Federal Reserve Poised For 0.25% Rate Cut

- This topic has 0 replies, 1 voice, and was last updated 10 months ago by .

-

Topic

-

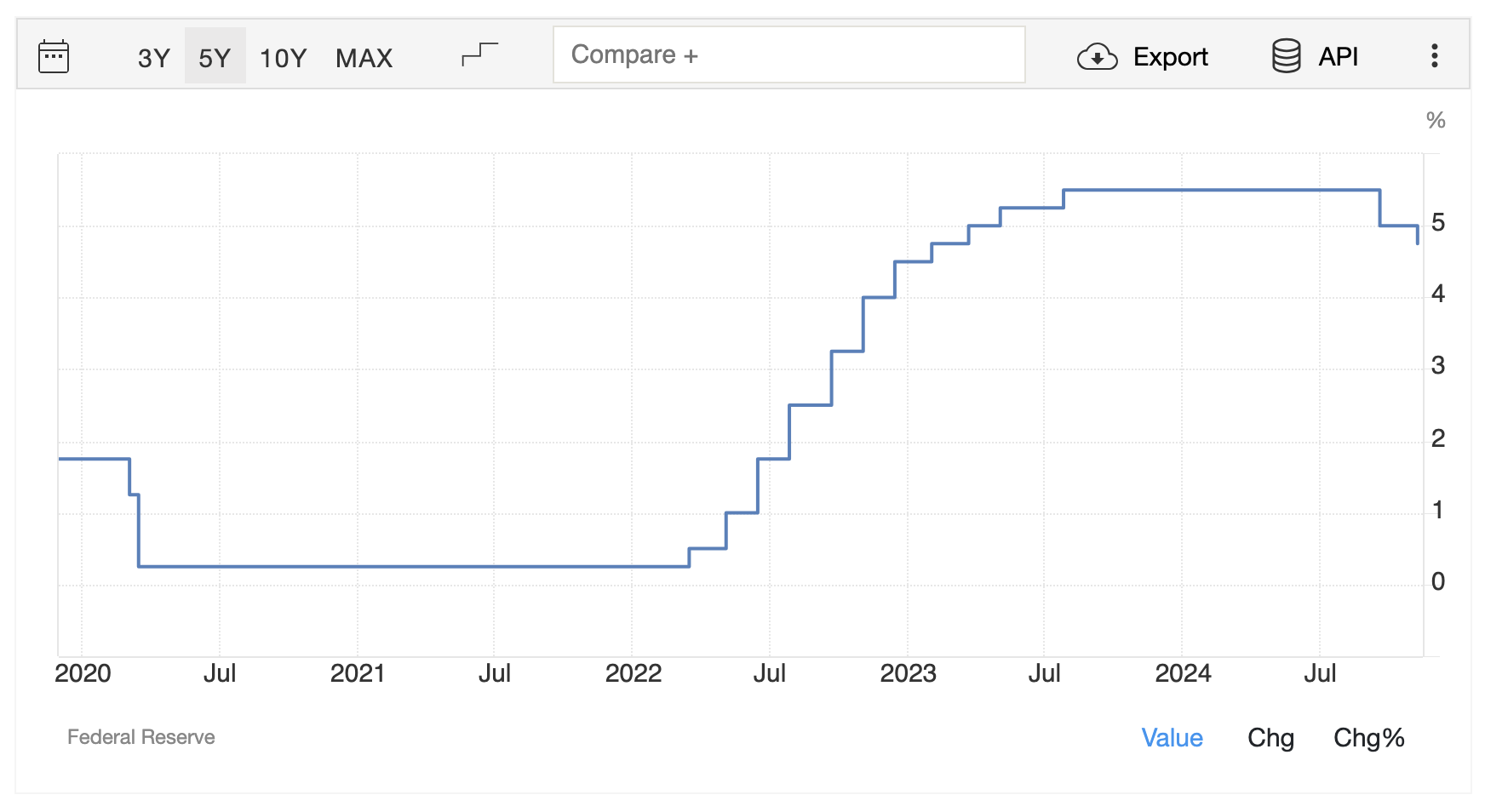

The Federal Reserve is widely anticipated to reduce interest rates by 0.25% on Wednesday 18th, lowering the benchmark federal funds rate to a target range of 4.25% to 4.5%.

This move, if confirmed, would mark a significant step in the Fed’s monetary policy strategy as it seeks to support the slowing US economy while remaining cautious about the risks posed by persistent inflation.

Despite this expected adjustment, the broader trajectory of rate cuts remains uncertain due to mixed economic signals, including sticky inflation and signs of softening in the labour market.

Market analysts are closely watching the upcoming remarks from Federal Reserve Chair Jerome Powell, which are expected to shed light on the central bank’s approach to balancing the dual mandate of inflation control and employment stability.

Powell is likely to address the challenges of combating price pressures without stifling economic growth, a delicate task as the US heads into 2025.

The cooling labour market, evidenced by slower job growth and declining wage increases, is adding complexity to the Fed’s decision-making process, as it seeks to prevent unemployment from rising too sharply.

The potential rate cut comes against a backdrop of diverging economic indicators. While inflation remains above the Fed’s 2% target, it has shown signs of moderation in recent months.

However, some sectors of the economy, such as housing and manufacturing, continue to face headwinds. A reduction in interest rates could lower borrowing costs for businesses and consumers, potentially boosting investment and spending.

However, any further loosening of monetary policy may risk reigniting inflationary pressures, complicating the Fed’s longer-term objectives.

Any hints regarding the pace and scale of future rate adjustments could have significant implications for financial markets, consumer sentiment, and economic growth heading into the new year.

Image: Trading Economics