Pound Hits 3-Week Low: Buy, Hold, Or Sell?

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

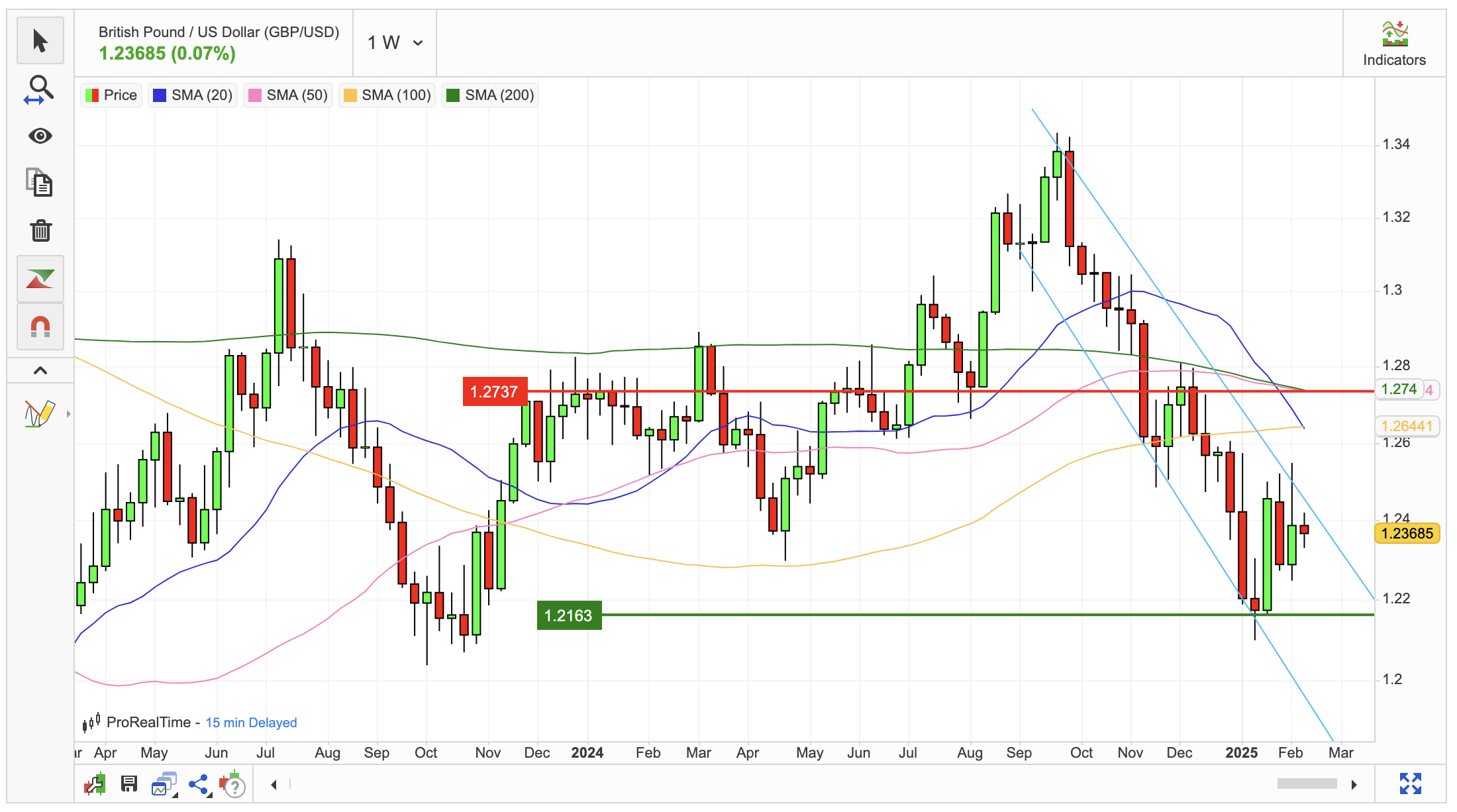

The British pound (GBP) has experienced a significant decline, reaching $1.236, its lowest point in almost three weeks.

This downturn comes in the wake of Bank of England (BoE) policymaker Catherine Mann’s recent comments highlighting the UK’s weakening economic demand as a more pressing concern than inflationary risks.

Mann’s shift from a hawkish to a dovish stance at the latest BoE meeting has contributed to this currency movement.

Mann emphasised that the UK’s demand conditions have deteriorated considerably, leading to reduced consumer spending and limiting companies’ ability to increase prices.

This economic environment is expected to naturally curb inflationary pressures.

Despite this, the BoE projects inflation to rise from its December 2024 level of 2.5% to 3.7% later in 2025, indicating ongoing economic challenges.

The BoE has also substantially revised its growth forecast for 2025, halving it from 1.5% to a mere 0.75%. This drastic reduction underscores the significant headwinds facing the UK economy.

Investors in the UK are now keenly awaiting several crucial economic indicators set to be released this week.

These include GDP estimates for December 2024, preliminary figures for Q4 2024, and industrial and manufacturing output data for December 2024.

These reports will provide critical insights into the current state of the UK economy and may influence future monetary policy decisions.

Regarding whether now is a good time to buy British pounds, the current situation presents a complex picture.

The pound’s weakness might appear attractive for those looking to acquire sterling at a lower rate. However, the underlying economic concerns, including weak demand and potential inflationary pressures, suggest caution.

The BoE’s reduced growth forecast and the anticipated rise in inflation later in the year indicate ongoing economic challenges that could further impact the pound’s value.

Investors should consider that while the current exchange rate might seem favourable, there’s potential for further depreciation if economic indicators continue to disappoint or if the BoE adopts a more dovish stance in response to weak demand.

Conversely, if upcoming economic data shows unexpected strength or if inflation concerns resurface, the pound could strengthen.

Given these factors, potential buyers should carefully assess their risk tolerance and investment horizon. For those with a long-term perspective and belief in the UK economy’s resilience, the current rates might present an opportunity.

However, short-term investors or those seeking immediate gains might want to exercise caution and closely monitor upcoming economic indicators before making significant currency purchases.

Sources: Trading Economics, MarketScreener