Potential for upward momentum

- This topic has 2 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

U.S. equities are positioned for a potential upturn this week, buoyed by several positive factors. A robust earnings season, coupled with anticipated Federal Reserve interest rate reductions, has instilled optimism among investors. Bargain hunting in previously undervalued stocks is further supporting market sentiment.

While small-cap stocks are demonstrating strength, a cautious undercurrent persists as traders await crucial tech earnings, the Federal Open Market Committee (FOMC) meeting, and the release of non-farm payroll data.

Major tech companies, including Apple, Amazon, Microsoft, and Meta Platforms, are anticipated to recover from recent declines.

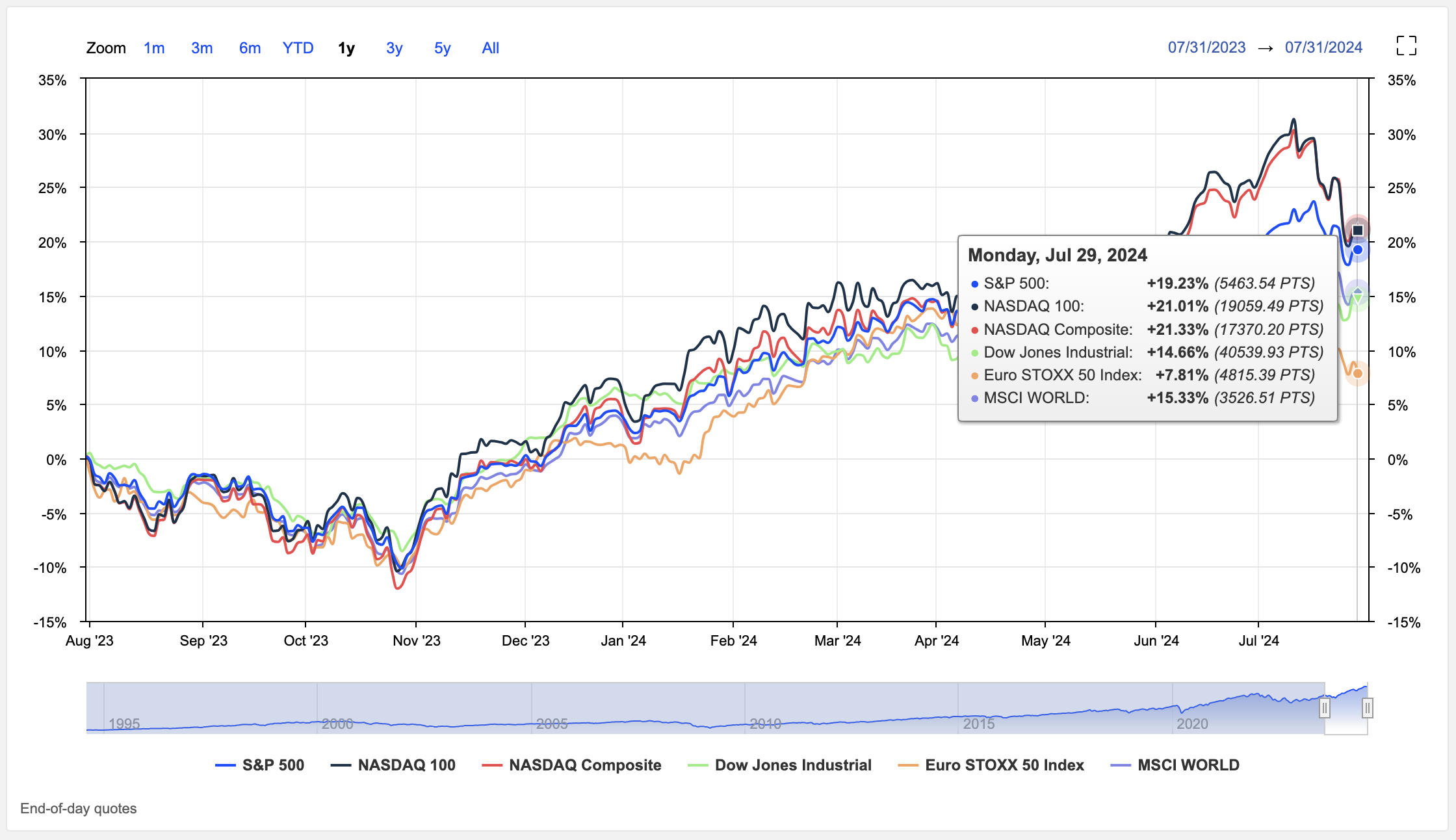

Key inflation data and earnings reports from these tech giants will be pivotal in determining the market’s trajectory. Despite a subdued market open, major indices like the Nasdaq-100, S&P 500, Dow Jones Industrial Average, and Russell 2000 have exhibited gains.

Investor interest is evident through inflows into exchange-traded funds tracking the S&P 500 and Russell 2000 Value Index. Microsoft and Apple continue to exert significant influence on market dynamics.

Overall, market conditions suggest potential for upward momentum and new year-end highs.