Do Trump’s Trade Tariffs Threaten US Growth?

- This topic has 1 reply, 1 voice, and was last updated 1 month ago by .

-

Topic

-

The proposed tariffs by former President Trump represent a complex economic challenge with far-reaching implications for the United States.

Economic analyses suggest these protectionist measures could potentially reduce US GDP by up to 1.3%, with Goldman Sachs estimating a potential 5% reduction in the S&P 500’s fair value.

Consumers would likely bear the brunt of these trade policies, with the typical US household facing over $1,200 in additional annual costs.

The Peterson Institute for International Economics projects a one-time consumer price increase of 0.5% to 0.7%, further straining household budgets already impacted by recent inflationary pressures.

The automotive and manufacturing sectors appear most vulnerable, with potential job losses estimated between 330,000 and 1.1 million full-time equivalent positions.

The proposed 100% tariff on imported vehicles could dramatically reshape the electric vehicle market and domestic manufacturing landscape.

For investors, these tariffs create a nuanced investment environment characterised by increased market volatility.

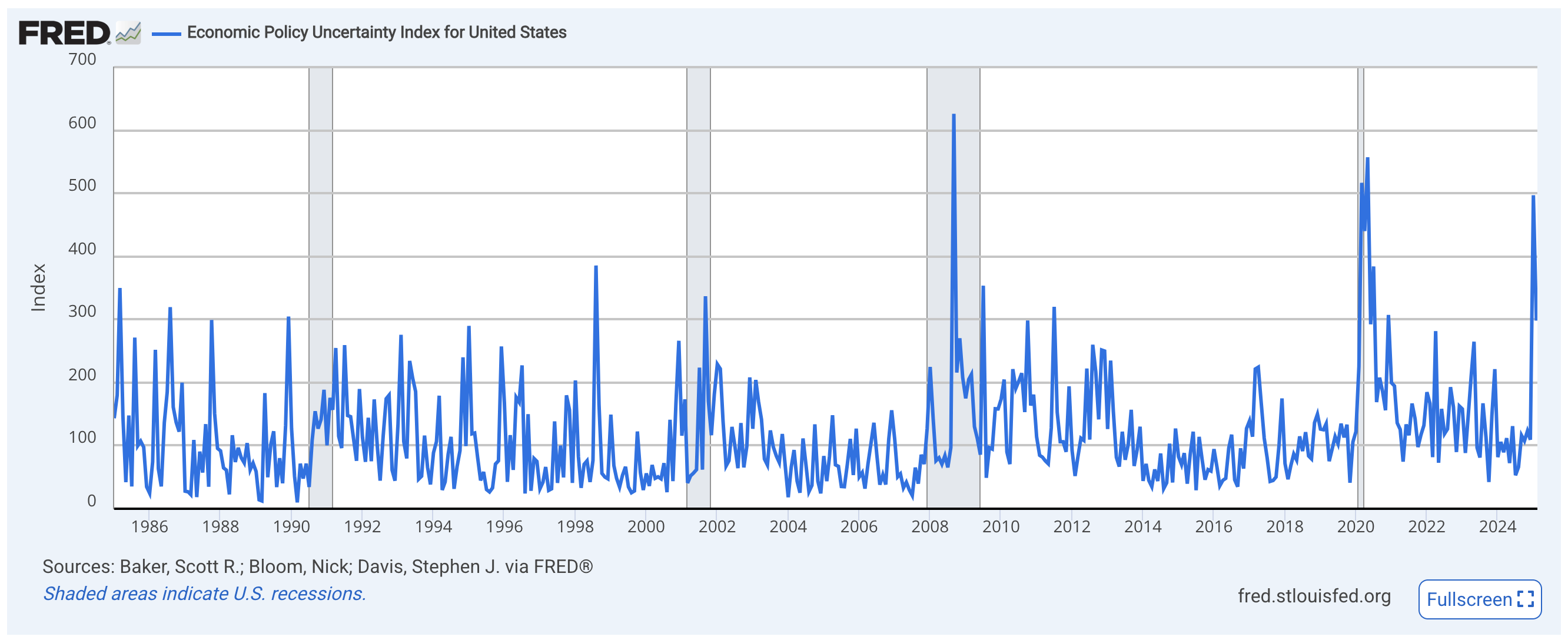

The US Economic Policy Uncertainty Index has already reached its highest level since March 2020, signalling significant market apprehension.

Strategic investment approaches would require careful sector selection and diversification.

Multinational corporations with extensive international supply chains could face particular challenges, while domestically-focused companies might find unexpected opportunities.

The potential for retaliatory measures by trading partners adds another layer of complexity to investment decision-making.

Currency markets could experience substantial movements, potentially strengthening the US dollar and impacting multinational corporate earnings.

Bond markets might also see shifts depending on the Federal Reserve’s response to potential inflationary pressures generated by these tariffs.

While proponents argue the tariffs could protect domestic industries and create more balanced trade relationships, most economic analyses suggest the overall impact would be economically detrimental.

Investors should remain vigilant, maintaining flexible investment strategies that can adapt to rapidly changing trade dynamics.

The ultimate economic impact remains uncertain, underscoring the importance of comprehensive, nuanced analysis and a diversified investment approach in navigating this complex trade landscape.