eToro Smart Portfolios are investment products that allow you to invest in thematic portfolios managed by eToro’s investment team.

Unlike copying a Popular Investor (a third-party investor), eToro’s Smart Portfolios are designed to follow specific investment strategies or market trends.

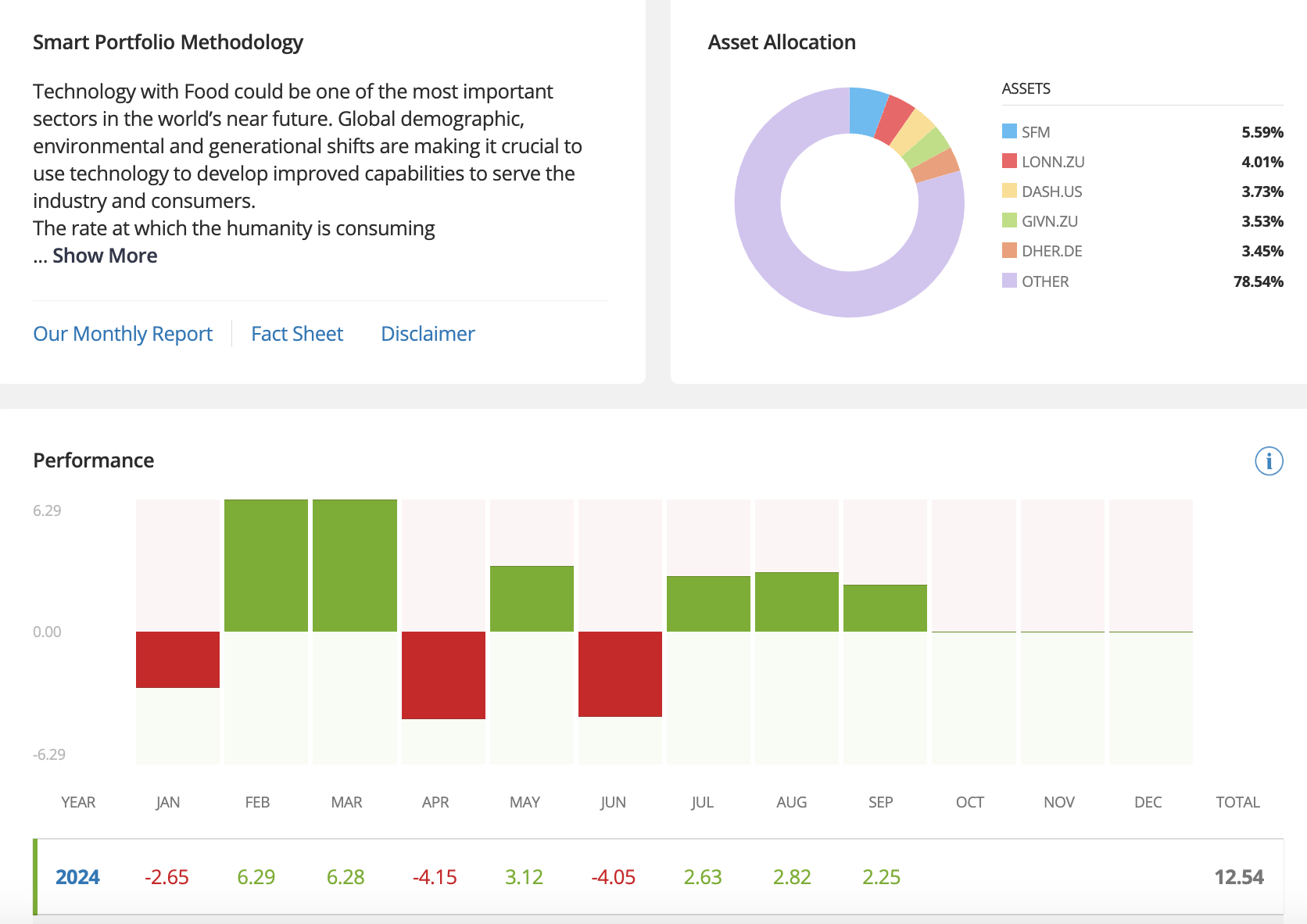

Instead of picking individual assets, you can choose a Smart Portfolio that aligns with your goals or interests, such as technology, clean energy, crypto, etc.

PROS:

Unlike traditional investment funds, Smart Portfolios come with no management fees.

eToro’s ‘experts’ actively manage the Smart Portfolios, adjusting asset allocation to reflect changing market conditions. In some cases, algorithm-driven strategies are also used to automate adjustments.

CONS:

The most significant disadvantage of Smart Portfolios is the lack of customisation.

While these portfolios offer a ‘professionally’ managed investment option, investors have little control over the individual assets or the specific allocation within the portfolio.

This means that if an investor has specific preferences or wants to tailor their investments to align with personal risk tolerance, market views, or ethical considerations, they may find the lack of flexibility limiting, especially as the performance of a Smart Portfolio can be significantly affected by broader market conditions beyond the manager’s control.

Hope that helps?

Reply