STOXX 600 And 50 Reach New Peaks, Defence Spending Increases

- This topic has 2 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

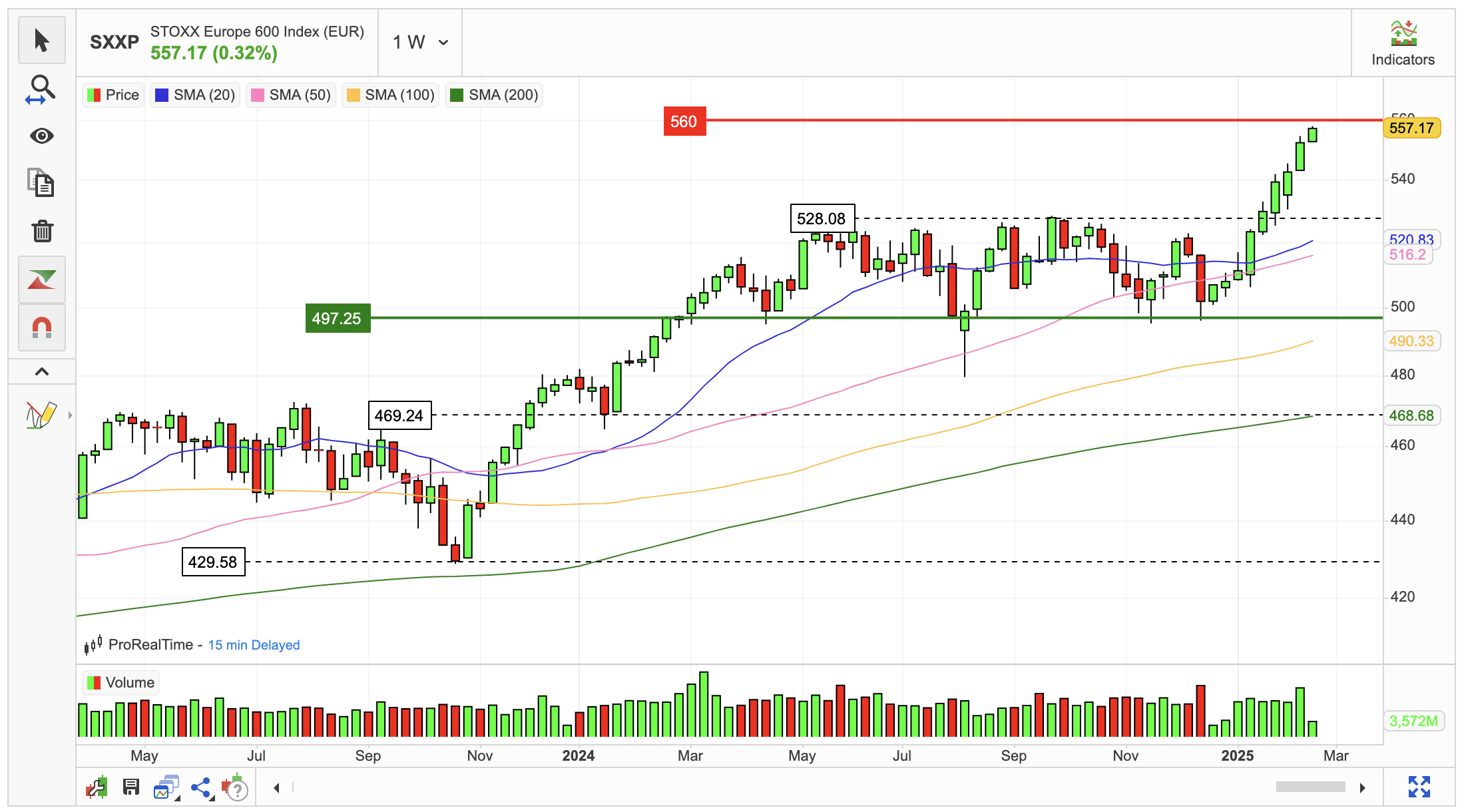

European stock markets continued their upward trajectory on Tuesday, February 18, 2025, with both the STOXX 50 and the STOXX 600 indices closing 0.4% higher, setting new all-time records.

This rally was primarily driven by the ongoing surge in defence stocks, as investors anticipate increased military spending by European governments in response to geopolitical tensions and the ongoing conflict in Ukraine.

The defence sector’s strong performance was exemplified by significant gains in companies such as Thales (EPA: HO), which rose 2.6%, Leonardo (BIT: LDO), up 1.8%, and Hensoldt (ETR: HAG), advancing 1.2%.

These gains reflect the market’s expectation of a potential “supercycle” in the European defence industry, with Bloomberg estimating that upgrading European defence capabilities and supporting Ukraine could cost major European powers an additional $3.1 trillion over the next decade.

However, the market’s optimism was tempered by the outcome of an informal summit in Paris among European leaders, which concluded without concrete measures regarding support for Ukraine.

The proposal to deploy peacekeeping troops to Ukraine remains a contentious issue, highlighting the complex geopolitical landscape facing European policymakers.

Adding to the geopolitical intrigue, US and Russian officials met in Saudi Arabia to discuss potential resolutions to the Ukraine conflict, notably excluding both Ukrainian and European representatives from these talks.

This development has raised concerns about Europe’s role in shaping the future of regional security and its relationship with traditional allies.

The current market dynamics reflect a complex interplay of geopolitical tensions, defence spending expectations, and corporate performance.

As European indices reach new heights, investors remain cautiously optimistic, balancing the potential for increased defence budgets against the uncertainties surrounding international negotiations and economic growth prospects.

Source: Trading Economics