Quantum Stocks Slide Again After Zuckerberg Comment

- This topic has 4 replies, 1 voice, and was last updated 3 months ago by .

-

Topic

-

Quantum computing stocks took a hit after Meta CEO Mark Zuckerberg commented on the technology’s limitations, stating it remains far from practical application.

This sentiment echoes recent remarks by Nvidia CEO Jensen Huang, who estimated that commercially viable quantum computers are likely 15 to 30 years away.

Such caution from industry leaders has tempered enthusiasm around the sector, leading to a sell-off in quantum computing stocks.

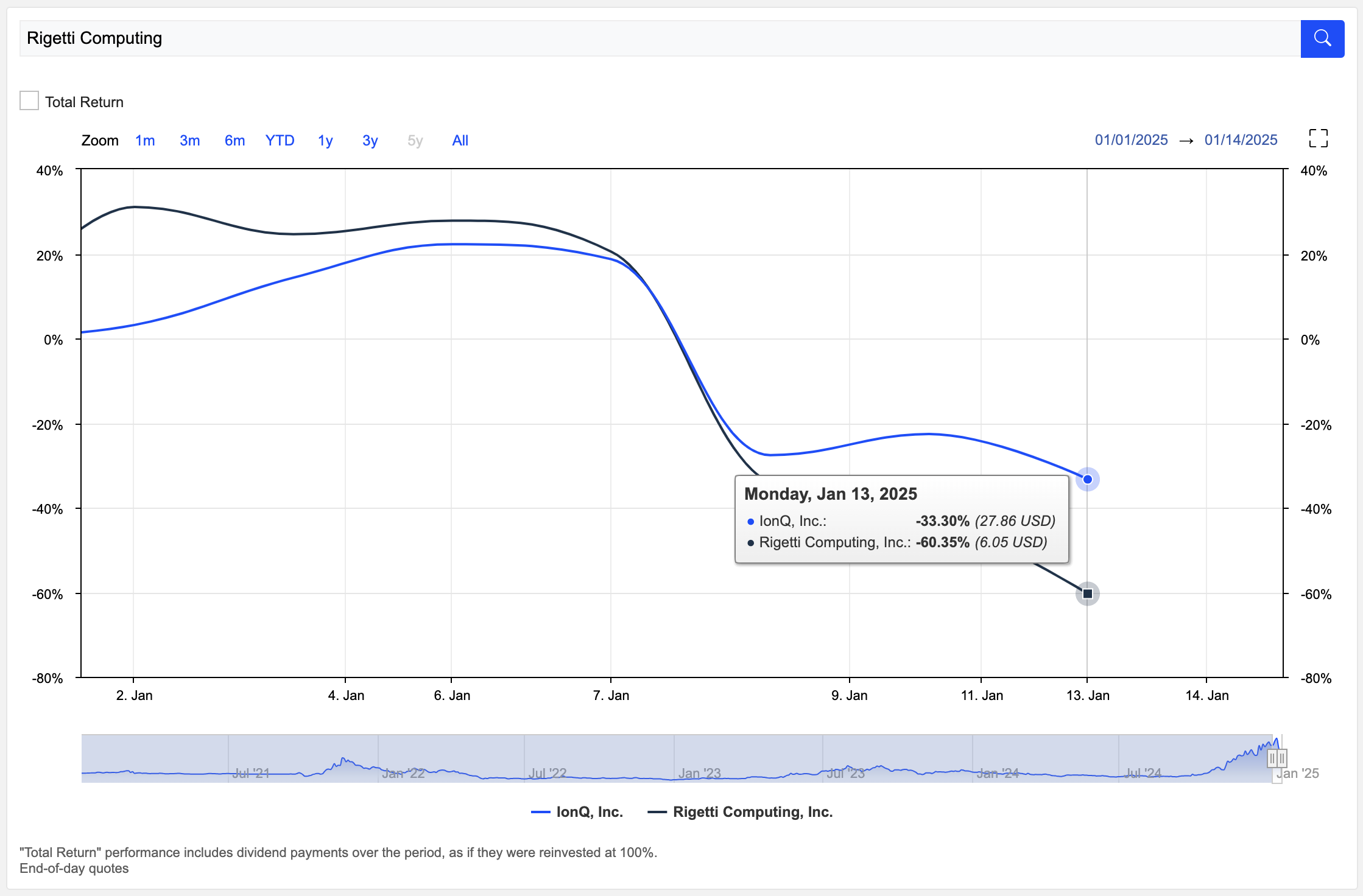

Companies like IonQ and Rigetti Computing, which are at the forefront of quantum development, saw significant declines.

Adding to the pressure, short interest in these stocks is alarmingly high, averaging 18%, compared to the typical 5% for many equities.

This indicates that many investors are betting against these companies, reflecting skepticism about their near-term prospects.

Despite substantial gains earlier in the year, quantum computing stocks remain highly volatile, attracting both speculative traders and long-term investors.

While breakthroughs in quantum technology hold transformative potential for industries like pharmaceuticals, logistics, and artificial intelligence, the timeline for meaningful commercialisation appears distant.

For now, these stocks present a high-risk, high-reward opportunity, with investors needing to navigate the sector’s inherent uncertainties carefully.

As the market reassesses the trajectory of quantum computing, traders should keep an eye on advancements in the field, partnerships with larger tech players, and any breakthroughs that could accelerate the path to practical use.

Until then, the road for quantum stocks is likely to remain bumpy.

Chart: MarketScreener