Moderate Outlook For SPY

- This topic has 3 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

The expected return for SPY is 2.31%, reflecting a moderate outlook for the stock. Positive signals for predicting stock trend changes include the 3 month treasury rate, 1-month holdings forecast, momentum 1 quarter, 52 week low, and price change 1 year. These signals suggest potential opportunities for growth and stability in the market.

Recent economic data shows a downward revision in US economic growth for Q1 2024, leading to a decrease in inflation. This has resulted in a slight decline in futures on US equity indices and an increase in Treasury yields.

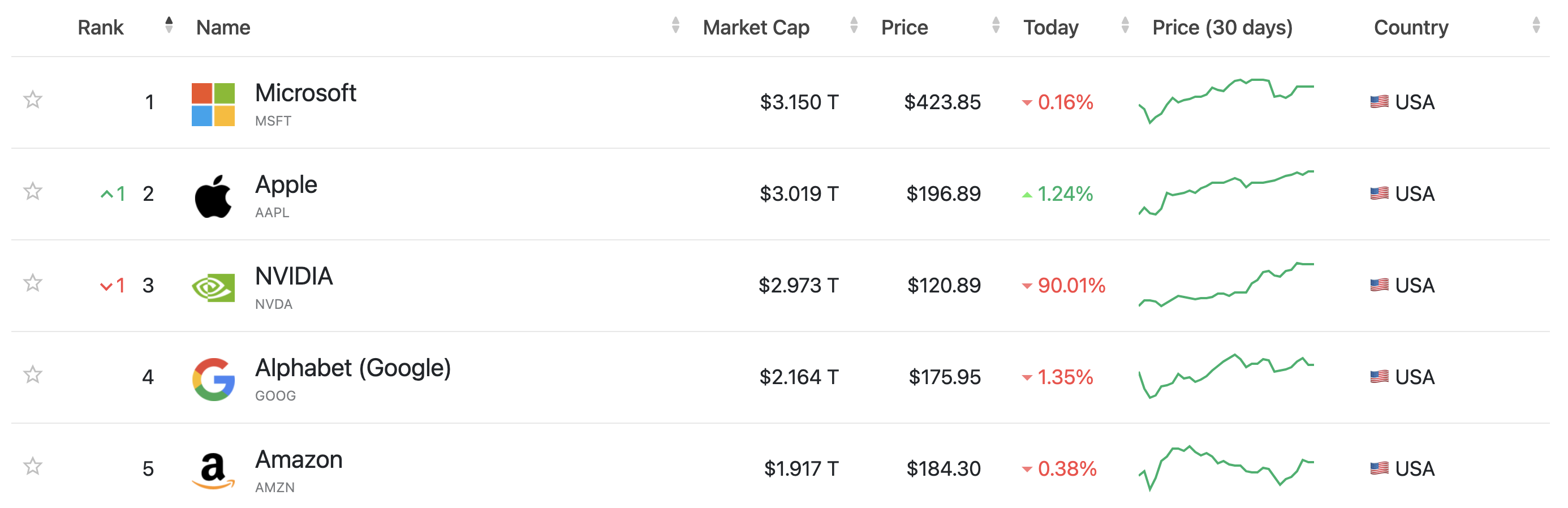

Despite this, Nvidia’s strong fundamentals in artificial intelligence have propelled its stock price, making it the second-largest holding in the SPDR S&P 500 ETF Trust. With the potential to surpass $1,200, Nvidia could potentially challenge Apple’s position as the second most valuable company globally.

While Nvidia continues to trail behind Apple in market cap, its growth potential and focus on artificial intelligence technology position it well for future success.

The competition between these tech giants highlights the dynamic nature of the market and the potential for shifts in leadership. Traders should closely monitor these developments to capitalise on emerging opportunities.