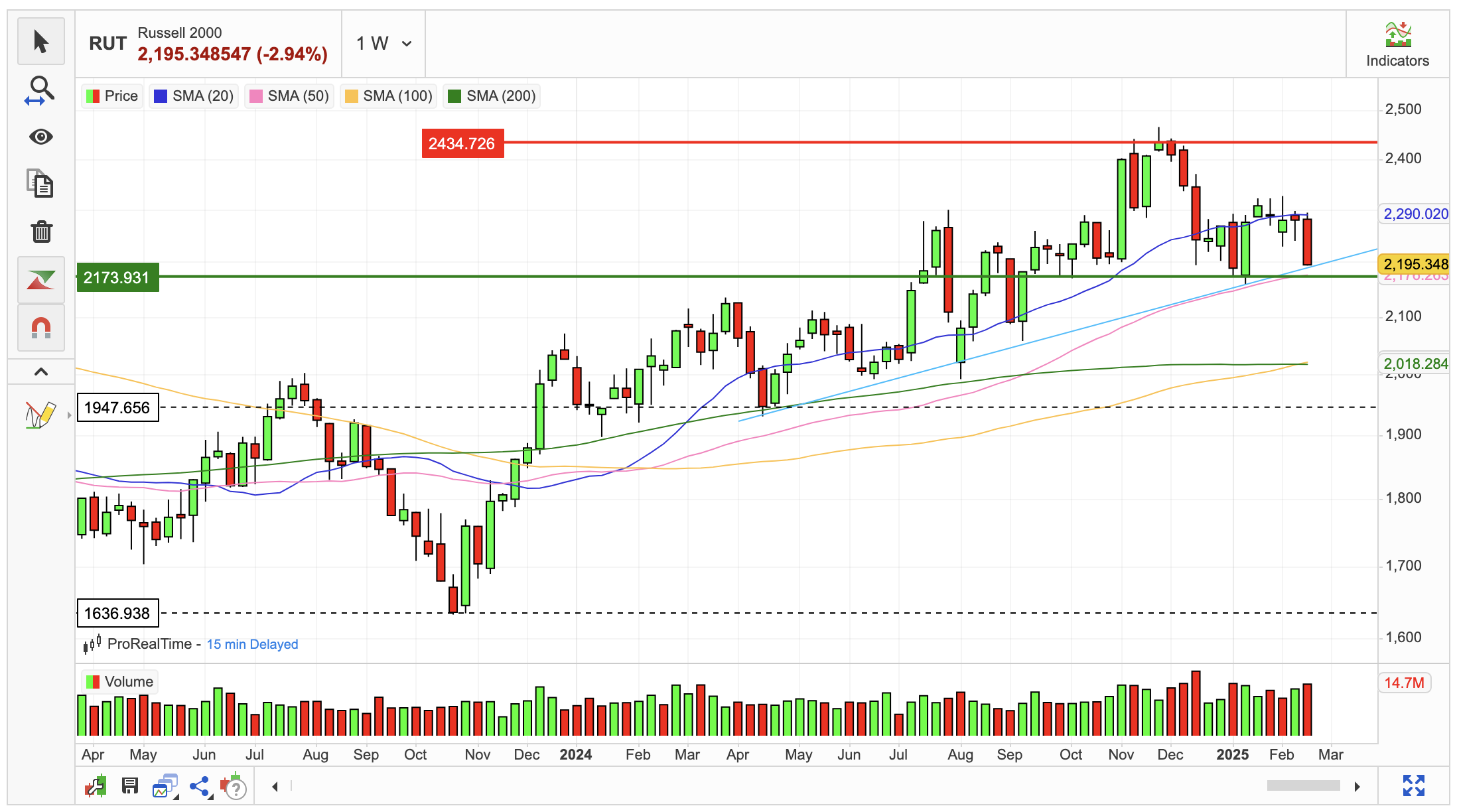

Small-Cap Stocks Slide: Russell 2000 Hits 5-Week Low

- This topic has 1 reply, 1 voice, and was last updated 1 month ago by .

-

Topic

-

The Russell 2000 index, which tracks small-cap US stocks, has recently experienced a significant downturn, reaching a five-week low of 2,229 points.

This decline marks a notable shift in the index’s performance, reflecting broader market uncertainties and potential economic headwinds.

Over the past month, the US2000 has shed 3.22% of its value, indicating a short-term bearish trend for small-cap stocks.

This recent pullback contrasts with the index’s longer-term performance, as it still maintains a 10.71% gain over the past year.

The divergence between short-term weakness and long-term strength highlights the complex dynamics at play in the small-cap segment of the US equity market.

Several factors may be contributing to this recent downturn.

Market analysts point to concerns over potential tariffs proposed by the Trump administration, which could disproportionately affect smaller companies that rely heavily on domestic revenues.

Additionally, the strengthening US dollar and signs of economic slowdown in certain sectors may be weighing on investor sentiment towards small-cap stocks.

Despite the recent dip, some analysts remain optimistic about the Russell 2000’s prospects for 2025.

Historical trends suggest that small-cap stocks often outperform in the year following a presidential election, with the Russell 2000 showing an 83% success rate in this regard over the past six election cycles.

If this pattern holds, the index could potentially rise to around 2,668 by November 2025, representing a significant upside from current levels.

Investors considering exposure to small-cap stocks might look to ETFs tracking the Russell 2000, such as the Vanguard Russell 2000 ETF (VTWO), as a way to capitalise on potential future gains while diversifying their portfolios.

However, it’s crucial to remember that small-cap stocks can be more volatile than their large-cap counterparts, and past performance does not guarantee future results.

Sources: Trading Economics, MarketScreener