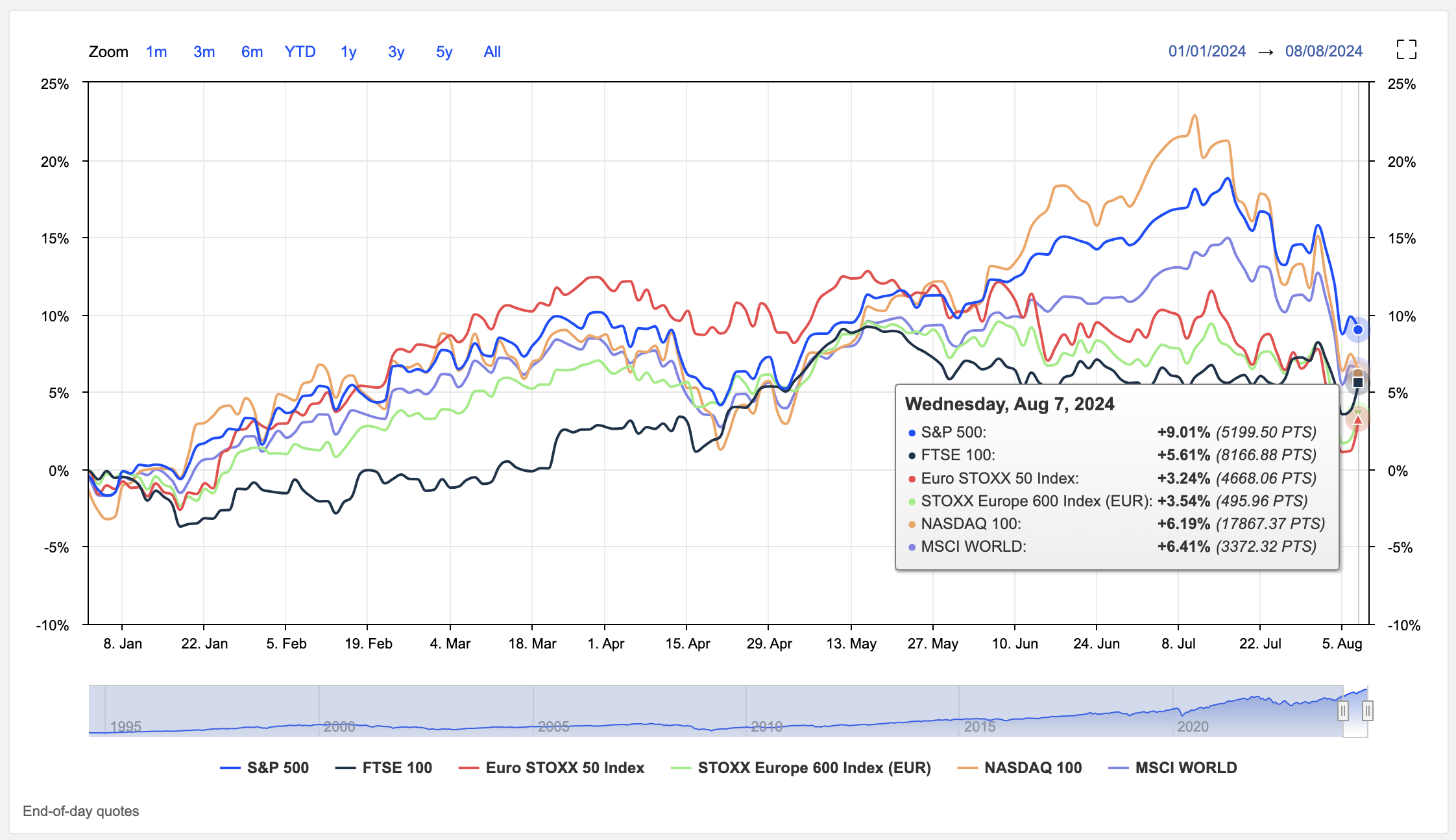

Stock markets are poised for a strong opening, with futures pointing higher as investors react to the Fed’s decision to hold rates. Financial news is buzzing, with the tech sector leading the rebound, fuelled by hopes of a potential rate cut in September.

While tensions in the Middle East drive demand for safe-haven US Treasuries, pushing long-term bond prices up, the overall market sentiment remains optimistic.

Recent economic data suggests a cooling labour market and weakening manufacturing, which has some anticipation of three rate cuts from the Fed before year-end.

Despite historical trends showing August and September as the worst-performing months, the stock market may defy these expectations.

Major US stock indexes hit all-time highs in July, with technology stocks leading the gains.

The market sentiment is being significantly shaped by the stellar earnings reports from tech behemoths like Apple, Amazon, Meta, and Microsoft. These reports are not only bolstering investor confidence but also setting a positive tone for the market.

The confluence of positive signals and financial news points towards a promising outlook for the stock market.

While geopolitical uncertainties remain a factor to watch, investors can still be cautiously optimistic about the potential for further gains in the stock market in the coming months.