EARNINGS: Amazon’s Ad Revenue Up 19%

- This topic has 0 replies, 1 voice, and was last updated 5 months ago by .

-

Topic

-

Amazon’s advertising revenue experienced a 19% year-over-year increase, reaching $14.3 billion in Q3.

This substantial growth underscores Amazon’s increasing prominence in the digital advertising landscape.

With this momentum, Amazon is emerging as a serious competitor to industry giants Alphabet and Meta.

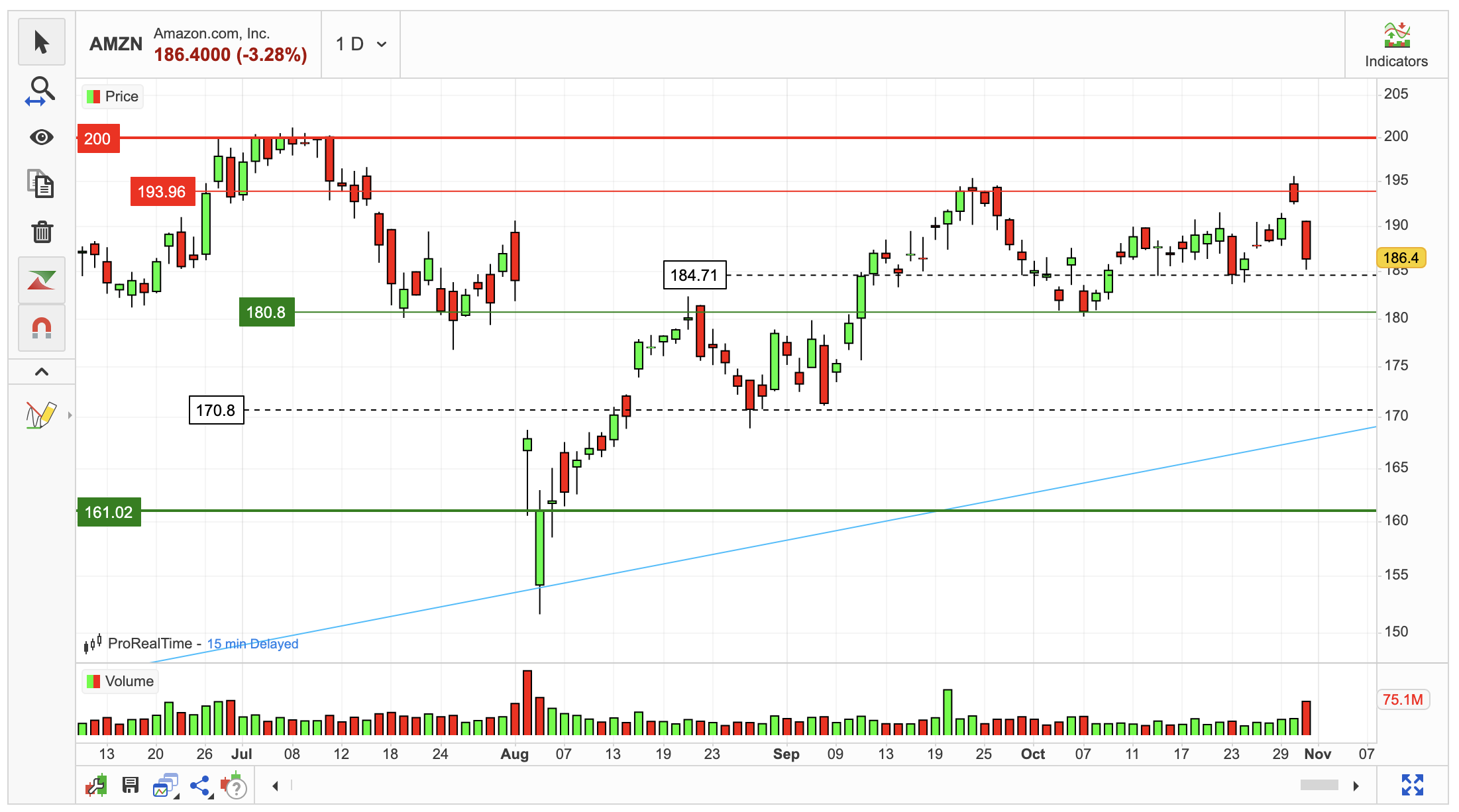

As of Thursday, October 31st, 2024, Amazon’s stock price experienced a 3.28% decline, closing at $186.40.

This marks a decrease from the previous day’s closing price of $192.73.

Throughout the trading session, the stock exhibited a 2.90% price fluctuation, with a low of $185.23 and a high of $190.60.

Over the past 10 trading days, Amazon’s stock has closed higher on eight occasions, resulting in a net decrease of 0.6%.

Despite the recent price decline, trading volume surged by 29 million shares. This significant increase in volume during a period of falling prices may be a warning sign, suggesting potential increased volatility and risk in the near future.

In total, 65 million shares were traded, amounting to an approximate trading volume of $12.13 billion.

In the short term, Amazon’s stock appears to be consolidating within a wide, upward-sloping trend channel.

While such a pattern typically presents a favorable buying opportunity, a breach of the lower trendline support at $180.80 could signal a potential slowdown in the uptrend or even a reversal.

Key levels are $193.96 resistance and $180.80 support.

Data: eToro, FactSet, Morningstar, S&P Capital IQ, ProRealTime, MarketScreener, StockInvest