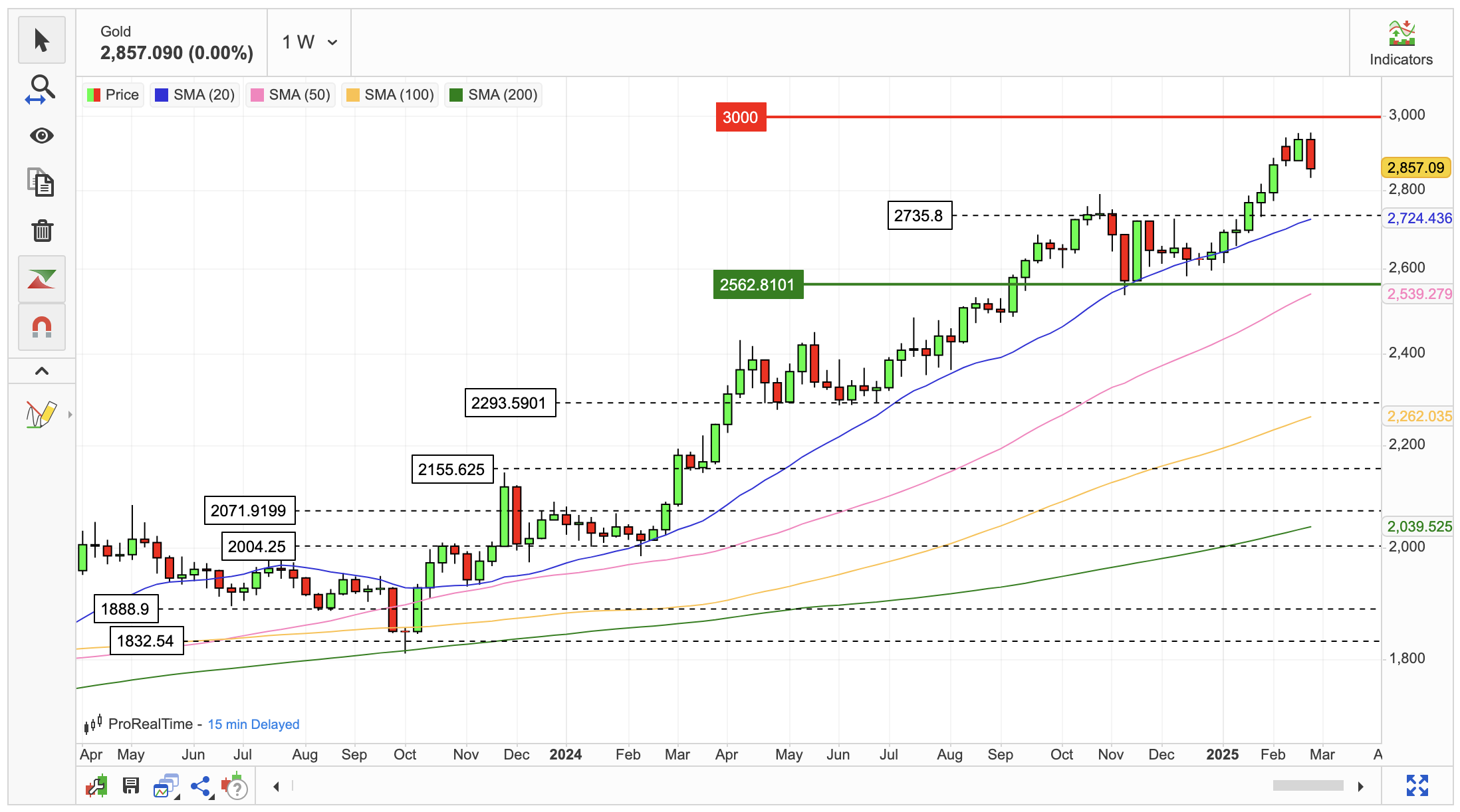

Gold Plunges Past $2,850, Biggest Weekly Drop Since November

- This topic has 0 replies, 1 voice, and was last updated 1 month ago by .

-

Topic

-

Gold prices retreated toward $2,850 per ounce, marking the most significant weekly decline since November 2024.

This downturn comes amid a strengthening US dollar and revised market expectations for Federal Reserve rate cuts in 2025.

The latest Personal Consumption Expenditures (PCE) data, released on Friday, showed prices rose 0.3% month-over-month in January, aligning with expectations.

The annual inflation rate eased slightly to 2.5% from 2.6% in December, still above the Fed’s 2% target5. This persistent inflation has led markets to price in only two rate cuts for 2025, down from earlier projections of more aggressive easing.

Surprisingly, the PCE report revealed a 0.2% drop in consumer spending, the first decline since March 2023, while personal income surged by 0.9%, the largest increase in a year.

This unexpected contraction in consumer spending, coupled with rising incomes, suggests potential shifts in consumer behaviour and economic dynamics.

Market attention has now pivoted to US trade policy, following President Donald Trump’s confirmation of impending tariffs.

Starting March 4, 2025, a 25% tariff will be imposed on Mexican and Canadian goods, along with an additional 10% duty on Chinese imports.

Trump has also threatened to levy 25% tariffs on European Union goods, escalating global trade tensions.

These tariff announcements have triggered a flight to safe-haven assets, with gold initially benefiting.

However, the strengthening dollar, which makes gold more expensive for foreign buyers, has overshadowed this effect in the short term.

For the week, gold lost 2.7% after eight consecutive weeks of gains.

Despite this setback, the precious metal still managed a 1.4% increase for February.

This overall monthly gain underscores gold’s resilience amid economic uncertainties and geopolitical tensions.

Looking ahead, Goldman Sachs Research forecasts gold prices to climb further, potentially reaching $3,100 per troy ounce by the end of 2025.

This projection is based on anticipated demand from central banks and increased purchases of gold ETFs as interest rates decline.

However, the gold market faces both upside and downside risks.

Sustained policy uncertainty or concerns about tariffs could drive speculative gold investing, potentially pushing prices as high as $3,300 by December 2025.

Conversely, if the Federal Reserve maintains higher interest rates than expected, it could limit gold’s ascent.

As global markets navigate these complex economic and political landscapes, gold’s performance will likely remain closely tied to inflation trends, monetary policy decisions, and the evolving trade environment.

Sources: Trading Economics, MarketScreener