Market outlook remains cautious

- This topic has 0 replies, 1 voice, and was last updated 8 months ago by .

-

Topic

-

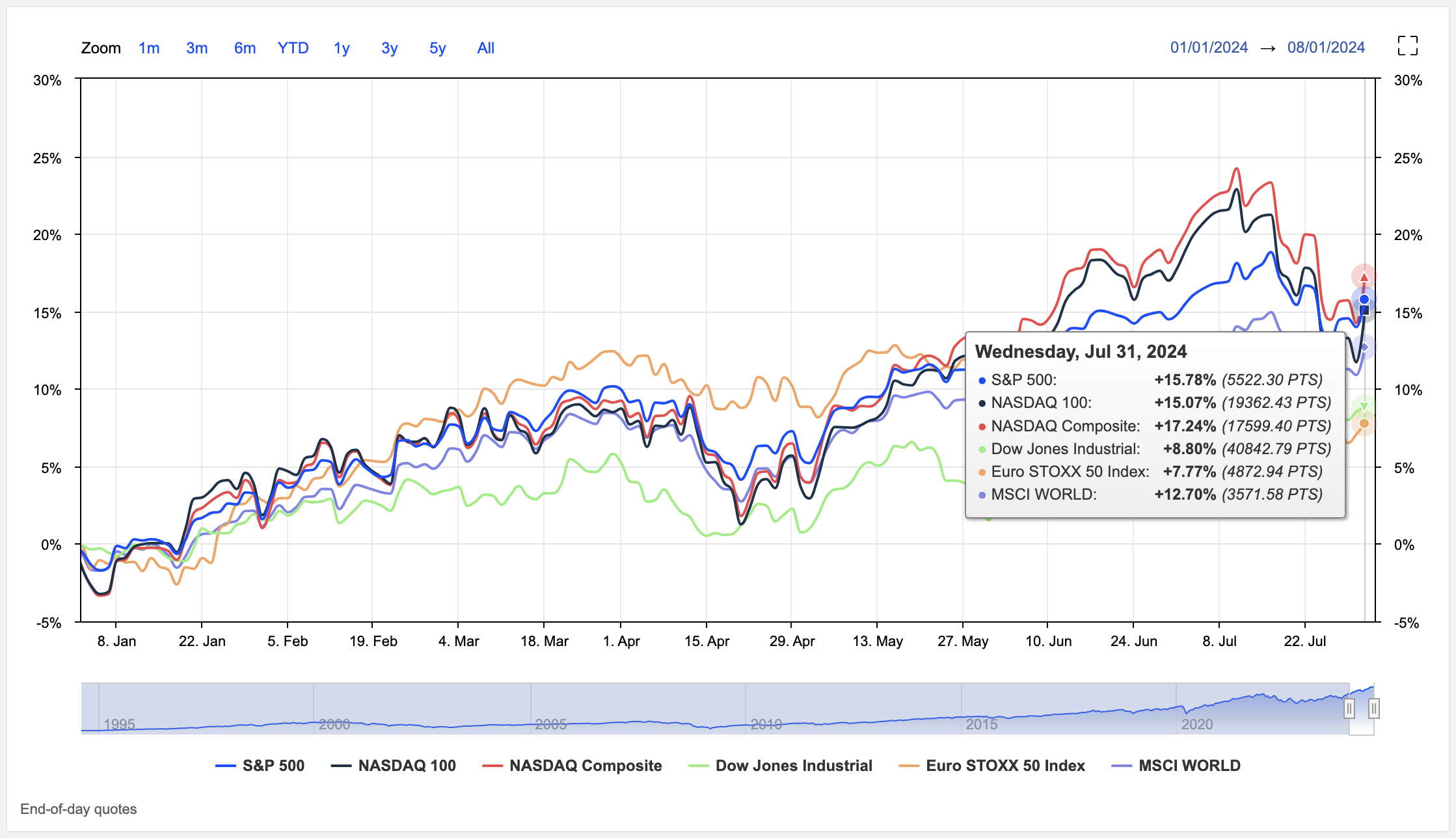

As August and September historically pose challenges for the S&P 500, investors should approach the coming months with caution.

The upcoming period is fraught with potential market movers, including the July FOMC meeting and the release of major companies’ earnings reports.

While recent tech rallies, fuelled by strong Q2 results from AI-levered companies like AMD and expectations of a September rate cut, have injected optimism, market sentiment remains fragile.

Tech stocks, which have significantly driven market gains, may experience volatility following earnings reports.

Furthermore, the heavy concentration of tech stocks in major indices introduces concentration risk, highlighting the importance of diversification.

As traders closely monitor economic indicators and second-quarter GDP data, investors should be mindful of the potential for market fluctuations and consider diversifying their portfolios across sectors and assets to mitigate risk.