Stocks Dive Amid Trade Tensions And Disappointing Economic Indicators

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

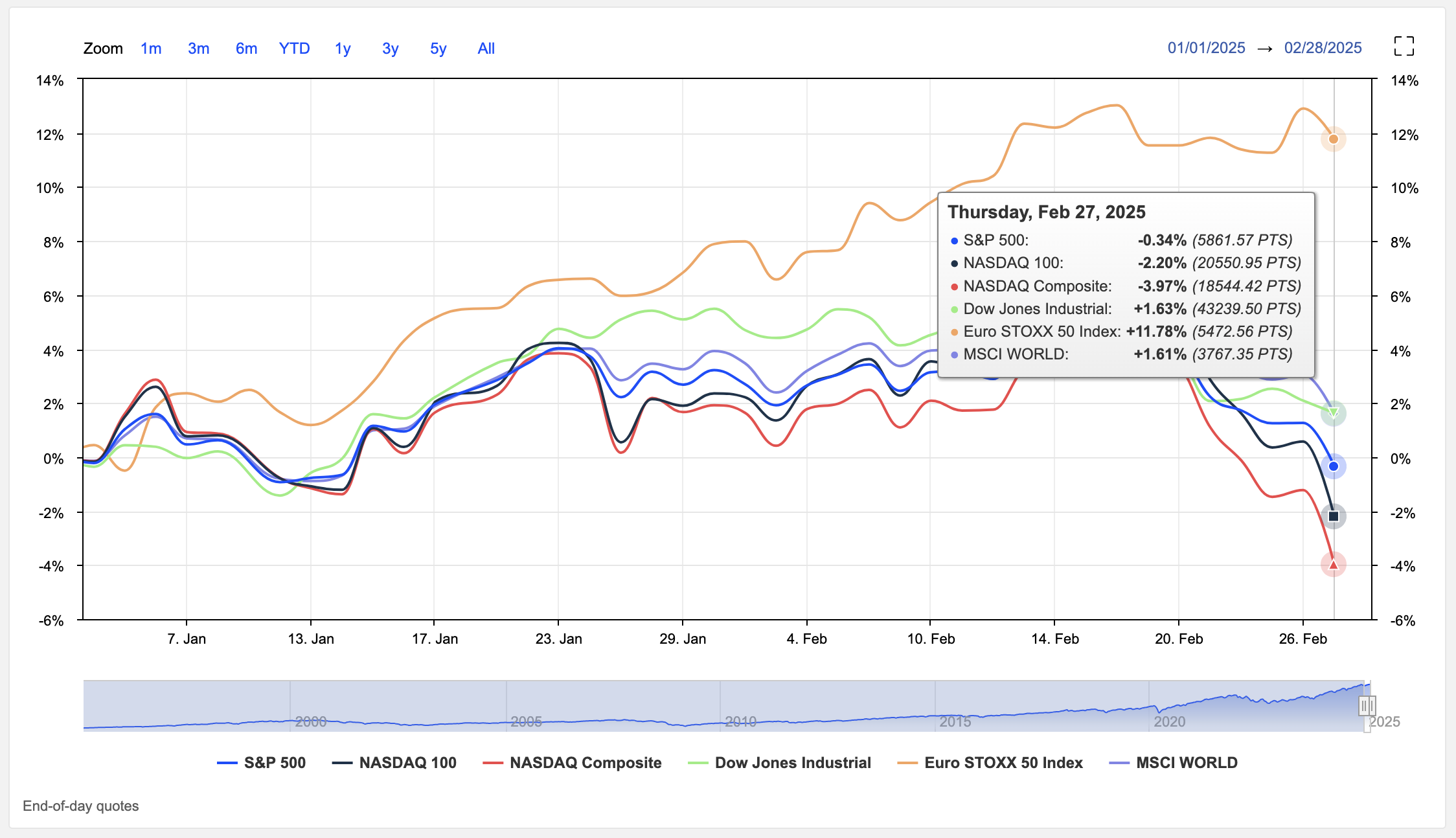

US stock markets experienced a significant downturn on Thursday, February 27, 2025, as multiple factors converged to shake investor confidence.

The Dow Jones Industrial Average plummeted 660 points, closing at 43,239.50, while the S&P 500 shed 135 points to end at 5,861.57.

The tech-heavy Nasdaq Composite bore the brunt of the sell-off, tumbling 707 points to finish at 18,544.42.

This sharp decline was primarily triggered by President Donald Trump’s announcement that the planned 25% tariffs on imports from Canada and Mexico would go into effect on March 4, with additional tariffs slated for China.

The news reignited concerns about global trade tensions and their potential impact on economic growth.

Adding to the market’s woes, weak economic data further dampened sentiment.

Jobless claims for the week ending February 22 rose unexpectedly to 242,000, surpassing economists’ estimates and fuelling worries about the labour market’s health.

This data point, combined with recent disappointing consumer confidence and retail sales figures, has intensified fears of an economic slowdown.

The technology sector, particularly AI-related stocks, faced significant pressure.

Nvidia, despite beating earnings expectations, saw its shares plunge 8.5% as investors scrutinised its gross margins and questioned the sustainability of the AI boom.

This sell-off rippled through other tech giants, with companies like Apple, Microsoft, and Amazon all losing ground.

Market volatility, as measured by the CBOE Volatility Index (VIX), spiked 16.28% to 18.21, reflecting heightened investor anxiety.

This fear indicator’s rise is particularly noteworthy given that major indices are still near their all-time highs, suggesting a disconnect between market performance and underlying sentiment.

As traders brace for Friday’s session, all eyes are on the upcoming personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge.

This report could provide crucial insights into the economic landscape and potentially influence the Fed’s future policy decisions.

With February drawing to a close, all three major indexes are poised to end the month in negative territory.

The S&P 500 has declined nearly 3%, while the Dow and Nasdaq have retreated 2.5% and 5.5% respectively.

These losses underscore the market’s vulnerability to geopolitical tensions and economic uncertainties.

As investors navigate this volatile environment, they will be closely monitoring upcoming earnings reports and economic data for signs of stabilisation or further deterioration.

The market’s reaction to these factors in the coming days will be crucial in determining whether this downturn is a temporary correction or the beginning of a more prolonged bearish trend.

Sources: eToro, MarketScreener