S&P 500 Earnings Surged In Q4 2024

- This topic has 2 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

The fourth quarter of 2024 has marked a significant milestone for S&P 500 companies, with earnings growth reaching levels unseen since the post-pandemic recovery of Q4 2021.

The blended earnings growth rate has soared to an impressive 16.4% year-over-year, substantially outpacing initial projections.

This robust performance is highlighted by 77% of reporting companies surpassing earnings per share (EPS) expectations and 63% beating revenue forecasts, despite a challenging economic backdrop marked by Federal Reserve policy concerns and ongoing trade tensions.

Sector-specific performance has varied, with Communication Services leading the charge at a staggering 32.2% earnings growth, largely driven by tech giants like Meta Platforms.

The Financials and Consumer Discretionary sectors have also shown impressive growth at 29.9% and 24.8%, respectively.

However, market reactions have been somewhat muted, with many companies experiencing stock underperformance on earnings announcement days, underscoring the complex relationship between earnings reports and stock price movements.

For investors contemplating whether to buy stocks ahead of earnings announcements, the current season presents a mixed landscape of opportunities and risks.

While the overall trend of earnings beats is encouraging, individual stock performance remains highly unpredictable.

Market expectations, forward guidance, and broader economic factors all play crucial roles in determining stock price movements, often overshadowing positive earnings results.

Given these considerations, a more conservative approach for risk-averse investors might be to wait for earnings results before making investment decisions.

This strategy allows for a more informed assessment based on actual performance and future guidance.

For those willing to take on more risk, using options strategies to hedge potential downside could be a viable alternative, though it requires a deep understanding of complex financial instruments.

Regardless of the chosen strategy, the golden rule of cutting losses quickly remains paramount, especially in the volatile environment often created by earnings season.

As we look ahead to 2025, analysts project a broadening of earnings growth beyond the “Magnificent 7” tech giants, potentially creating new opportunities across a wider range of sectors.

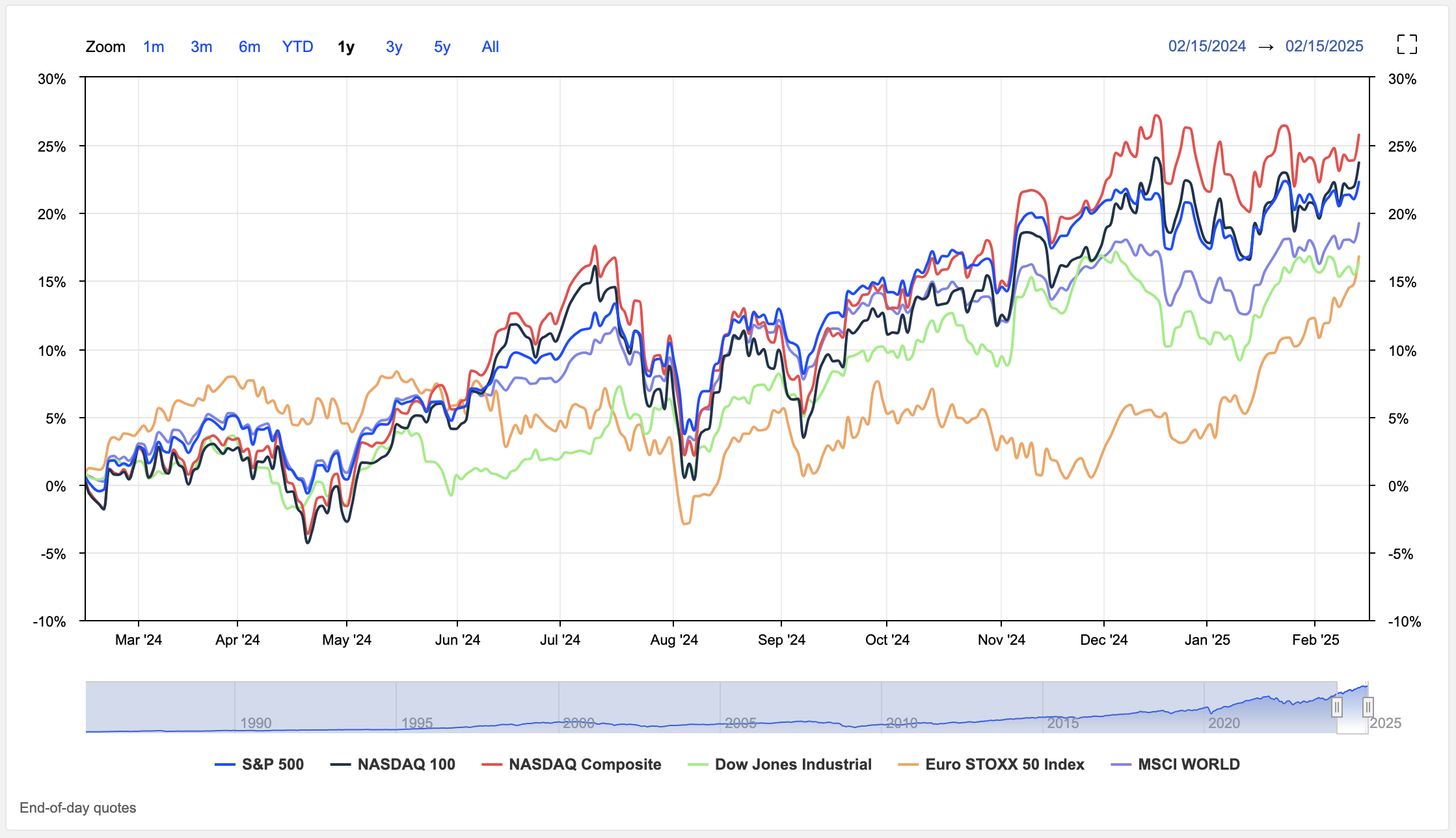

Chart: MarketScreener