Conflicting signals

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

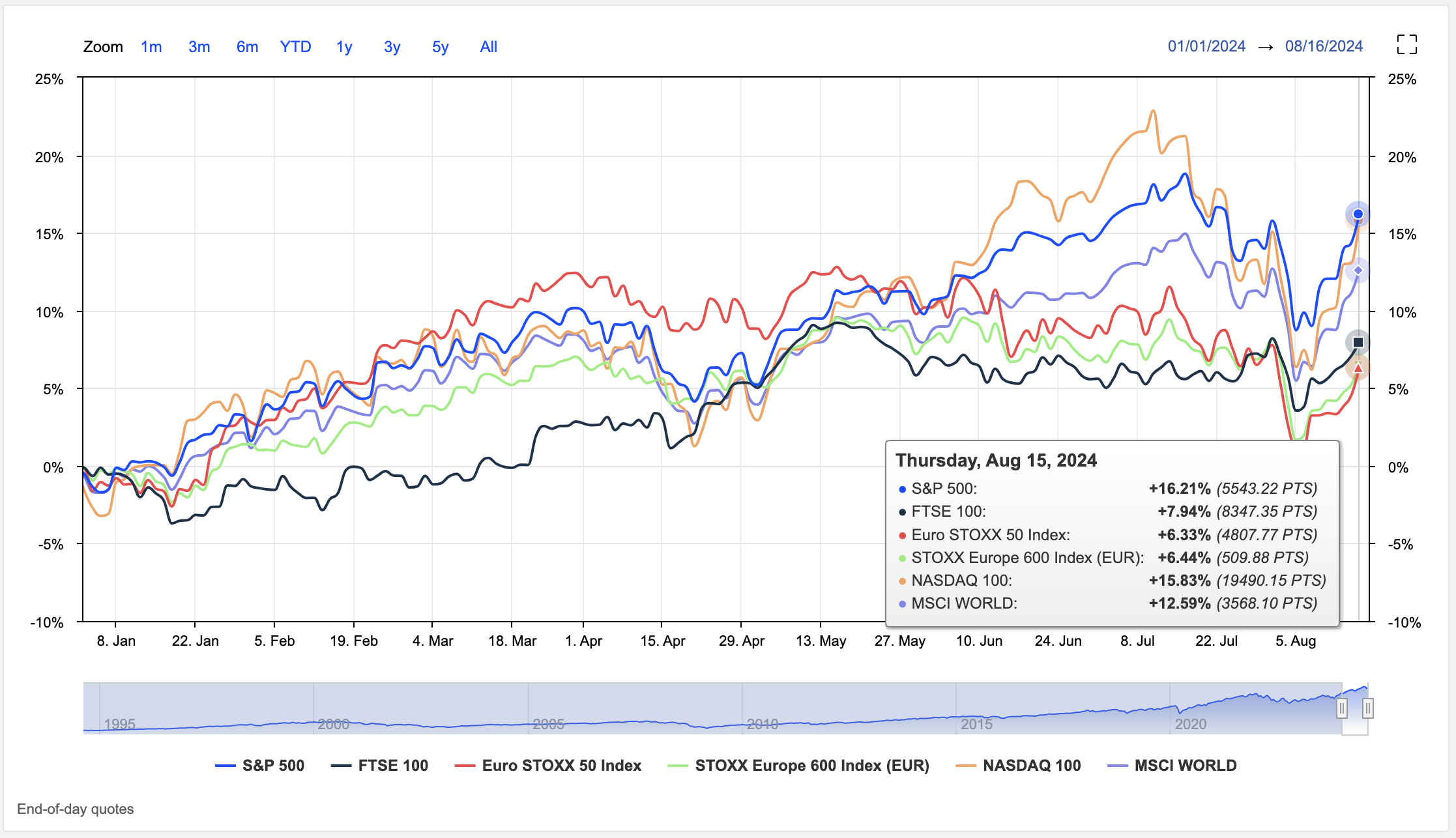

The S&P 500 has recently rebounded from its lows, but market sentiment remains cautious.

Upcoming economic indicators and the Federal Reserve’s September meeting will likely shape market direction, with the looming presidential election adding uncertainty.

While short-term volatility persists, analysts maintain a long-term bullish outlook, viewing recent weakness as a potential buying opportunity.

However, conflicting signals, including a recent market drop and expert opinions such as J.C. O’Hara’s belief in a longer-term upward trend, create a complex market landscape.

Investors should exercise caution and adopt a strategic approach.