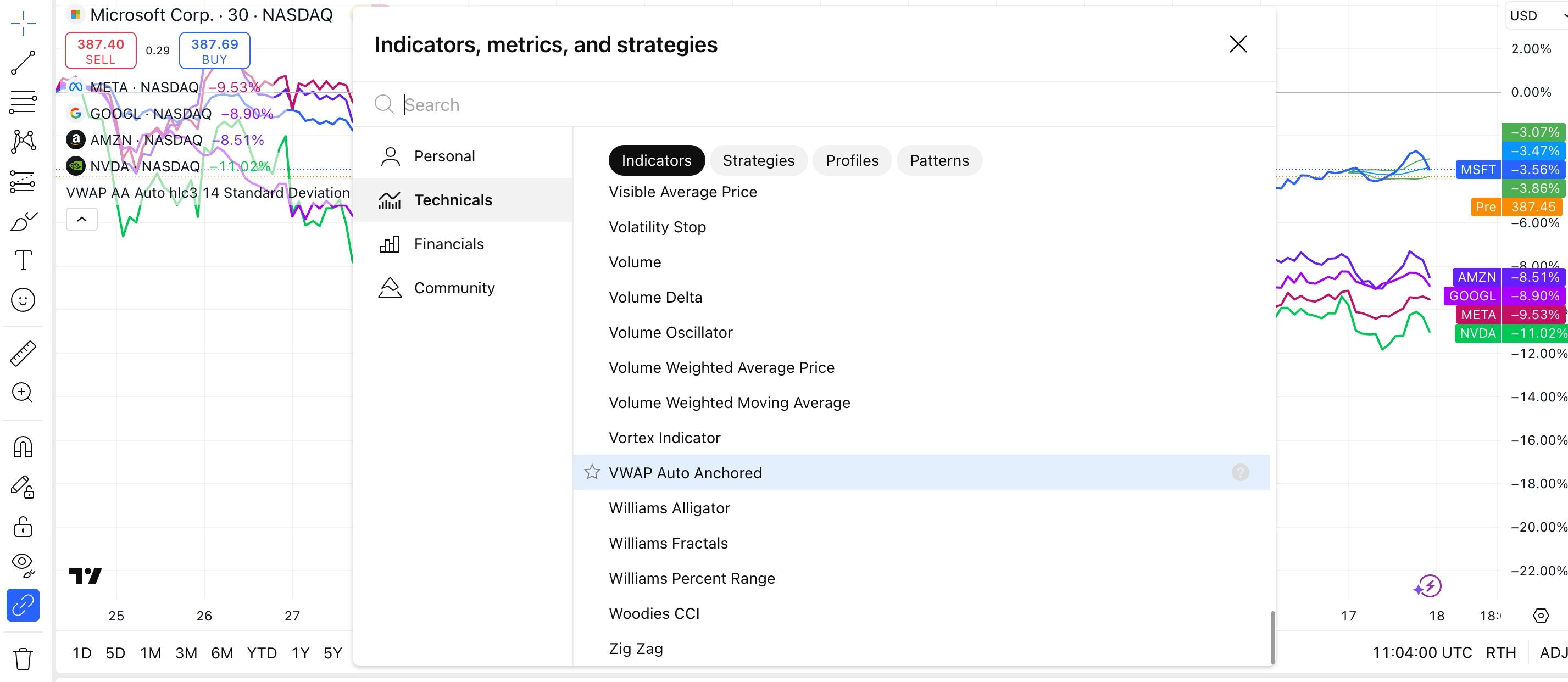

The VWAP Auto Anchored on TradingView is a pretty handy tool for intraday setups, especially since it automatically picks anchor points based on the chart timeframe.

For example, on intraday charts, it anchors to the session start, while on daily charts, it defaults to the monthly start.

This adaptability makes it easier to focus on price action without manually resetting anchors.

When it comes to momentum trading, VWAP Auto Anchored works well as a dynamic support/resistance level, especially when combined with other indicators like RSI or MACD.

It’s particularly useful for spotting mean reversion opportunities or confirming breakouts.

However, it’s not a standalone tool—pairing it with volume analysis or trendlines can give you a clearer edge.

Compared to other short-term TIs, it’s less noisy and more adaptable to market context, but it’s not perfect.

For instance, it might lag during low-volume periods or extended trends.

That said, it’s definitely worth experimenting with, especially if you’re trading high-volume stocks or index futures.

Have you tried it with other indicators?

Reply