Trump’s “Liberation Day” Jitters

- This topic has 1 reply, 1 voice, and was last updated 3 weeks ago by .

-

Topic

-

Buckle up, traders! 🎢

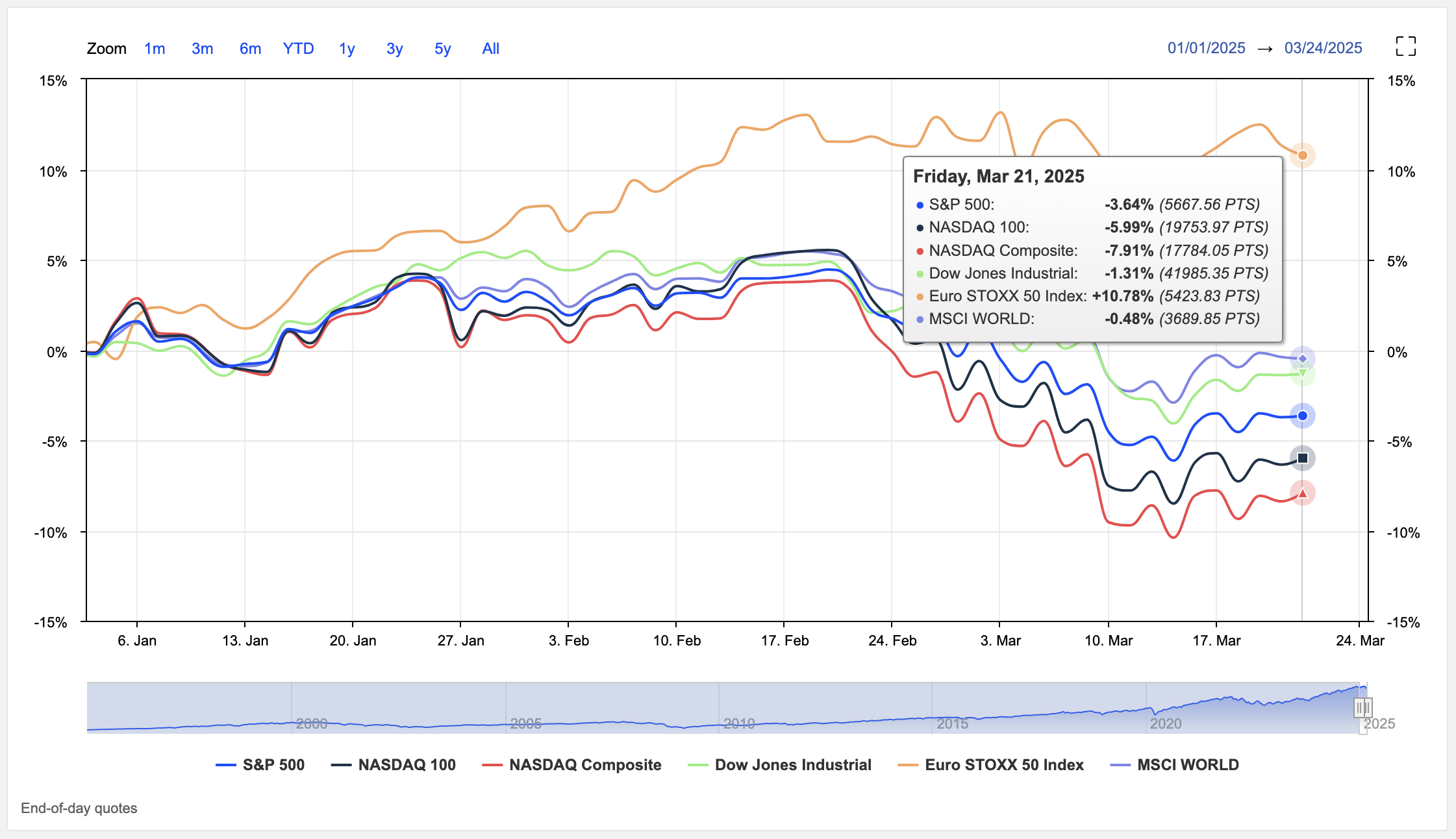

Trump’s “Liberation Day” is coming in hot on April 2nd, and markets are getting jittery.

But here’s the twist: recent reports suggest the tariff tsunami might be more of a ripple.

The White House is reportedly narrowing its focus to a “dirty 15” countries, accounting for about 15% of total trade, and putting the brakes on those headline-grabbing auto and chip tariffs.

Still, don’t let your guard down. This week’s trading could be a rollercoaster of pre-positioning and uncertainty.

Keep your eyes peeled for the US PCE data drop and UK’s CPI numbers. These economic heavy-hitters could send the USD on a wild ride.

For short-term traders, volatility is the name of the game. Watch for sector-specific moves, especially in areas like steel and agriculture that have been tariff battlegrounds before.

And remember, Wall Street’s crystal ball is showing an 18% chance of EU import duties and a 43% chance of a US recession. Talk about high stakes!

So, strap in and stay nimble.

This week’s cocktail of politics, pricing challenges, and shifting sentiment could serve up some juicy opportunities for those quick on their feet. 📊