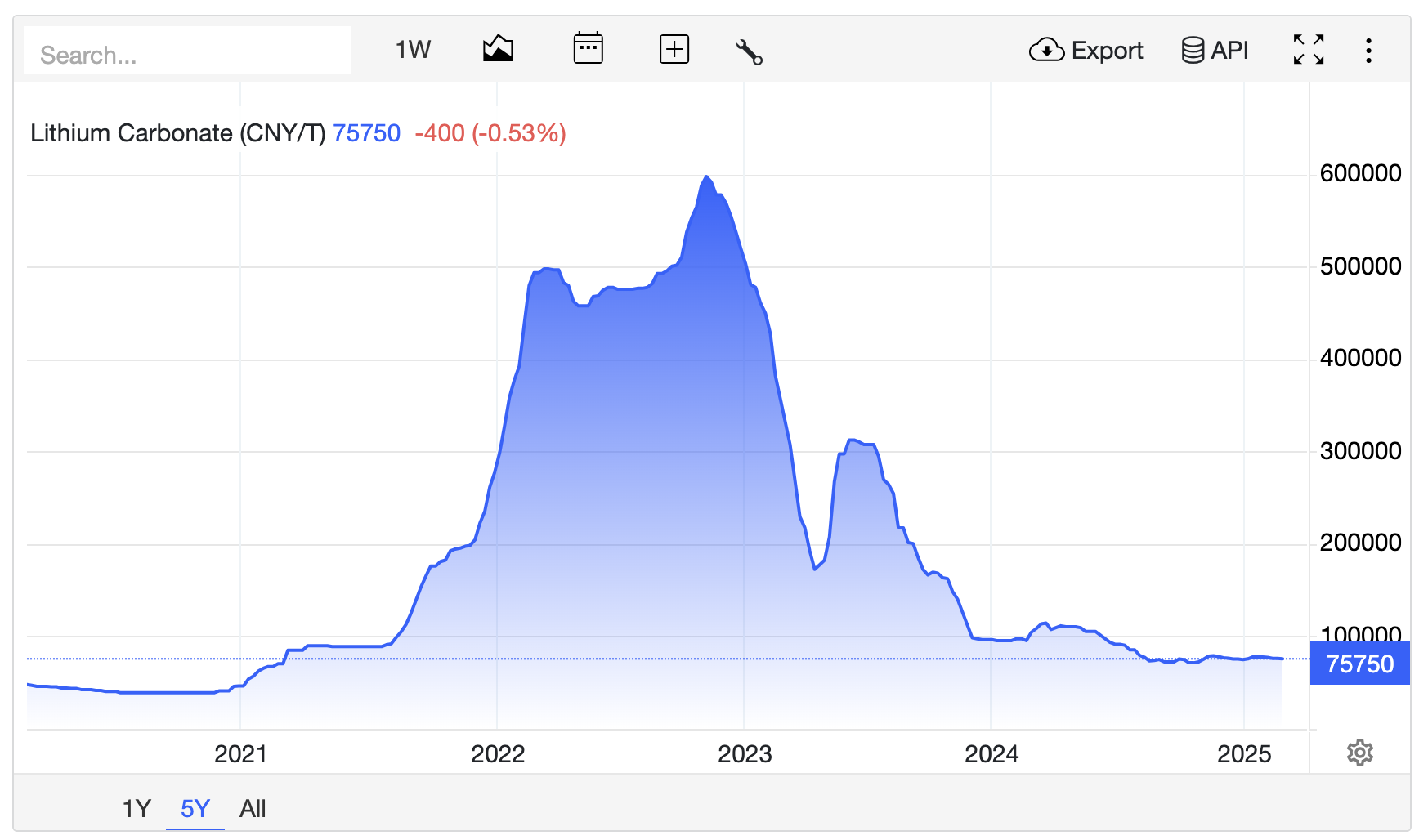

Oversupply Weighs On Lithium, Price Falls To Year-To-Date Low

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

Lithium carbonate prices have continued their downward trend, dropping below CNY 76,000 per tonne in late February 2025, marking the lowest point since the beginning of the year.

This decline is primarily attributed to persistent oversupply in the lithium market.

Despite the Chinese government’s introduction of new fiscal incentives for new energy vehicle (NEV) purchases, which boosted electric vehicle (EV) sales by 17% year-on-year in January 2025, with NEVs accounting for over 42% of total vehicle sales, the lithium market remains under pressure.

The high levels of battery inventories held by manufacturers have reduced the urgency for EV producers to initiate new supply contracts.

Lithium miners are reluctant to curtail operations, prioritising market share retention and maintaining relationships with governments and battery producers.

This strategy is evident in recent industry developments.

CATL, a major battery manufacturer, has reopened a lithium mine in China’s Jiangxi province following its successful IPO in Hong Kong.

Additionally, Ganfeng Lithium has launched its latest mining project in Salta, Argentina, further expanding global lithium production capacity.

Mining giant Rio Tinto is also seeking to enter the lithium market through the acquisition of US-based Arcadium Lithium for $6.7 billion, signalling continued interest in the sector despite current price pressures.

These developments suggest that the lithium market may continue to face oversupply challenges in the near term.

However, long-term demand projections remain strong, with global annual lithium carbonate equivalent (LCE) production expected to exceed 2.5 million tonnes by 2030, up from just over 1 million tonnes in 2024.

As the market navigates this period of oversupply, industry experts anticipate a potential recovery in the second half of 2026, driven by increased adoption of lower-cost lithium iron phosphate (LFP) batteries and the emergence of lithium iron manganese phosphate (LFMP) technologies.

These shifts in battery chemistry could play a crucial role in rebalancing the lithium market and supporting price stabilisation in the coming years.

Source: Trading Economics