Tech Earnings Boost US Markets As Q4 GDP Growth Slows

- This topic has 3 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

US stock markets concluded Thursday’s session on a positive note, overcoming volatility amid a flurry of earnings reports and significant economic data releases.

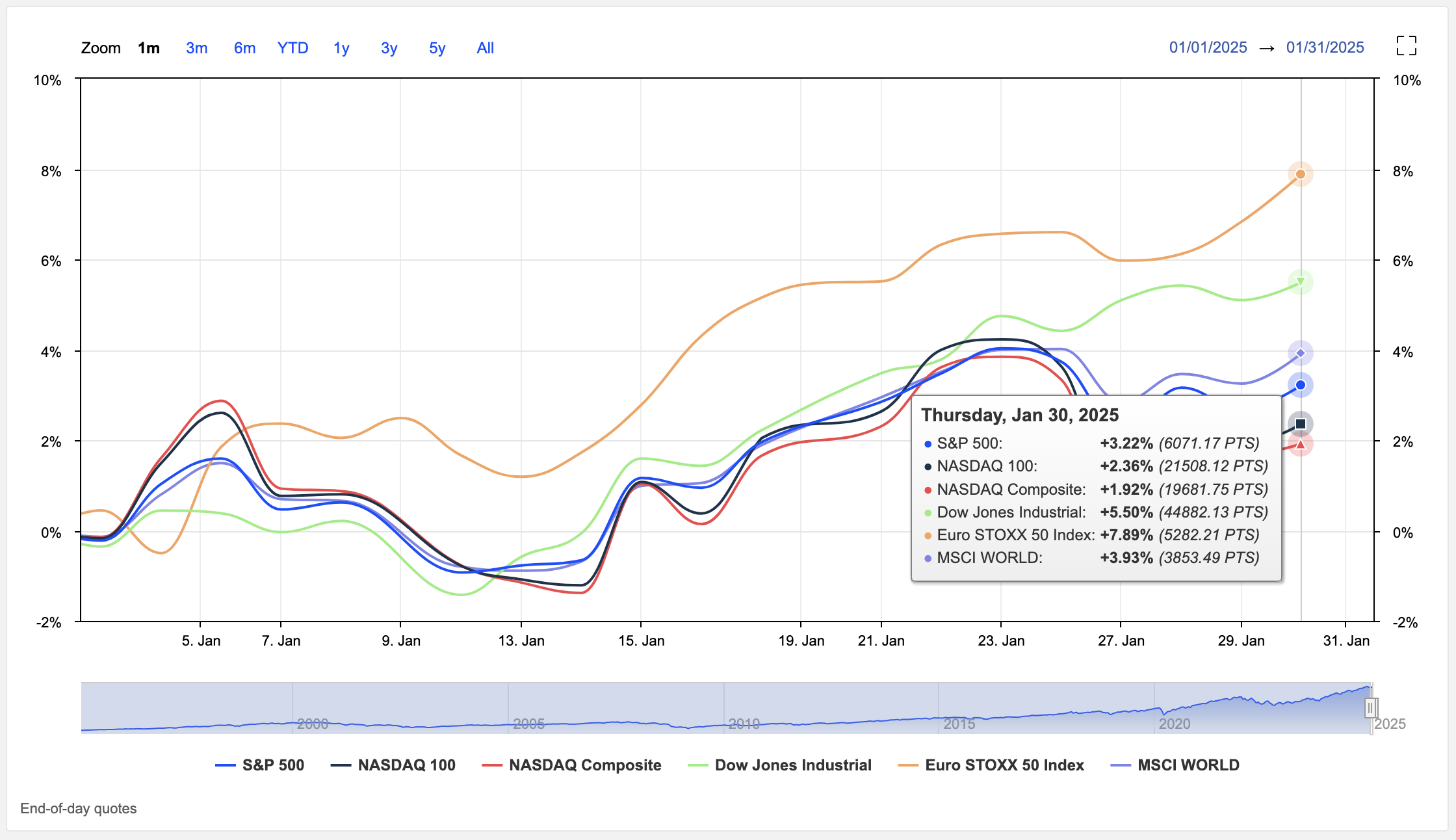

The Nasdaq Composite and Dow Jones Industrial Average both climbed 0.3% and 0.4% respectively, while the S&P 500 advanced 0.5%.

Tech giants’ earnings played a pivotal role in market movements.

Meta Platforms saw its shares rise 2.3% in after-hours trading, buoyed by strong financial results and ambitious AI plans.

Tesla’s stock surged 4% post-earnings, despite initially falling on missed expectations, as investors focused on the company’s future growth prospects.

Apple stock initially dropped after its earnings report but quickly rebounded, rising 3% in after-hours trading. While iPhone sales declined, the company still surpassed revenue expectations.

IBM stood out with a remarkable 12% gain, driven by significant growth in its AI business.

Conversely, Microsoft’s shares declined 4.6% due to slower-than-anticipated growth in its cloud services segment.

The market also digested key economic data, with US GDP growth for Q4 2024 coming in at an annualised 2.3%, below the expected 2.6%.

This slower growth, coupled with inflation data, influenced investor speculation about the Federal Reserve’s future rate decisions.

The tech sector’s performance continues to be a focal point, with ongoing discussions about AI investments and their impact on company valuations.

Despite some volatility earlier in the week, all three major averages were on track for monthly gains as of Thursday’s close, with the S&P 500 up 3.2% and the Nasdaq set for a 1.9% rise in January.

Chart: MarketScreener