Gronkowski’s Call Ignites Rally, Investors Eye Fed Move

- This topic has 4 replies, 1 voice, and was last updated 7 months ago by .

-

Topic

-

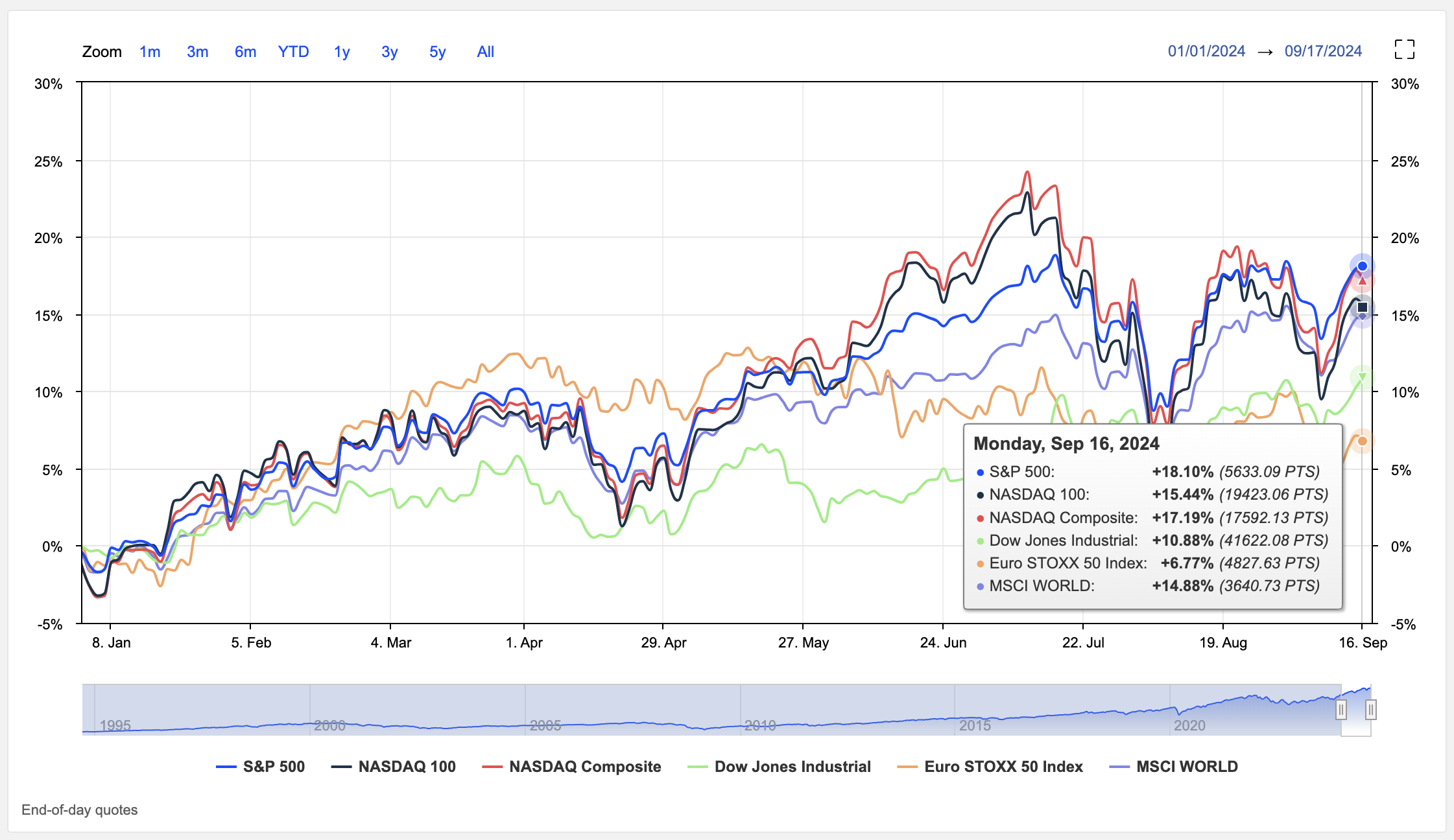

Technical indicators suggest a bullish outlook for the market, driven by positive momentum, favourable interest rate expectations, and strong price performance.

Recent market sentiment has been bolstered by comments from prominent figures. Former NFL star Rob Gronkowski’s call for a market rebound aligned with positive remarks from NVIDIA CEO Jensen Huang, contributing to a rally in the S&P 500 and technology stocks.

However, despite the initial optimism, market participants remain cautious as they await the Federal Reserve’s upcoming interest rate decision. While a rate cut is widely anticipated, uncertainty persists regarding its magnitude.

Mixed news within the technology sector has introduced some hesitation among investors. Major index futures have shown relative stability, with the S&P 500 experiencing a 3.5% weekly gain.

In the competitive landscape of S&P 500 ETFs, VOO and IVV are gaining ground on SPY. VOO, in particular, is poised to surpass SPY in assets under management due to its faster growth and lower expense ratio.

Although SPY continues to attract significant trading volume, the increasing inflows into VOO and IVV from retail investors signal a potential shift in market share, prompting investors to reassess the evolving dynamics.

As the market enters a potentially volatile phase within the ongoing bull market, investors are encouraged to prioritise stocks with solid earnings growth and reasonable valuations. This becomes particularly important in the lead-up to the Federal Reserve’s meeting on September 18th.

In conclusion, while the market exhibits positive signs, a degree of caution is warranted as various factors influence its trajectory.