Tariff Concerns Weigh On US Markets

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

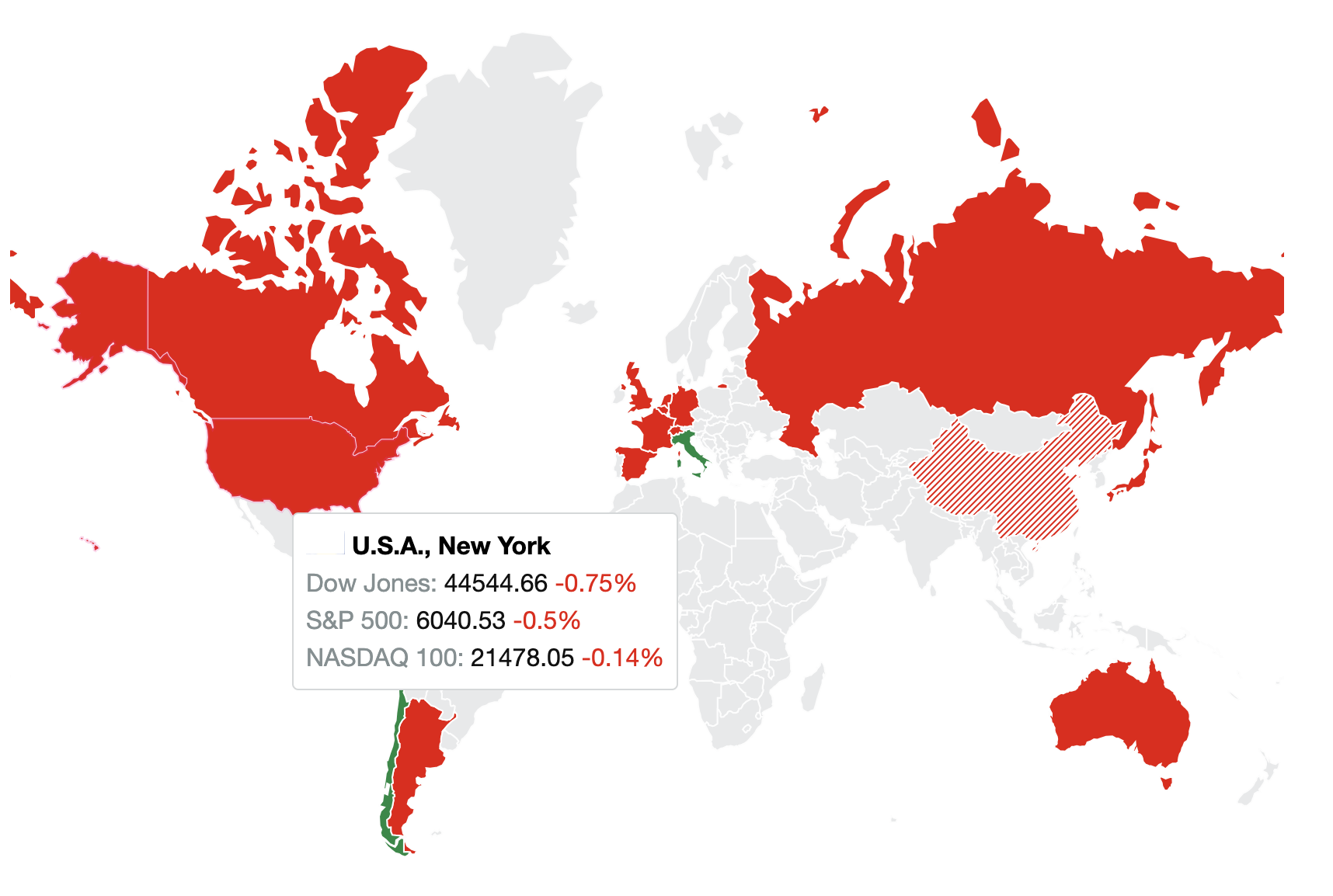

US stock markets experienced a turbulent end to the week on Friday, as initial gains were wiped out following a White House denial of reports suggesting that President Trump would delay the implementation of new tariffs.

Instead, the administration confirmed its plans to move forward with tariffs on Mexico, Canada, and China over the weekend, reigniting investor fears of escalating trade tensions and triggering a late-session selloff.

The S&P 500 closed down 0.5%, while the Dow Jones Industrial Average shed 310 points, and the Nasdaq-100 slipped slightly into negative territory.

The tech sector was hit particularly hard, with Nvidia falling 3.7% amid ongoing concerns that competition from a rising Chinese AI startup could disrupt current tech valuations.

Apple also declined by 0.7%, despite reporting a 4% increase in revenue and issuing optimistic guidance for the upcoming quarters, indicating that broader market anxiety outweighed individual company performance.

In the energy sector, Exxon Mobil and Chevron faced notable losses of 2.5% and 4.6%, respectively, after releasing quarterly earnings that failed to impress investors.

The declines reflected not only company-specific results but also broader worries about global economic growth and demand for energy amid trade uncertainties.

On a more positive note, AbbVie saw its shares rise by 4.7% after the pharmaceutical giant’s projected 2025 earnings surpassed Wall Street’s average expectations.

Strong performance from two of its key medications contributed to the bullish outlook, providing a bright spot in an otherwise downbeat market session.

Meanwhile, economic data had a muted effect on markets.

The US Core PCE inflation gauge, the Federal Reserve’s preferred measure of inflation, came in line with expectations, offering no surprises.

Despite the market’s volatility, traders continued to price in two interest rate cuts by the Federal Reserve this year, reflecting persistent concerns over slowing economic growth and the potential impact of prolonged trade conflicts.

As investors navigate this unpredictable environment, the interplay between geopolitical developments, corporate earnings, and monetary policy expectations continues to shape market sentiment, suggesting further volatility in the weeks ahead.

Sources: Trading Economics, Business Insider