December Jobs Report Erases All YTD Gains

- This topic has 0 replies, 1 voice, and was last updated 3 months ago by .

-

Topic

-

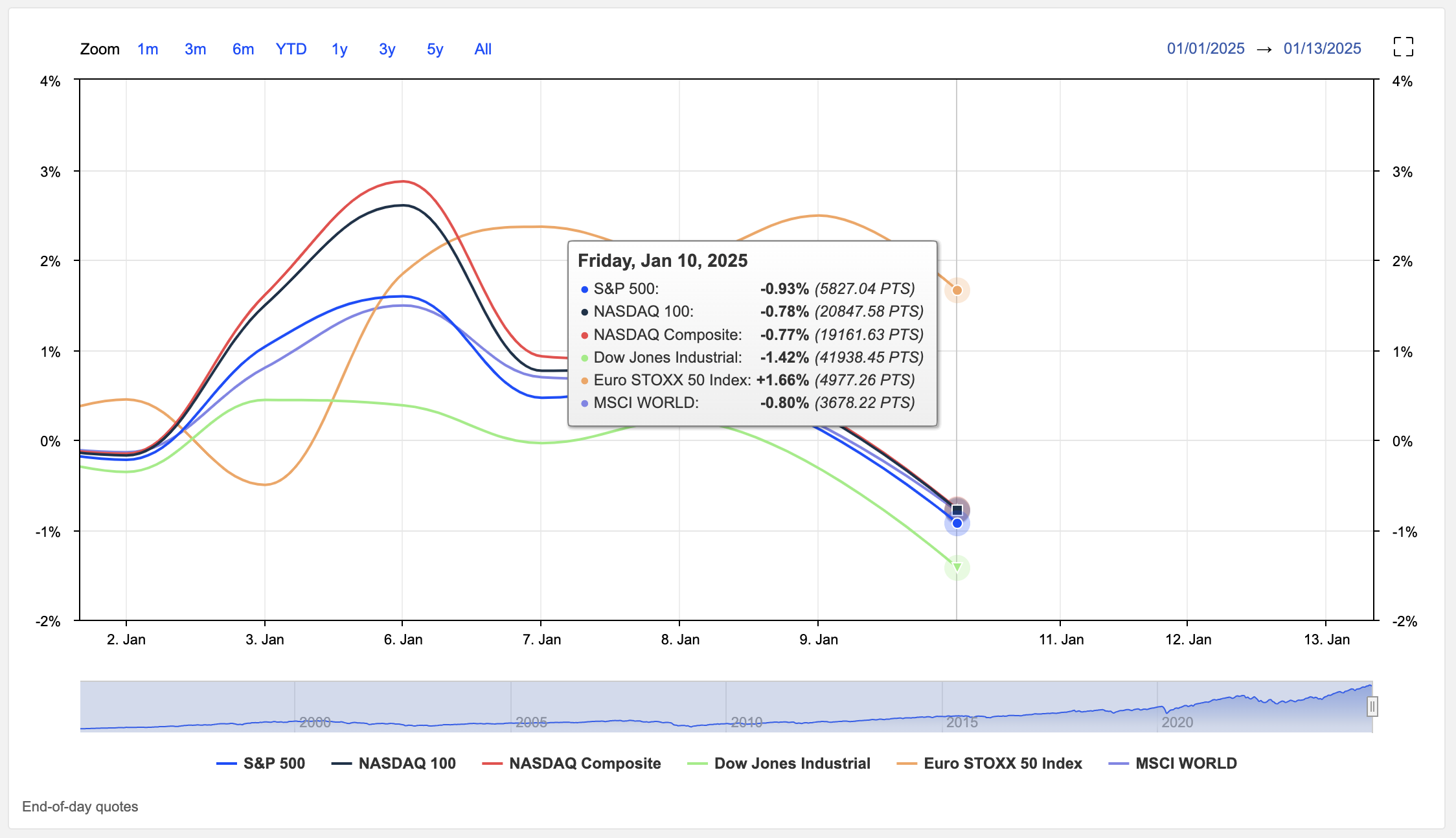

Following a period of market optimism often referred to as the ‘Trump Rally,’ US stock markets experienced notable declines after the release of a robust December jobs report on January 10, 2025.

The Labor Department reported an addition of 256,000 jobs in December, significantly surpassing economists’ expectations of 155,000, with the unemployment rate edging down to 4.1% from 4.2%.

This stronger-than-anticipated employment data led investors to reassess their expectations regarding the Federal Reserve’s monetary policy.

Concerns emerged that the Fed might maintain higher interest rates for a longer duration to counter potential inflationary pressures, thereby reducing the likelihood of anticipated rate cuts in 2025.

Higher interest rates can increase borrowing costs for both consumers and businesses, potentially slowing economic growth and impacting corporate profits.

In response to these concerns, major US stock indices declined.

The Dow Jones Industrial Average fell by 697 points, or 1.6%, closing at 41,938. The S&P 500 dropped 1.5%, and the Nasdaq Composite decreased by 1.6%.

These declines erased the S&P 500’s gains for 2025, reflecting investor apprehension about the future trajectory of interest rates and their potential impact on the economy.

Additionally, bond yields rose, with the 10-year Treasury yield reaching its highest level since November 2023. This increase in bond yields made fixed-income investments more attractive relative to stocks, further contributing to the sell-off in equities.

Chart: MarketScreener