Is Santa’s Rally Stuck In Traffic?

- This topic has 0 replies, 1 voice, and was last updated 3 months ago by .

-

Topic

-

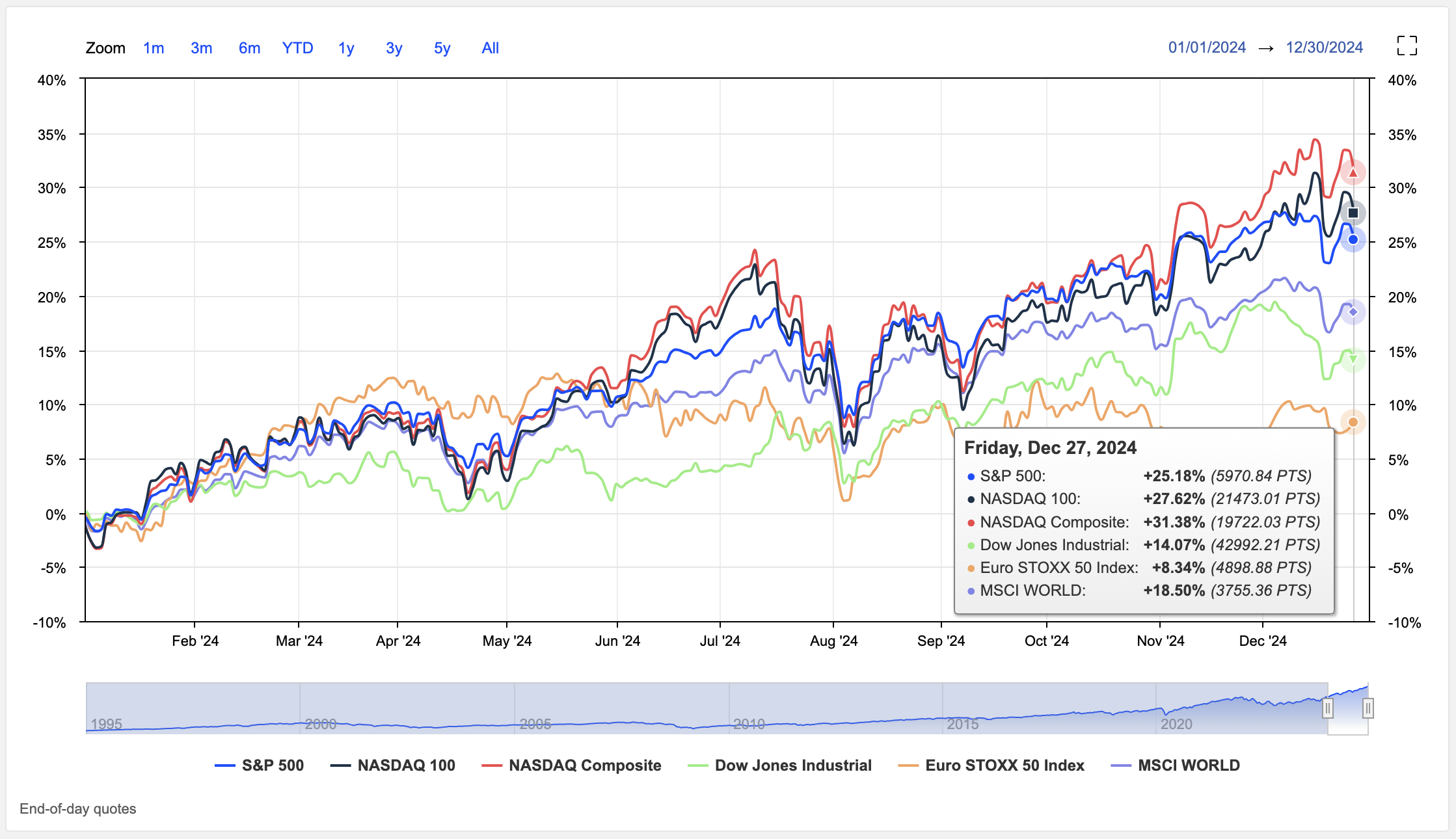

The 2024 stock market has soared, with the S&P 500 gaining an impressive 24-26% year-to-date as December unfolds.

This performance sets the stage for the highly anticipated “Santa Claus Rally,” a phenomenon characterised by stock market gains during the final five trading days of the year and the first two of the new year.

Since 2000, this trend has materialised over 75% of the time, fuelled by a combination of optimism, lighter trading volumes, and year-end tax strategies.

Early indicators suggest the rally may sustain its tradition, as positive momentum continues to underpin market sentiment.

Driving this optimism is a mix of solid corporate earnings, easing inflationary pressures, and investor confidence in select sectors, particularly technology and energy.

However, the rally is not without its potential challenges.

As the Federal Reserve maintains a less accommodative stance, higher interest rates loom as a possible headwind for growth-oriented equities.

Coupled with expectations of increased market volatility in the coming months, investors may need to tread cautiously.

Looking ahead to 2025, analysts project a more tempered pace of global equity gains, likely in the range of 5-10%.

These forecasts emphasise a shift toward caution, driven by concerns over economic slowdown, geopolitical uncertainties, and tightening liquidity.

While the Santa Claus Rally could bring a cheerful close to an extraordinary year, market participants should brace for a more measured environment as the new year unfolds.

Data: eToro, MarketScreener