Signs of resilience amidst Powell’s Jackson Hole address

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

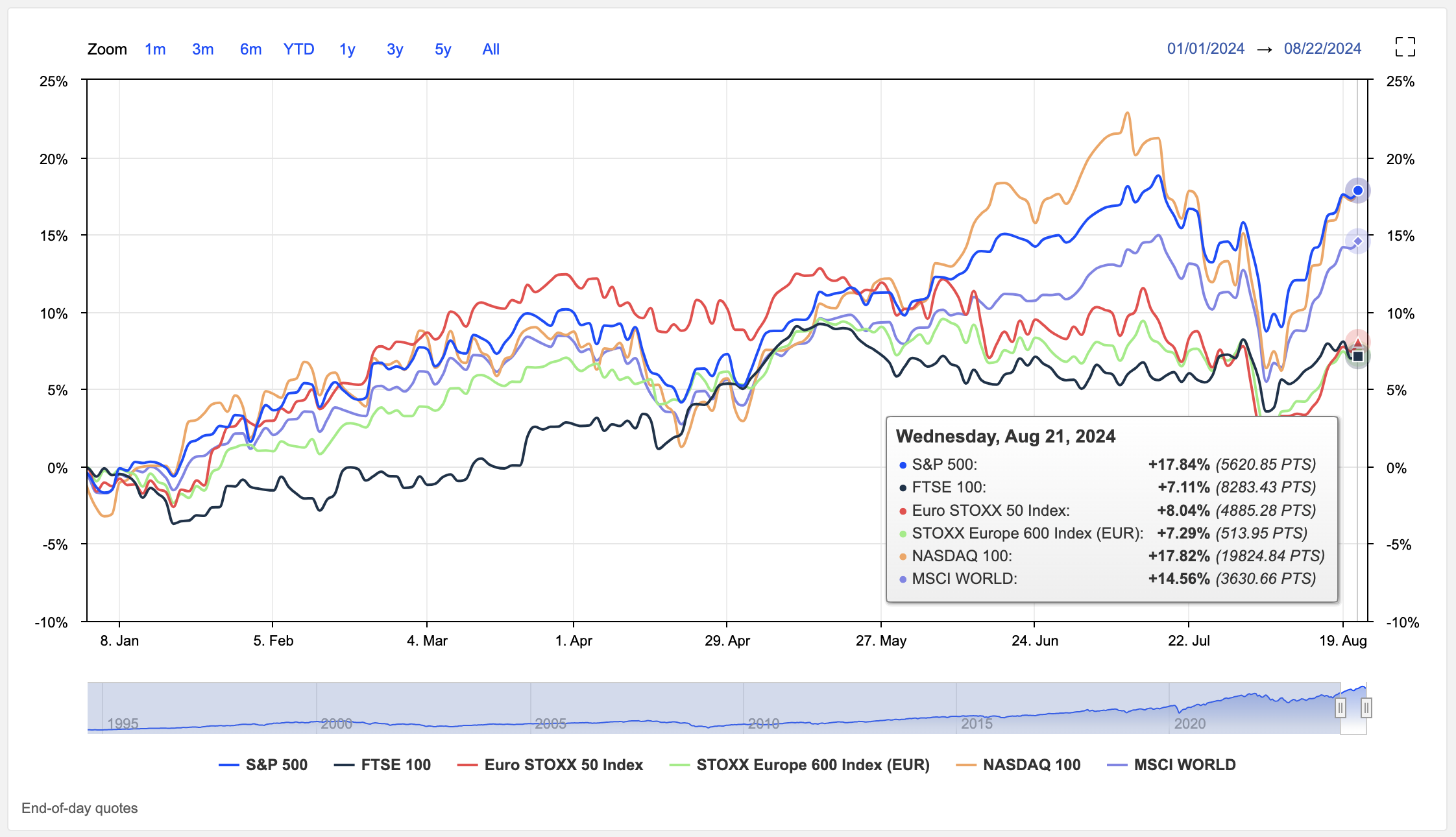

Despite a recent market pullback, US stocks are demonstrating signs of recovery, buoyed by expectations of potential rate cuts from the Federal Reserve.

However, investor sentiment remains cautious ahead of Jerome Powell’s highly anticipated speech at the Jackson Hole Symposium.

Index futures are currently trading mixed, but tech stocks are projected to maintain their upward trajectory. The broader market outlook remains bullish, with the possibility of monetary easing contributing to the positive sentiment.

Following an early August correction, the S&P 500 has experienced eight consecutive trading days in the green, nearing all-time highs.

Investors are actively monitoring Federal Reserve speeches and corporate earnings reports as the market approaches these record levels. These factors could significantly influence trading dynamics in the coming days, keeping investors engaged.

While the market’s overall trajectory is positive, a potential pullback cannot be ruled out. This cautious optimism keeps investors alert as they await key developments and announcements from policymakers.