Stocks Fall With Tariff Fears, Inflation Worries Overshadow Jobs Data

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

US stock markets experienced a significant downturn on Friday, February 7, 2025, as investors grappled with multiple economic concerns.

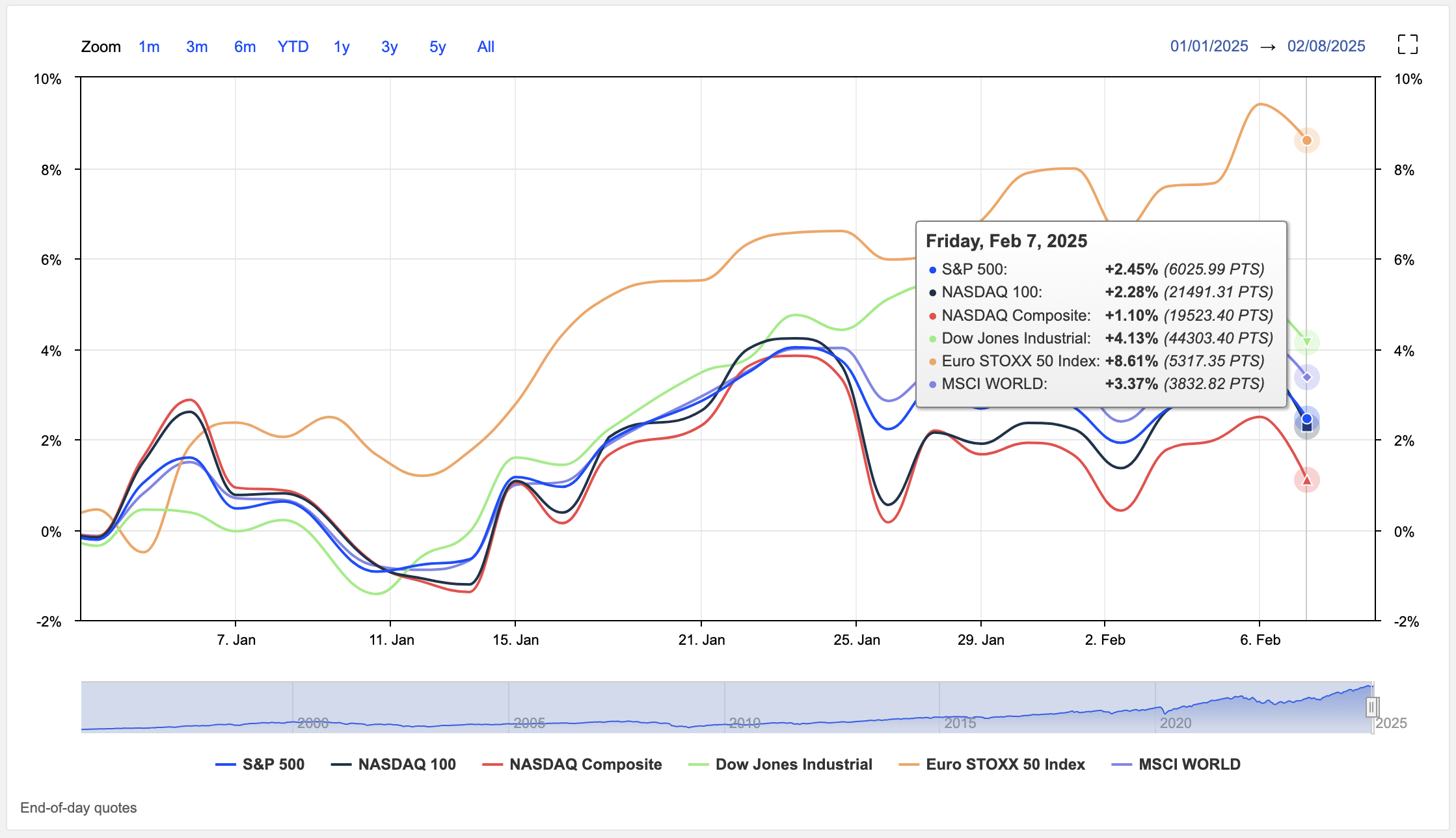

The S&P 500 fell 0.9%, closing at 6,025.99, while the Nasdaq composite suffered a more substantial loss of 1.4%, ending at 19,523.40. The Dow Jones Industrial Average also declined by 1%, or 444 points, settling at 44,303.40.

This market retreat was primarily driven by three key factors: potential new tariffs, rising inflation expectations, and mixed job market data.

President Donald Trump’s announcement of an upcoming tariff-related statement early next week reignited fears of escalating trade tensions.

These concerns were compounded by reports suggesting the administration was considering reciprocal tariffs, which could potentially lead to higher rates on US trading partners.

Adding to investor anxiety, the University of Michigan’s consumer sentiment report revealed a significant uptick in inflation expectations.

Although the exact figure wasn’t provided in the search results, this increase has raised concerns about potential inflationary pressures in the economy.

The January jobs report presented a mixed picture of the US labour market.

The economy added 143,000 jobs, which was lower than anticipated but still indicative of continued growth.

The unemployment rate showed a slight improvement, decreasing to 4%.

This data suggests that while the job market remains resilient, it may be showing signs of cooling.

In the corporate sphere, Amazon’s shares experienced a notable decline of 4% in after-hours trading, erasing approximately $100 billion from the company’s market value.

This drop came despite Amazon reporting strong fourth-quarter earnings that exceeded expectations.

The primary cause for concern was the company’s weaker-than-expected guidance for the current quarter, projecting first-quarter sales between $151 billion and $155.5 billion, falling short of the expected $158.5 billion.

Despite Friday’s losses, the major indices still managed to post gains for the week.

The S&P 500 and Nasdaq each added 1.5%, while the Dow gained 0.8%.

These weekly gains reflect the market’s resilience in the face of ongoing economic uncertainties and geopolitical tensions.

As we move forward, investors will likely be closely monitoring developments related to Trump’s tariff policies, inflation trends, and future job reports to gauge the overall health of the US economy and its potential impact on monetary policy decisions.

Sources: Trading Economics, MarketScreener