Tech Rout Drags Nasdaq-100 Lower

- This topic has 0 replies, 1 voice, and was last updated 5 months ago by .

-

Topic

-

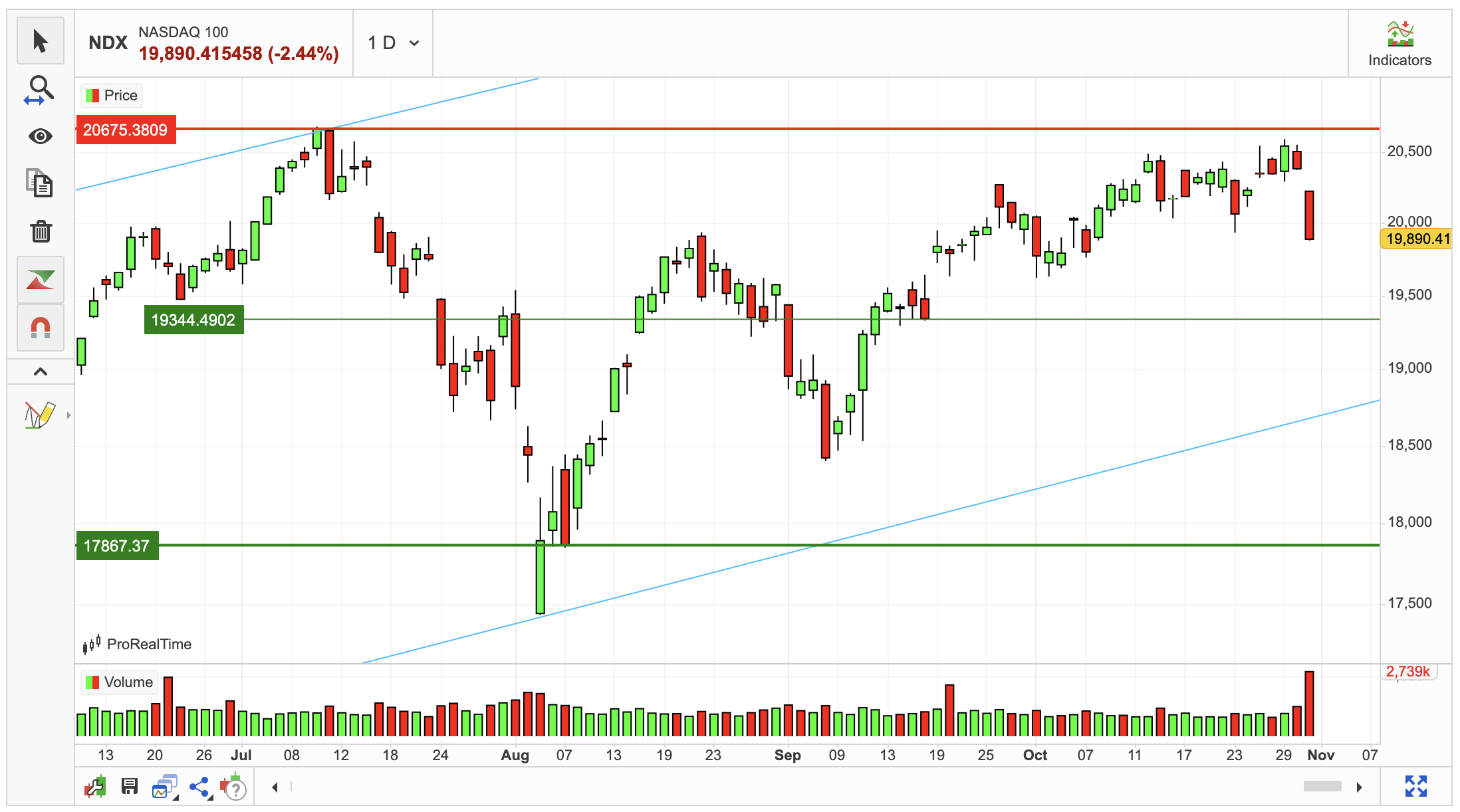

As of Thursday, October 31st, 2024, the Nasdaq-100 declined by 2.44%, closing at 18,095.15 points.

This marks a decrease from the previous day’s closing level of 18,607.93 points.

Throughout the trading session, the index exhibited a 1.90% price fluctuation, with a low of 18,083.95 points and a high of 18,427.31 points.

Over the past 10 trading days, the Nasdaq-100 has closed higher on seven occasions, resulting in a net decrease of 1.52%.

Despite the recent price decline, trading volume fell by 290 million shares, which is a positive sign as volume typically follows price trends.

In total, 6 billion shares were traded, amounting to an approximate trading volume of $102.97 trillion.

In the short term, the Nasdaq-100 appears to be consolidating within a strong upward trend channel.

A breach of the lower trendline support could signal a potential slowdown in the uptrend, but the overall trend remains bullish.

Key levels are 20,675.40 resistance and 19,344.50 support.

Data: FactSet, Morningstar, S&P Capital IQ, ProRealTime, MarketScreener, StockInvest