ECB Slashes Rates As Eurozone Economy Stalls

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

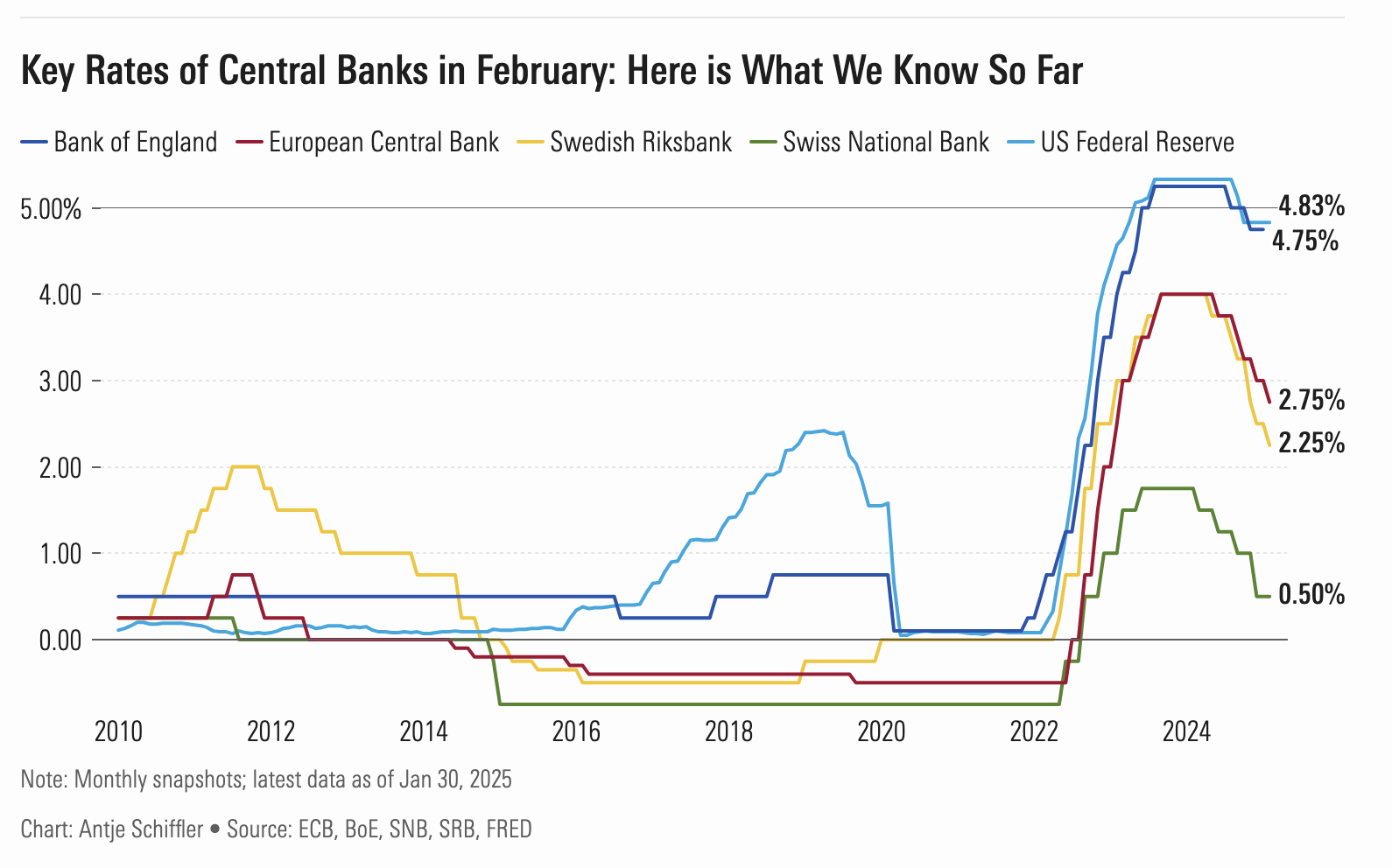

The European Central Bank (ECB) has implemented its fifth consecutive interest rate cut, lowering the key deposit rate to 2.75%.

This decision comes amid economic stagnation in the eurozone, with GDP growth in the fourth quarter of 2024 registering at 0.0%.

Economic Implications

The rate cut aims to stimulate economic activity by encouraging spending and investment.

However, the eurozone faces several challenges:

- Weak Growth: The economy is underperforming, with GDP growth projections for 2025 at 0.8%, below the consensus forecast of 1.2%.

- Currency Pressure: Lower interest rates may lead to a weaker euro, potentially benefiting exporters but making imports more expensive.

- Trade Uncertainties: The threat of tariffs from the new US administration could offset any positive effects from monetary easing.

Inflation & Future Outlook

Despite recent rate cuts, inflation in the eurozone reached 2.4% in December, showing a slight uptick.

The ECB expects inflation to stabilise around its 2% target in the course of 2025.

Market expectations suggest further rate reductions:

- Analysts forecast rates could fall to 2% by the end of 2025.

- Some projections indicate rates might reach 1.5% by year-end.

Global Context

The ECB’s decision contrasts with the US Federal Reserve’s approach, which has maintained steady rates.

This divergence in monetary policy could have implications for currency markets and international trade.

As the eurozone navigates these economic headwinds, the effectiveness of monetary policy in stimulating growth remains to be seen, especially in light of potential trade tensions and global economic uncertainties.

Source: Morningstar