Using economic calendars effectively for day trading

- This topic has 8 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

Dummy question but how do I get the most out of my economic calendar for my day trading setups?

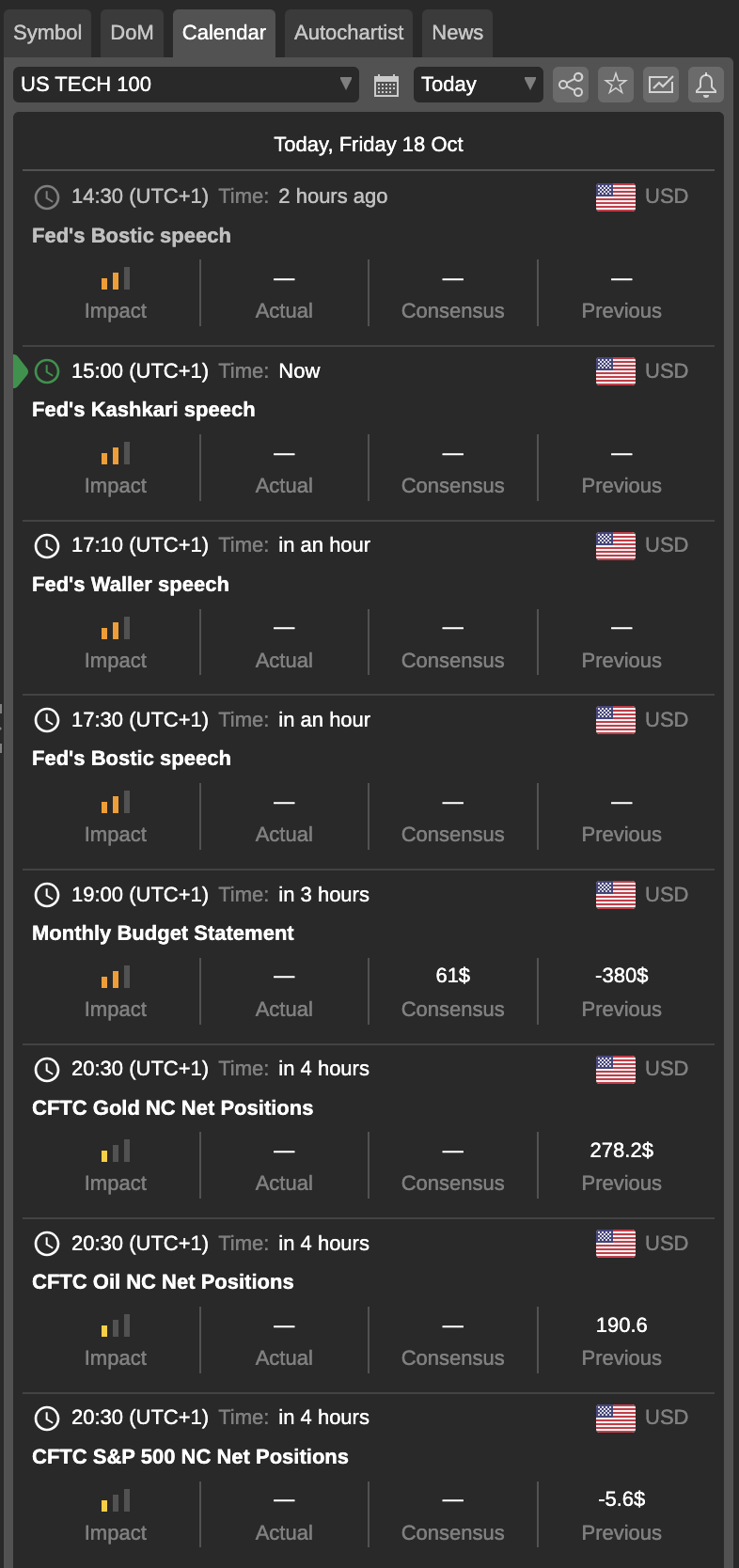

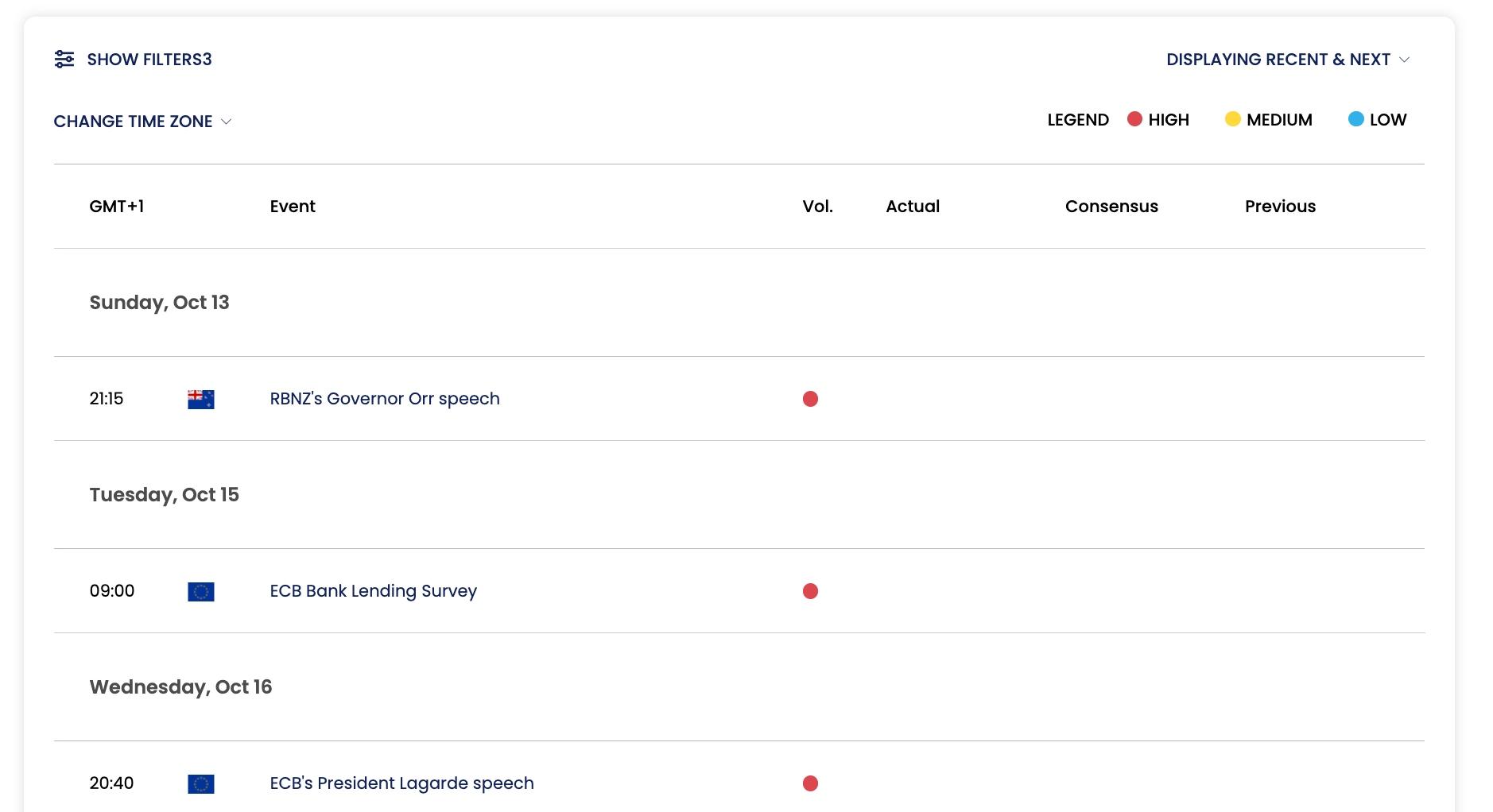

Like do you plan your whole day around events coming up or just use it to avoid nasty surprises? Which economic events do you pay attention to, just big ones or lesser-known events like manufacturing reports? Which calendars do you guys use? I use this one from Forex.com because that’s where I have an account but it’s very basic. Should I be using something difference?

Viewing 3 reply threads

Viewing 3 reply threads