Cautious optimism despite headwinds

- This topic has 1 reply, 1 voice, and was last updated 1 year ago by .

-

Topic

-

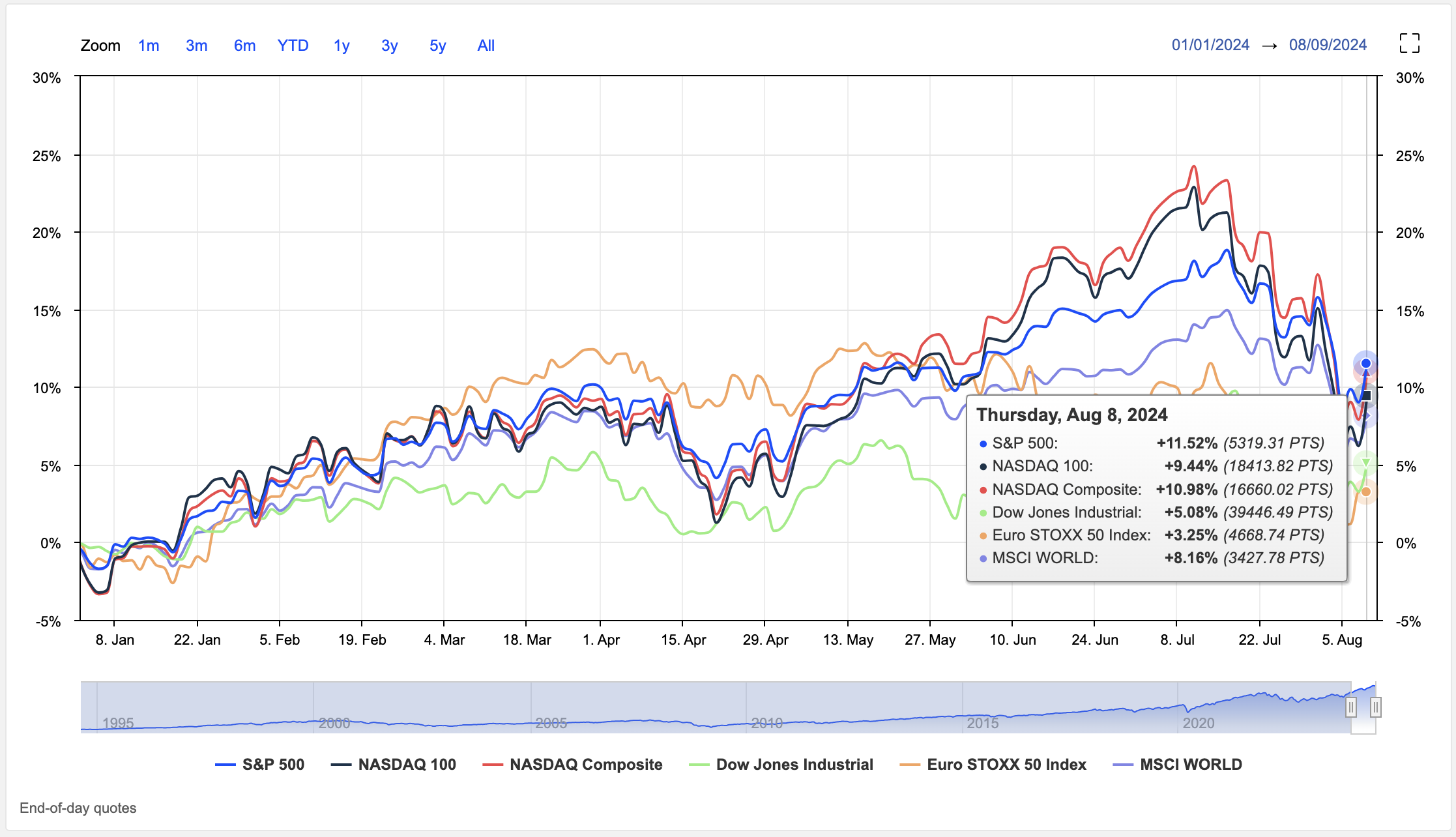

The S&P 500 is expected to climb modestly in the coming days (around 0.95%), reflecting potential stock price increases.

This is fuelled by recent market rebounds, particularly in tech stocks, following the Federal Reserve’s interest rate decision.

While the Fed’s rate hikes address inflation, they also increase borrowing costs and potentially dampen investment returns.

Geopolitical tensions are driving demand for safe-haven US Treasuries, strengthening the dollar. This could lead to the Fed considering three rate cuts by year-end.

August and September are historically weaker months, but tech giant earnings reports could significantly impact market performance.

In a volatile market, maintaining a long-term perspective is crucial. Consider adjusting your portfolio to mitigate risks and capitalise on new opportunities as they arise.