Nasdaq-100 Hits Record High, 22,140 Points

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

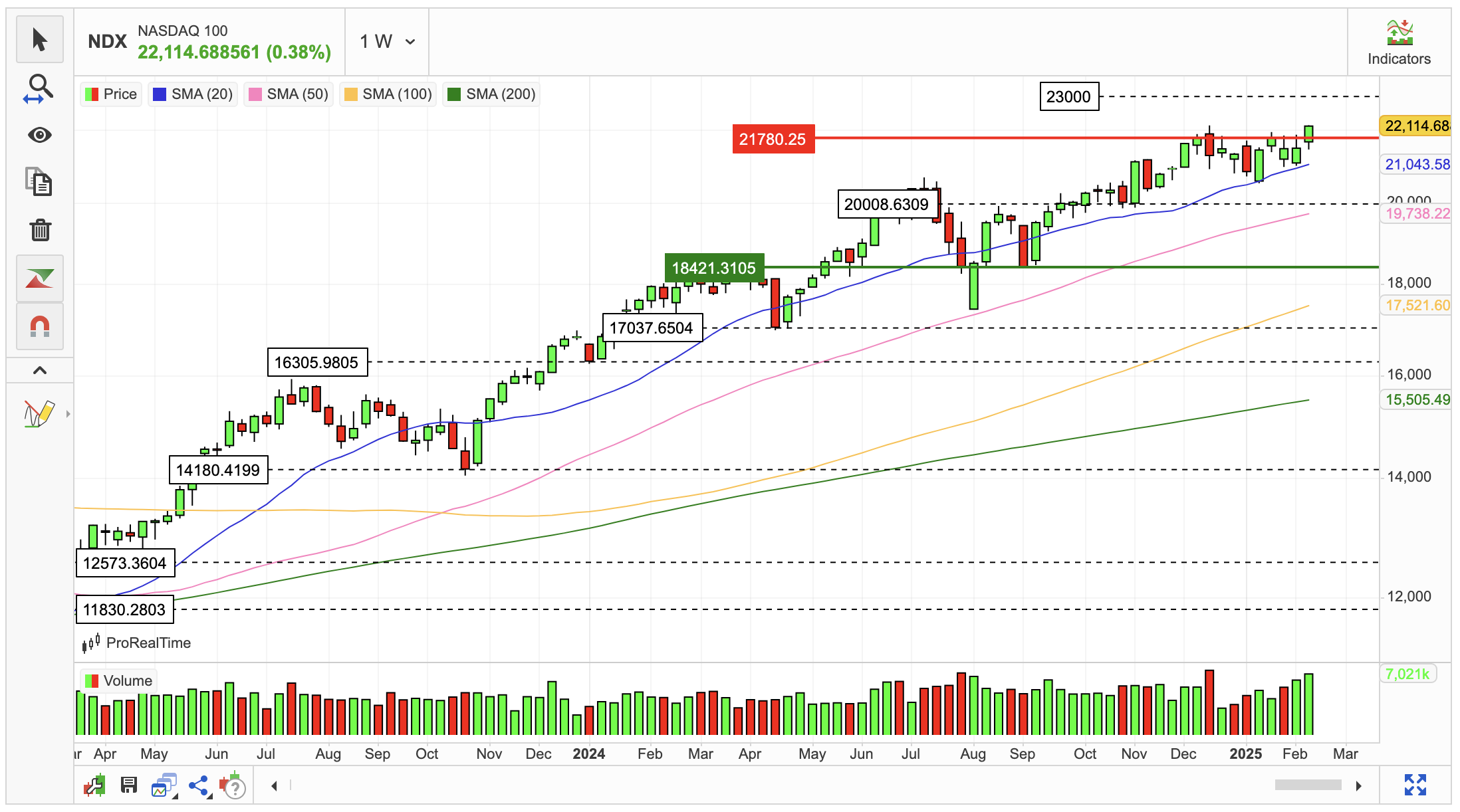

The Nasdaq-100, also known as the US 100 Tech Index, has reached a significant milestone by hitting an all-time high of 22,140.

This achievement underscores the continued strength and resilience of the technology sector in the United States.

Over the past four weeks, the index has shown robust growth, gaining 4.21%.

This short-term performance indicates strong investor confidence and positive momentum in tech stocks.

The recent gains may be attributed to factors such as advancements in artificial intelligence, positive earnings reports from major tech companies, or favourable macroeconomic conditions.

Looking at the longer-term perspective, the Nasdaq-100 has demonstrated impressive performance over the past 12 months, with a substantial increase of 24.01%.

This year-over-year growth reflects the tech sector’s ability to navigate challenges such as inflation concerns, supply chain disruptions, and geopolitical tensions while continuing to innovate and expand.

The index’s performance surpasses earlier forecasts.

For instance, Trading Economics had projected the Nasdaq-100 to be priced at 21,182 by the end of the first quarter of 2025. The actual figure of 22,140 significantly exceeds this prediction, suggesting that the tech sector has outperformed expectations.

This sustained growth of the Nasdaq-100 may have broader implications for the overall stock market and economy.

As technology companies often lead in innovation and productivity gains, their strong performance could signal positive trends for other sectors and potentially contribute to overall economic growth.

However, investors should remain cautious. Historical data shows that the tech sector can be volatile, with periods of rapid growth sometimes followed by corrections.

For example, after reaching previous highs, the index experienced significant drops, such as the 33.10% decline in 2022.