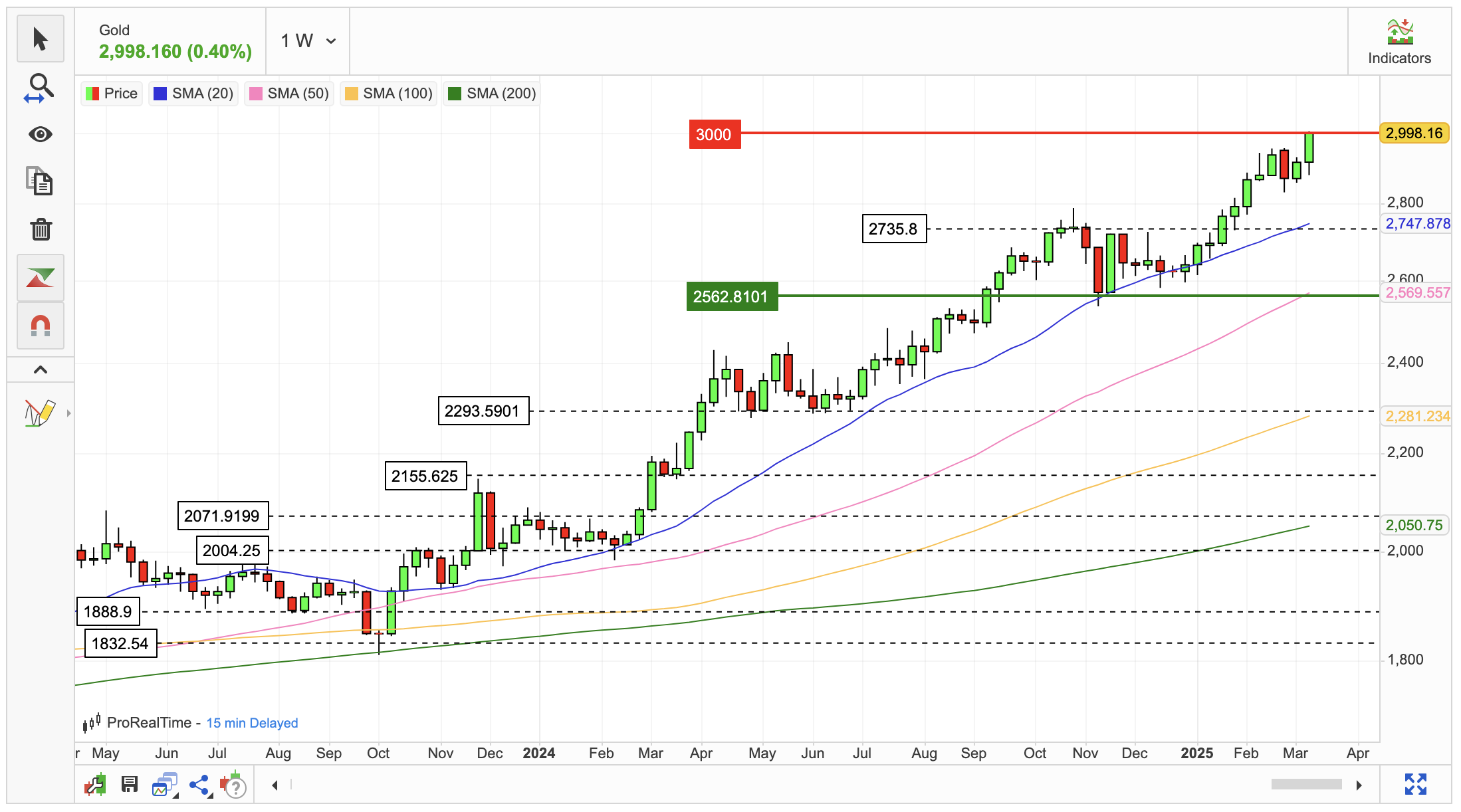

Gold Soars Past $3,000: Inflation, Tariffs Fuel Record Rally

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

Gold prices have skyrocketed, briefly crossing the $3,000-per-ounce threshold for the first time in history, marking a 12% surge over the past three months.

This rally is driven by a combination of inflation concerns, escalating tariff uncertainty, and a broader flight to safe-haven assets amid geopolitical and economic instability.

The VanEck Gold Miners ETF (GDX), which tracks gold mining companies, has also benefited, gaining 3% and nearing its October highs.

Gold miners historically provide leveraged exposure to gold prices, making them an attractive option for investors seeking to capitalise on the metal’s upward momentum.

Central banks have been key drivers of demand, increasing their gold reserves while reducing holdings of US Treasuries.

This trend, coupled with weaker-than-expected US inflation data, has strengthened expectations of a Federal Reserve rate cut in June, further boosting gold’s appeal.

Analysts are now raising their forecasts, with some predicting gold could reach $3,500 by Q3 2025.

This bullish outlook is supported by stagflation risks—a scenario where inflation persists despite slowing economic growth—which historically favours gold as a store of value.

Will gold continue its climb, or is a correction on the horizon? 🤔📈