Nvidia Takes The Crown As The World’s Most Valuable Company, Surpassing Apple

- This topic has 3 replies, 1 voice, and was last updated 9 months ago by .

-

Topic

-

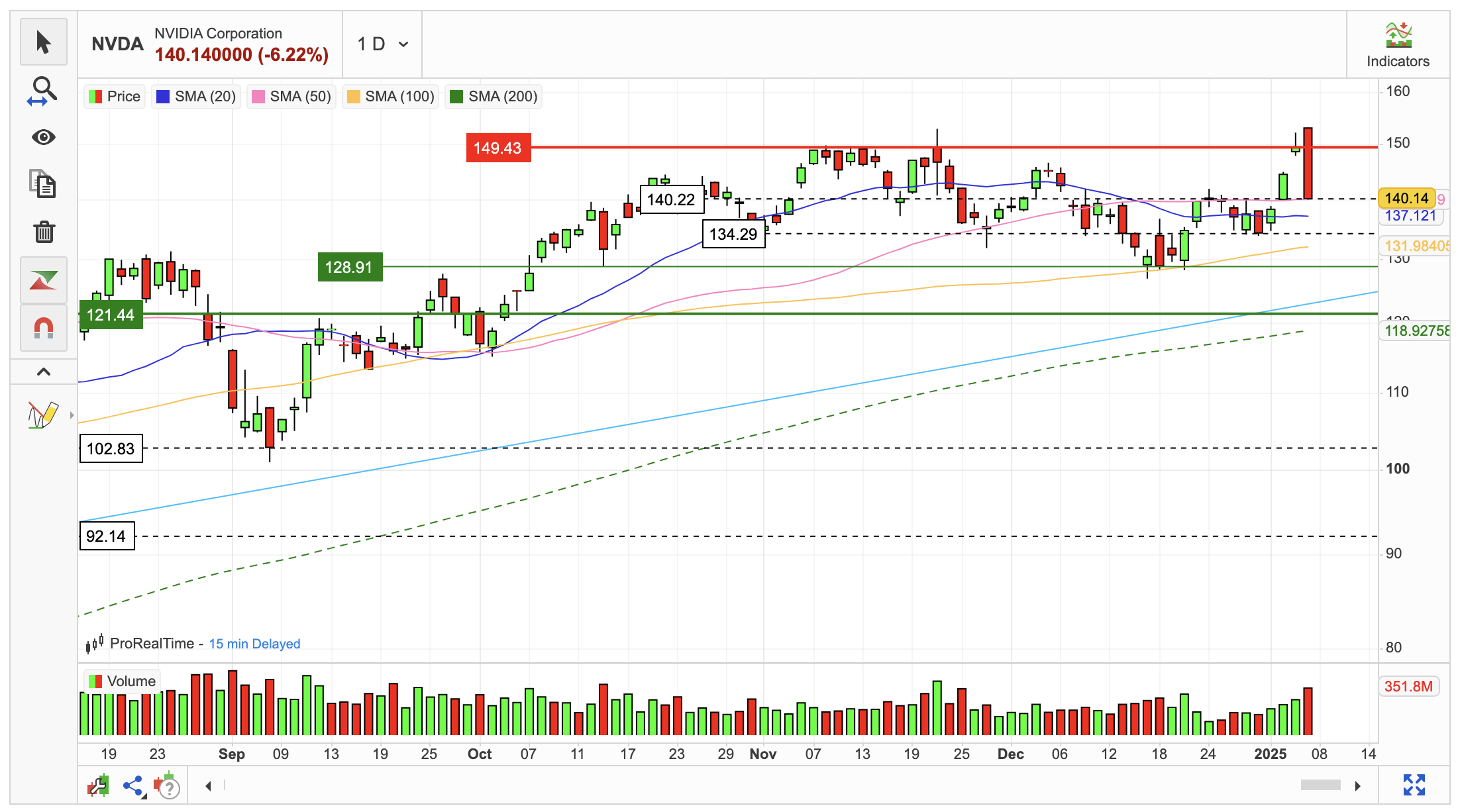

Nvidia Corporation (NVDA) saw its stock fall by 6.22% during the most recent trading session, retreating from a record high.

Despite the decline, the company made headlines by surpassing Apple Inc. (AAPL) to become the largest publicly traded company by market capitalisation, highlighting its dominant position in the AI and semiconductor sectors.

Blackwell Architecture: A Leap Forward In Computing

In tandem with its market performance, Nvidia unveiled its much-anticipated Blackwell architecture chips, which are poised to redefine the landscape for desktop and laptop computing.

These chips promise enhanced computational efficiency, energy savings, and unparalleled performance—key attributes as the demand for high-performance AI processing continues to soar.

The Blackwell chips target applications in generative AI, machine learning, and gaming, solidifying Nvidia’s status as a leader in both consumer and enterprise markets.

Stock Decline: A Reflection Of Market Dynamics

The stock’s pullback followed a prolonged rally that had seen Nvidia’s valuation skyrocket amid the AI boom. Analysts suggest the decline may be a result of profit-taking by investors after the stock reached unprecedented heights.

Additionally, broader market conditions, including concerns over inflation, interest rates, and geopolitical uncertainties, could have contributed to the downward pressure on Nvidia’s shares.

Despite the drop, Nvidia’s year-to-date performance remains stellar, with its stock significantly outperforming broader market indices.

The company’s strong fundamentals, fuelled by its cutting-edge AI technologies and growing data centre revenues, continue to attract institutional and retail investors alike.

Market Cap Milestone

Passing Apple to become the largest company by market capitalisation underscores Nvidia’s meteoric rise. This achievement highlights the shifting investor focus toward AI and semiconductor technologies, which are increasingly viewed as critical drivers of the next phase of technological innovation.

Looking ahead, Nvidia’s success will hinge on its ability to maintain its leadership in the AI and semiconductor industries.

The rollout of Blackwell architecture chips positions the company to capture even greater market share, particularly as enterprises and developers seek state-of-the-art hardware to power advanced AI models and computational workloads.

However, Nvidia faces challenges such as growing competition from rivals like AMD and Intel, potential regulatory scrutiny, and the need to sustain high levels of R&D investment to stay ahead in a rapidly evolving market.

Furthermore, macroeconomic factors, including supply chain disruptions and fluctuating demand for technology hardware, could influence the company’s performance in the near term.

Implications For Investors

While the recent dip in Nvidia’s stock might unsettle short-term traders, long-term investors may view this as a buying opportunity.

The company’s dominant position in AI and its consistent track record of innovation provide a compelling case for continued growth.

Analysts maintain a positive outlook, with many predicting that Nvidia’s stock will rebound as demand for AI solutions expands.