Markets Rally As Soft Inflation Report Fuels Fed Rate Cut Hopes

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

Markets saw a strong rally on Wednesday as a softer-than-expected inflation report boosted optimism for potential Federal Reserve rate cuts and greater policy flexibility.

The Consumer Price Index (CPI) for February showed year-over-year inflation cooling to 2.8%, down from January’s 3%, while core CPI (excluding food and energy) also eased to 3.1%.

This moderation in inflationary pressures has alleviated fears of stagflation and raised hopes for a more accommodative Fed, with traders now pricing in a 77% chance of a rate cut by June.

JPMorgan added to the positive sentiment, suggesting that the worst of the US equity correction may be behind us.

The bank pointed to credit markets signalling lower recession risks, with debt markets implying only a 9-12% probability of a downturn, compared to equities pricing in a 50% chance.

This divergence indicates that recent market turbulence may have been driven more by technical factors, such as quant fund position adjustments, rather than a fundamental reassessment of economic risks.

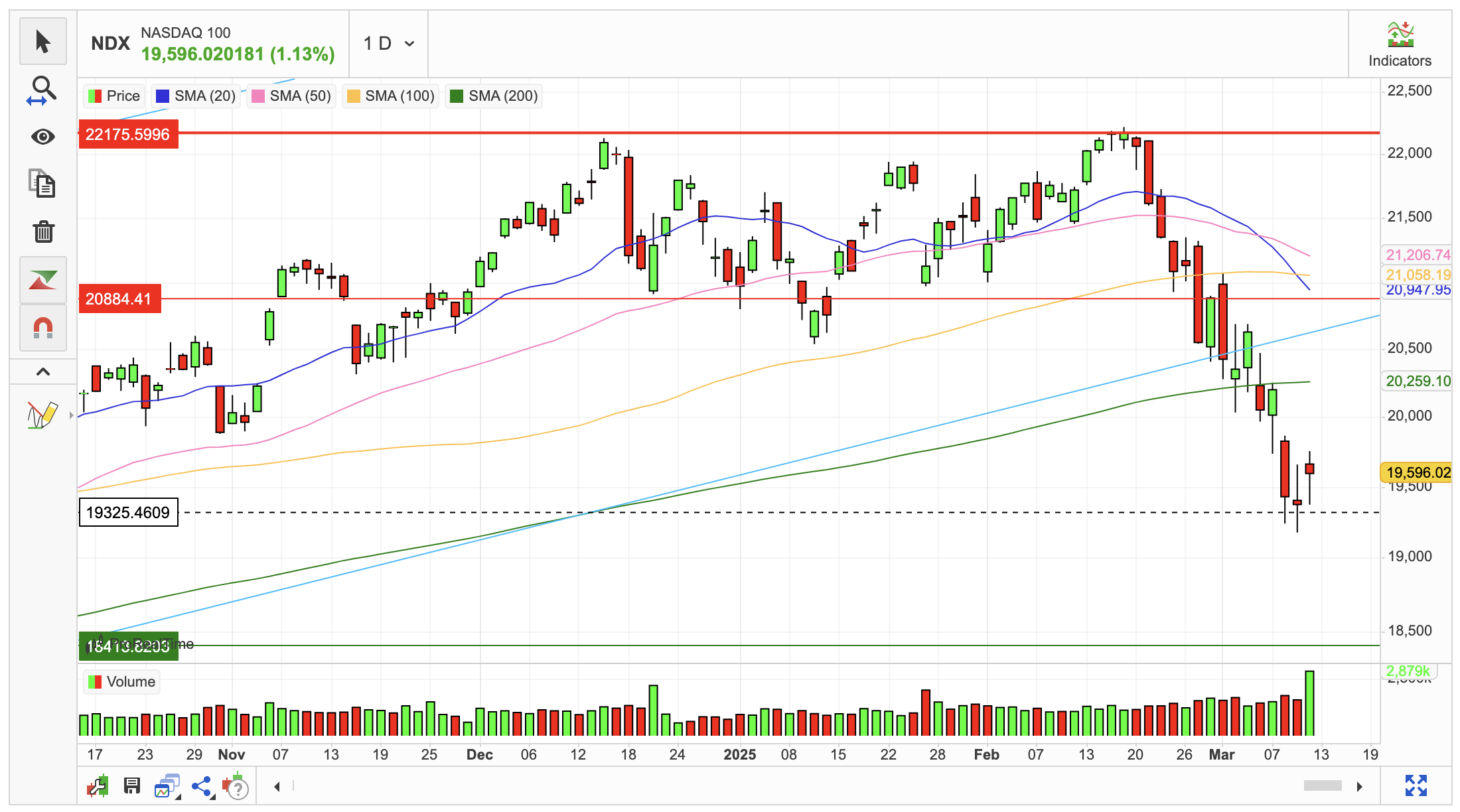

Tech stocks led the charge, with the Nasdaq Composite jumping 1.2%.

Nvidia surged 6% following its record-breaking fiscal 2025 results, driven by soaring demand for its AI chips.

AMD gained 4%, buoyed by expectations of strong data centre growth, while Tesla soared 7.59% after Elon Musk’s pledge to double US production and Trump’s public endorsement.

The S&P 500 edged up 0.49%, though the Dow slipped 0.2%, reflecting mixed sentiment across sectors.

Looking ahead, potential inflows from ETFs and pension funds could provide further market support.

JPMorgan estimates that month-end rebalancing by mutual funds and defined benefit pension funds could inject around $135 billion into equities, helping stabilise the market after recent volatility.

Additionally, continued inflows into equity ETFs suggest that the worst of the correction may indeed be over.

While the rally offers a reprieve, lingering uncertainties—such as the impact of Trump’s tariff policies and the Fed’s upcoming decisions—mean markets are not yet out of the woods.

However, the combination of easing inflation, tech sector strength, and potential inflows paints a cautiously optimistic picture for the near term.

What’s your take—is this the start of a sustained recovery, or just a temporary bounce? 📈🤔